⚡ 70% of financial advisors converted to cryptos, Polymarket raises $50M, and China dominates Bitcoin mining!

Welcome to the Daily Tribune of Wednesday, September 25, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, September 25, 2024, and as every day from Tuesday to Saturday, we summarize the news of the last 24 hours not to be missed!

But first…

✍️ Cartoon of the day:

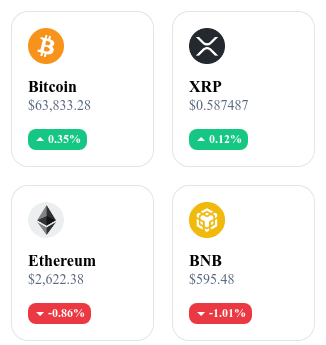

A quick look at the market…

🌡️ Temperature:

Partially sunny 🌤️

24h crypto recap! ⏱

🕌 Investing in crypto according to Sharia is finally possible!

A new era opens for Muslim investors with the launch of cryptocurrency investment services compliant with Sharia law. These platforms guarantee transactions that respect Islamic principles, avoiding forbidden financial practices such as usury. Projects like Haqq and Islamic Coin are leading this initiative and offer halal solutions to meet the growing demand in majority-Muslim countries. The goal is to provide an ethical and regulated alternative, allowing millions of investors to participate in the crypto economy while staying true to their religious beliefs. 🔗 Read the full article here

💰 Polymarket aims for $50 million for a new crypto!

Polymarket, the platform specializing in predictive markets based on blockchain, is preparing an ambitious fundraising of $50 million to launch its own cryptocurrency. This project aims to expand the Polymarket ecosystem by creating a native token that will facilitate transactions on the platform and provide additional benefits to users. This new crypto could also enhance liquidity and offer increased incentives for participants in predictive markets. The strategy behind this fundraising is to consolidate Polymarket’s position in the decentralized market sector while attracting a new user and investor base. 🔗 Read the full article here

🕵️♂️ 55% of global Bitcoin mining under the secret control of China!

Despite the official ban on cryptocurrency mining in China, an investigation reveals that 55% of the global Bitcoin hashrate still clandestinely comes from Chinese territory. Local miners have found hidden ways to continue their activities using virtual private networks (VPNs) and connecting to foreign mining pools. This secret dominance of hashrate by China raises questions about Bitcoin's decentralized control, as Chinese influence persists despite regulations. 🔗 Read the full article here

💼 70% of financial advisors converted to Bitcoin

A recent survey reveals that 70% of financial advisors are now favorable to the integration of Bitcoin into investment portfolios, reflecting a radical shift in the traditional attitude of the financial sector towards cryptocurrencies. Despite this growing adoption, many of their clients remain reluctant to take the plunge. Advisors perceive Bitcoin as a class of assets for diversification with a strong potential for long-term returns, but the lack of understanding and volatility hinder investor uptake. This gap may gradually close as education and trust in cryptocurrencies intensify. 🔗 Read the full article here

Crypto of the day: Sei (SEI)

Sei is an innovative Layer 1 blockchain, specially designed to optimize decentralized exchanges (DEX). Its uniqueness lies in its ability to offer fast and reliable transactions, meeting the specific requirements of DEX, blockchain games, and NFT marketplaces.

The native crypto of the platform, SEI, is used to pay transaction fees, participate in governance, and be staked for rewards. SEI holders benefit from direct influence over network decisions, making this cryptocurrency essential to the Sei ecosystem.

Recent performance

Current price: €0.4125

Variation (24h): +23.45 %

Market capitalization: €1.53 billion

Rank on CoinMarketCap: 52

🐉 China awakens the economic dragon: Bitcoin could benefit!

The Chinese economy, in the midst of a recovery, could well become a driver for the cryptocurrency market, particularly Bitcoin. After a series of economic slowdowns and strict restrictions on cryptos, China seems eager to rekindle its role as a major player on the international scene. The government is ramping up efforts to revive the economy through massive investments in technological and digital infrastructure. Although regulations on cryptocurrencies remain strict, this economic revitalization could indirectly benefit Bitcoin by boosting appetite for digital assets as a safe haven against global economic uncertainty.

China's strategic position, coupled with its potential influence on global financial markets, could catalyze broader adoption of cryptocurrencies in the region and beyond. If China plays an important role in blockchain technology, its users and companies might seek to circumvent current restrictions to exploit Bitcoin as an alternative to the traditional financial system. Ultimately, this resurgence in economic activity could bolster global demand for Bitcoin and provide growth opportunities, even in a regulated environment.