🚀 2 billion in a week: Is the crypto bull run finally confirmed?

Welcome to the Daily Tribune of Tuesday, November 12, 2024 ☕️

Hello Cointribe! 🚀

Today is Tuesday, November 12, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

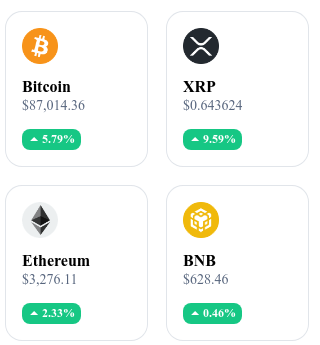

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🌟 Bull Run confirmed? Record influx of 2 billion dollars 🌟

The crypto market is experiencing an impressive influx of 1.98 billion dollars in the week from November 3 to November 9, confirming a bullish trend. For five consecutive weeks, fund inflows into cryptocurrencies have reached 7.7 billion dollars, which is about a quarter of the year's crypto investments. This renewed interest is particularly driven by the decision of the U.S. Federal Reserve to lower interest rates for the first time in four years, boosting investor optimism.

Bitcoin, at the forefront, captures 1.8 billion dollars, while Ether sees record inflows with 157 million dollars, benefiting from the enthusiasm for ETFs. Solana and other altcoins are also gaining popularity and reflecting a growing diversification of crypto portfolios. However, some investors remain cautious.

🐋 Panic at Ethereum? A whale liquidates 1.2 billion in ETH 🐋

The crypto market is in turmoil as a "whale" of Ethereum began to liquidate a significant part of its holdings, worth 1.28 billion dollars, threatening to destabilize the ETH price. This whale sold 46,853 ETH for 138 million dollars and transferred an additional 12,886 ETH, amounting to 41.24 million dollars, to an exchange wallet. It still holds 352,036 ETH, worth 1.27 billion dollars, which could have a significant impact if other sales follow.

Analysts and traders closely monitor the resistance at 3,000 $: a break of this threshold could initiate a major correction. Meanwhile, figures like Peter Brandt estimate that a collapse of the ETH price to 1,550 $ is possible if buying signals continue to dwindle. This situation, amidst Ethereum's recent rise, could trigger a "domino effect" if other large holders follow this selling trend.

📈 Bitcoin at 82,000 $: MicroStrategy dominates the crypto market 📈

As Bitcoin crosses the 82,000 $ mark, MicroStrategy reaffirms its position as an institutional leader with a portfolio of 252,200 BTC valued at over 20.68 billion dollars, representing an investment return of more than 108%. Acquired at an average price of 39,292 $, this portfolio validates the bold strategy of Michael Saylor, the company’s executive chairman.

MicroStrategy, far ahead of players like Marathon Digital and Riot Platforms, plans to further strengthen its position with an ambitious fundraising plan called "plan 21/21," aiming to raise 42 billion dollars in three years. This success encourages global institutions to follow suit: Bhutan now holds over one billion dollars in BTC, accounting for 32% of its GDP, while El Salvador continues to accumulate Bitcoin despite criticism, benefiting from a capital gain of nearly 218 million dollars. Institutional momentum around Bitcoin continues to strengthen, solidifying its status as a strategic store of value.

🚨 Snowden sounds the alarm on Solana's centralization 🚨

At the Redacted conference, Edward Snowden denounced the centralization of Solana, criticizing its control by venture capital investors. He states that Solana was "born in prison" and believes that this blockchain, although technically advanced, sacrifices decentralization for governance facilitated by large investors. According to Snowden, this dependency on venture capitalists undermines the very essence of blockchain, leaving strategic decisions in the hands of a few powerful players.

Snowden extends his warning to the entire digital ecosystem, alerting on the risks of centralization in a context where AI increases mass surveillance. To counter this trend, he advocates for the adoption of open-source technologies, allowing for better digital autonomy. His criticisms could influence the choices of many blockchain projects, seeking a balance between performance and decentralized ethics.

Crypto of the day: Dogecoin (DOGE)

The Dogecoin blockchain, initially developed as a joke inspired by the famous Shiba Inu dog meme, stands out for its simplicity and community approach. Based on the proof-of-work (PoW) mechanism with the Scrypt algorithm, it offers fast transactions and minimal fees, promoting its adoption for microtransactions and online tips.

The native crypto DOGE, primarily used for peer-to-peer exchanges and online donations, has been widely distributed through mining and benefits from an unlimited supply, ensuring constant accessibility. For its holders, Dogecoin offers advantages of quick liquidity and integration across multiple platforms, allowing its use in various payment and exchange services.

Recent Performance

Current price: 0.4306 USD (~0.40 €)

24h change: +53.99 %

Market capitalization: 63.19 billion USD (~57.72 billion €)

Rank on CoinMarketCap: 6

Technical analysis of the day: Bitcoin (BTC)

Bitcoin, after a slight correction at the end of October, rebounded and reached a historical peak, nearing 90,000 $. This surge is fueled by market optimism, notably due to the pro-crypto position of newly elected Donald Trump.

Since early November, Bitcoin has recorded an impressive increase of 25%, entering a consolidation around 76,000 $, which represents a first resistance on the monthly pivot points. While the momentum remains solidly bullish in the short, medium, and long term, the cryptocurrency is beginning to diverge from its 50 and 200-day moving averages, signaling a potential correction after this marked increase.

In the derivatives markets, the open interest of BTCUSDT perpetual contracts shows increasing interest, supported by a positive funding rate and strong selling liquidation volume, particularly around 70,000 $ and 73,000 $. These levels constitute crucial liquidation zones: if the price approaches these thresholds downwards, it could lead to increased volatility.

Forecasts indicate that a break above 89,000 $ could push Bitcoin towards 90,000 $ or even 95,000 $, while a pullback below 82,000 $ could bring the price back to support zones at 80,000 $ or 75,000 $. In this context, monitoring key levels is essential to adjust strategies in response to the rapid market evolution.

🔗 Read the full analysis here.