📉 2025: Is Ethereum About to Post the Worst Year in Its History?

Welcome to the Daily for Saturday, December 27, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, December 27, 2025, and as we do every day from Tuesday to Saturday, we bring you a summary of the past 24 hours’ must-know news!

But first…

✍️ Cartoon of the day:

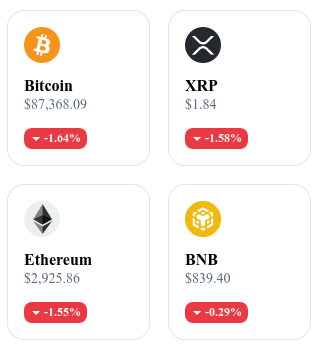

A quick look at the market…

🌡 Weather:

Rainy 🌧️

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

⚙️ Bitmain sells mining machines at a loss amid Bitcoin mining crisis

Bitmain is offering steep discounts on its mining equipment, including recent models like the immersion-cooled S21, with some bundles sold with no price floor. This strategy comes as the hashprice drops to around $35/TH/s/day, below the estimated breakeven point of $40/TH/s/day, and the block reward has fallen to 3.125 BTC after the halving. The decline in Bitcoin’s price since its January 2025 peak is squeezing miner margins, pushing Bitmain to offload its inventory rapidly.

👉 [Read the full article]

📈 Tom Lee predicts Ethereum surge driven by tokenization and institutional adoption

Tom Lee (Fundstrat) highlights the significant rise in real-world tokenized assets (RWA) on Ethereum, increasing from $5.6B to $18.9B in 2025, with around $12B hosted on the network. He points to initiatives by major institutions like BlackRock, Robinhood, and the DTCC, all involved in Ethereum-based tokenization projects. Lee believes ETH could reach between $7,000 and $9,000 by early 2026 — or even $20,000 in a full adoption scenario.

👉 [Read the full article]

💳 Trump-backed stablecoin USD1 hits $3 billion market cap

Stablecoin USD1 has reached a market capitalization of $3.07B, ranking 32nd among crypto assets on CoinMarketCap. Binance is replacing BUSD with USD1 in some products and offers up to 20% APR via its Booster program for holders. The project, led by WLFI (founded by Donald Trump Jr.), is expanding through partnerships with Coinbase, FalconX, and Raydium.

👉 [Read the full article]

🚀 BNB Chain accelerates with upcoming Fermi hard fork

The Fermi hard fork on BNB Chain is scheduled for January 14, 2026, and will reduce block times from 750ms to 250–450ms, enhancing transaction speed. The upgrade also introduces partial indexing and optimized voting parameters to lower resource costs for nodes. With 2.87 million active addresses — on par with Solana — the network is publishing migration guides for the transition.

👉 [Read the full article]

Crypto of the Day: Ondo (ONDO)

🧠 Innovation & Value Proposition

Ondo is building infrastructure for real-world asset (RWA) tokenization. The protocol offers on-chain financial products backed by traditional instruments like U.S. Treasury bills, aiming to deliver transparent and regulated yields.

Ondo operates at the intersection of traditional finance and DeFi. It targets institutional adoption with clear structures, reputable partners, and strong regulatory compliance. This approach meets growing demand for crypto products backed by real, stable, and liquid assets.

💰 The Token

The ONDO token plays a governance role within the ecosystem. Holders participate in strategic decisions related to product development, economic parameters, and the protocol’s direction.

ONDO also supports coordination across the platform’s components. Its utility grows as RWA products expand and the total value locked increases, reinforcing its central role in Ondo Finance’s strategy.

📊 Live Performance (CMC)

💵 Current Price: €0.3222

📈 24h Change: +1.64%

💰 Market Cap: €1.01B

🏅 CMC Rank: #56

🪙 Circulating Supply: 3.15B ONDO

📊 24h Volume: €24.49M

🔴 Ethereum: The Moment of Truth (Or the Last Chance?)

While the crypto market seems overall euphoric, a shadow looms over the second-largest asset in the sector: Ethereum.

For several months now, the question has shifted — it’s no longer whether ETH will rise in dollar terms, but whether it can finally stop losing ground to Bitcoin. According to recent analyses, we’re approaching a historic tipping point. Let’s break it down.

1. The reality check: A “lost” year against Bitcoin

The chart worrying investors the most is ETH/BTC. In 2024, as Bitcoin broke records thanks to ETFs, Ethereum struggled to maintain relevance.

ETH/BTC recently dropped to levels not seen in over three years (around 0.038 BTC). For many traders, Ethereum is currently writing one of the most bearish chapters in its modern history.

2. The Layer 2 paradox

Why is Ethereum stagnating? Could it be due to the success of Layer 2s (L2s) like Arbitrum, Optimism, or Base?

The issue: Offloading transactions to L2s to reduce fees has dried up activity — and thus revenue — on Ethereum’s mainnet (Layer 1).

The consequence: Fewer burned fees mean ETH has lost its “ultrasound money” status (deflationary appeal), making it less attractive to investors seeking scarcity.

3. “Last chance”: The critical technical support

Ethereum is now approaching a decisive technical zone. This level could determine the asset’s medium-term trajectory:

Bullish scenario: If ETH manages to bounce off this support against BTC, we could see a massive short squeeze and a rapid recovery toward $4,000 and beyond.

Bearish scenario: If this level breaks, Ethereum may enter a prolonged period of underperformance, giving faster competitors like Solana more room to rise.

4. Why there’s still hope

Not everything is bleak. Institutional interest via Ethereum ETFs is slowly stabilizing, and the upcoming Pectra upgrade (expected in 2025) promises major improvements to user experience and network efficiency.

Ethereum remains the most decentralized, secure, and developer-rich ecosystem. But the market’s patience is wearing thin.

Ethereum is up against the wall. To rewrite its story and reverse this downtrend, it must prove it can still capture value — even in the age of dominant L2s.