💰+6,000 Bitcoins for Strategy and Metaplanet, the rush does not slow down!

Welcome to the Tuesday Daily Tribune of July 1, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, July 1, 2025, and as every day from Tuesday to Saturday, we summarize for you the news from the last 24 hours that you should not have missed!

But first…

✍️ Cartoon of the day:

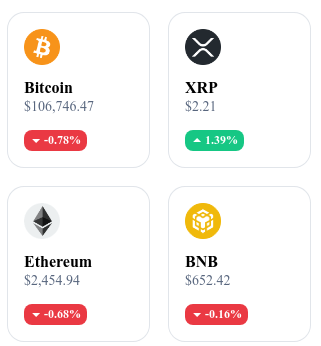

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🧠 Saylor doubles the bet

Strategy bought an additional 4,980 BTC for a total of 293 million USD. Michael Saylor now controls more than 226,331 BTC through his company.

🎬 Musk, VIP of Squid Game?

The creator of Squid Game compared Elon Musk to the VIP characters in the series to highlight a power disconnected from reality. He believes that current billionaires manipulate the rules like the game masters.

🔥 Nobitex survives the attack

After the massive cyberattack it was victim of, the Iranian crypto exchange Nobitex has restored its services.

🪙 MetaPlanet stacks BTC

The Japanese company MetaPlanet has also bought 1,005 additional bitcoins for an amount of 62 million USD. It now holds 2,030 BTC in total.

Crypto of the day: Algorand (ALGO)

🧠 Technology & innovation

Algorand is a layer 1 blockchain launched in 2019 by Silvio Micali, a MIT researcher and Turing award winner. It is based on a Pure Proof-of-Stake (PPoS) consensus that randomly selects validators, thus offering scalability, decentralization and resistance to Sybil attacks.

The Algorand network allows fast transactions (up to 7,500 TPS) with very low fees, while remaining carbon negative, thanks to an eco-friendly infrastructure. It supports smart contracts, real asset tokenization, NFTs, and attracts many projects in finance, digital identity and traceability fields.

💰 Main utility & benefits

The ALGO token plays a central role in the Algorand ecosystem:

It is used to pay transaction fees on the network.

It allows holders to participate in the PPoS consensus via a staking mechanism without complex delegation.

It provides access to on-chain governance, allowing users to vote on protocol developments.

It fuels infrastructure projects, notably in DeFi, asset tokenization and Web3 innovation.

Its simplicity of use, speed and open governance make it a versatile token, suitable for both individuals and institutions.

📊 Market data (as of June 28, 2025)

Current price: $0.1872 USD

24h change: +3.41 %

Market capitalization: $1.62 billion USD

Rank on CoinMarketCap: #47

Circulating supply: 8,635,839,640 ALGO

24h trading volume: $101.6 million USD

Tesla and SpaceX: Giants Sitting on a Bitcoin Treasure

A recent revelation from Arkham Intelligence shakes up certainties about Elon Musk's real involvement in the crypto ecosystem. Tesla and SpaceX together would hold more than 19,000 bitcoins, a digital fortune estimated at about two billion dollars. Information that reignites debates about the discreet but powerful strategy of tech giants regarding Bitcoin.

Arkham unveils Musk's secret wallets

Arkham Intelligence, specialized in on-chain analysis, claims to have identified the Bitcoin addresses held by Tesla and SpaceX. According to its data, Tesla holds 11,509 BTC, about 780 million dollars at the current price, while SpaceX holds 8,285 BTC, representing nearly 560 million dollars. These funds would represent a total estimated at 1.34 billion dollars, but Arkham mentions a global valuation close to 2 billion, potentially including other wallets or based on earlier BTC prices.

This announcement relies on advanced traceability techniques used by Arkham, which allow linking anonymous addresses to well-identified entities.

A hidden but significant crypto strategy

While Elon Musk's public statements on Bitcoin have often varied, ranging from declared support to environmental criticism, the holding of more than 19,000 BTC by his companies testifies to a real and significant exposure to the asset. In 2022, Tesla declared having reduced its bitcoin holdings, but the persistent presence of such volume suggests a more complex strategy than communicated to shareholders.

This discreet management could respond to a desire to limit media and regulatory exposure. By keeping silent about these wallets, Musk's companies avoid reputation fluctuations related to cryptocurrency volatility. Nevertheless, this practice raises questions about financial transparency and the consistency of communications to investors.

In the current context of renewed institutional interest in Bitcoin, this revelation gives weight to the hypothesis that Musk anticipates a rise in crypto-assets in company balance sheets.