🚨 243M $ liquidated on Bitcoin, Ripple in full turmoil

Welcome to the Daily Tribune of Thursday, October 3rd, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, October 3rd, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

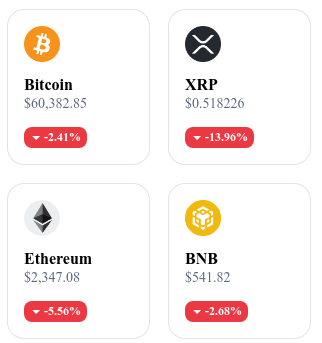

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

Massive capital outflow on Bitcoin ETFs amid Middle Eastern tensions 💸

Bitcoin ETFs have recorded massive capital outflows following the escalation of geopolitical tensions in the Middle East. Between October 1st and 2nd, nearly 243 million dollars left these funds, reversing a recent bullish trend that saw inflows of 1.4 billion dollars over eight days. The most affected fund is the Fidelity Wise Origin Bitcoin Fund, with a loss of 144.7 million dollars. Others, like ARK 21Shares and Bitwise Bitcoin, also experienced significant outflows.

This situation reflects a loss of confidence from institutional investors, exacerbated by the drop in Bitcoin's price of around 4,000 dollars, caused by Iranian strikes on Israel. American spot Ether ETFs are not spared, with a total outflow of 48.6 million dollars. Despite this context, the BlackRock iShares Bitcoin Trust has resisted with positive flows.

The SEC resumes its offensive against Ripple: A new chapter in crypto regulation ⚖️

The SEC has officially appealed the favorable ruling for Ripple made in 2023, reigniting uncertainties regarding the legal status of cryptocurrencies. On October 2nd, 2024, the SEC contested Judge Torres' decision, who ruled that secondary sales of the XRP token did not constitute securities transfers. This case, beyond Ripple, could redefine crypto regulation in the United States, as the outcome of this appeal will influence the SEC's ability to pursue other cryptocurrencies.

Ripple's initial victory was seen as a major win for the industry, but the SEC's appeal revives doubts in the market. This decision comes at a time when institutional players are showing increased interest in XRP, while ETFs on XRP are awaiting validation. This litigation could well alter the regulatory approach towards cryptocurrencies and strengthen the SEC's position on the classification of digital assets.

Crypto: 500 million dollars liquidated, "Uptober" disappoints from its start 💥

The month of October, often considered favorable for cryptocurrencies, is starting poorly this year. In just 48 hours, over 500 million dollars have been liquidated in the markets, mainly due to leveraged positions. Bitcoin has fallen below 61,000 dollars, leading to a contraction of the overall crypto market capitalization by 3.29%, or 2.16 trillion dollars. This drop is partly explained by geopolitical tensions in the Middle East, which have pushed investors to favor safer assets like gold.

The domino effect particularly affected long positions, with 85% of liquidations in this category, signaling an excess of optimism among traders. Bitcoin suffered liquidations worth 139 million dollars, closely followed by Ethereum with 109 million. More than 155,000 traders have been impacted, with the largest liquidation being 12.66 million dollars on Binance.

Goldman Sachs warns: the dollar will gradually collapse 💵

Goldman Sachs forecasts a gradual weakening of the dollar due to the reduction of interest rates by the American Federal Reserve (Fed). The bank anticipates a gradual devaluation of the US currency against major currencies like the euro and the British pound, which could reach 1.15 USD and 1.40 USD respectively. The Fed recently cut its rates by 50 basis points, signaling an aggressive approach to avoid an economic recession in the United States. This situation diminishes the dollar's appeal to international investors, increasing interest in alternative assets like cryptocurrencies.

Nevertheless, some players, like Deutsche Bank, believe that Donald Trump's re-election could reverse this trend by strengthening the dollar. This divergence of opinions highlights the uncertainty surrounding the future of currency markets and the possibility of increased demand for cryptocurrencies as a hedge against currency devaluation.

The crypto of the day: Bonk (BONK)

Bonk is a native cryptocurrency of the Solana ecosystem, designed to offer a decentralized alternative to other tokens influenced by whales. This crypto is based on a community approach, initially distributed through airdrops to Solana users, encouraging wider adoption. Bonk's innovation lies in its rapid integration into the Solana ecosystem, particularly in DeFi and NFT projects, while serving as a means of exchange within the community.

Bonk holders benefit from low transaction fees thanks to Solana and can use the token for various decentralized applications, including games and staking platforms.

Recent performances:

Current price: 0.000019 €

24h change: -17.15 %

Market capitalization: 1,342,031,989 €

Rank on CoinMarketCap: 51

Bitcoin undervalued: an investment opportunity before a potential rebound? 🚀

Bitcoin is currently undervalued according to several key indicators, offering a potential opportunity for savvy investors. The MVRV Z-score, which compares market value to realized value, shows a significant drop, suggesting that Bitcoin is currently trading at a price lower than its true value. With declines of -116% over three months, -94% over two years, and -107% over four years, these metrics reveal a disconnection between Bitcoin's current value and its fair valuation. Furthermore, open interest on perpetual futures contracts has increased by 800% over the last four years, signaling anticipation of a bullish movement. Recent market corrections have eliminated excess optimism and create a favorable setup for a potential rebound before the year's end.

However, uncertainties remain, particularly due to the upcoming US presidential election, which could lead to increased volatility in the markets. Historically, election years have been marked by more significant fluctuations in Bitcoin's price. Despite this, some experts believe that Bitcoin may benefit from a more stable context once the election results are known, and that momentum could improve as we approach 2025, especially with the upcoming Bitcoin halving.

🔗 Read the complete analysis here.