Hello Cointribe! 🚀

Today is Tuesday, July 02, 2024, and like every day from Tuesday to Saturday, we summarize the news from the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

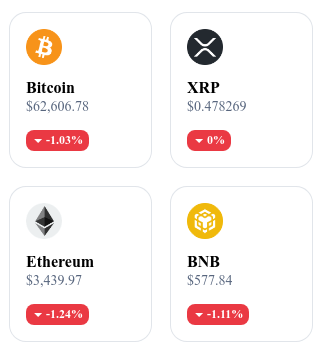

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

🚀 Optimism on Bitcoin: 75% of traders bet on a rise

Despite global economic turbulence, Bitcoin is showing remarkable resilience. A recent study reveals that 75% of traders on Binance are betting on a rise in BTC, reflecting renewed confidence in the cryptocurrency. This trend is particularly evident in BTC/USDT perpetual contracts. However, despite this optimism from retail traders, the Bitcoin market faces major challenges: significant sales of BTC by the German and American governments, and the imminent repayment of Mt. Gox which could disrupt supply and demand. Miners, with historically low reserves, are going through a difficult period, while institutional investors continue to support Bitcoin, especially with ETFs managed by major players like BlackRock. 🔗 Read the full article here.

⏳ Launch of Ethereum ETFs delayed until mid-July

The launch of Ethereum ETFs, initially scheduled for early July, has been postponed by the US Securities and Exchange Commission (SEC). This decision comes in response to requests for additional revisions to the S-1 forms submitted by potential issuers. Issuers have until July 8 to submit their revised forms, which could delay the launch of ETFs until mid-July or later. This delay is part of a two-step process for ETF approval, with the first step completed in May. Market reactions are mixed: some remain optimistic about a quick approval, while others see this delay as a sign of deeper regulatory challenges. The approval of Ethereum ETFs could offer new investment opportunities and strengthen Ethereum's position in the global financial market. 🔗 Read the full article here.

🔄 Sony revolutionizes crypto exchanges

Sony, the Japanese giant, is redefining the crypto exchanges market with the launch of S.BLOX, a new exchange platform resulting from the acquisition of DeCurret. This initiative is part of Sony's strategy to expand its digital portfolio, integrating Web3 services and targeting users in the fiat economic zone. S.BLOX promises an improved user experience with a redesigned interface and a user-friendly mobile application. The acquisition of Amber Group, backed by $300 million in financing, marks a strategic turning point for Sony in the cryptocurrency sector and aims to solidify its position and meet the needs of investors affected by recent market turbulence. 🔗 Read the full article here.

🌐 Bitcoin at your fingertips: ATM proliferation

The democratization of cryptocurrencies continues with a proliferation of Bitcoin ATMs worldwide. According to Coin ATM Radar, 2,564 new machines were installed in 2024, contrasting with a net loss of 2,861 in 2023, bringing the total to 38,279 ATMs, close to the record of 39,541 in December 2022. Key players like Bitcoin Depot, Coinflip, and Athena Bitcoin dominate the market. The United States accounts for 82% of ATMs, followed by Canada (7.7%) and Australia, which has seen an impressive increase, reaching 1,107 machines. Bitcoin ATMs offer a fast and secure alternative to traditional methods of buying cryptocurrencies, reinforcing the global adoption of Bitcoin, particularly popular in transactions. This expansion promises unprecedented accessibility to cryptocurrencies, making their use increasingly familiar to the general public. 🔗 Read the full article here.

Crypto of the day: MultiversX (EGLD)

MultiversX (formerly Elrond) stands out for its blockchain protocol offering true horizontal scalability through the use of complete sharding (network, transactions, and state). This technology aims to create an ecosystem for the new internet, encompassing decentralized finance, real-world assets, and the metaverse. With a processing capacity of up to 100,000 transactions per second, a latency of 6 seconds, and transaction costs of only $0.002, MultiversX offers an extremely efficient smart contract execution platform.

The native crypto of MultiversX, EGLD (Electronic Gold), is used to pay network fees, serve as a medium of exchange between users and validators, and enable the deployment of smart contracts, protocols, and decentralized applications (dApps) on the platform. EGLD holders can participate in the consensus process through staking and receive validation rewards, in addition to benefiting from transaction fees. EGLD also functions as a governance token, allowing holders to vote on network decisions, giving them an active role in platform management.

Recent performance:

Current price: €29.94

Percentage increase/decrease: 6.71% (1-day increase)

Market capitalization: €812,449,339

Rank on CoinMarketCap: 81

Can finance meet the expectations of the French?

French finance is currently facing a divide between supporters of a liberal economy and those advocating for a more solidarity-based model. On one hand, liberals argue for a reduction in state intervention and tax cuts to stimulate growth. On the other hand, interventionists demand increased regulation and a more equitable distribution of wealth, notably through taxes on financial transactions. This debate is fueled by growing social tensions, illustrated by protests against pension reform and discussions on tax justice. The general opinion remains wary of finance, especially when it comes to new assets like cryptocurrencies.

Ethical finance, which aims to support socially and environmentally beneficial projects, is gaining momentum in France. In 2022, ethical savings reached €24.5 billion, marking a 20% increase from the previous year. However, this form of finance faces obstacles, such as low public awareness and returns often lower than those of traditional financial products. The increasing centralization of the financial sector also presents challenges, but the adoption of blockchain technology could offer solutions in terms of transparency, reduced transaction fees, and inclusion of the unbanked population. Nevertheless, large-scale implementation of blockchain in traditional finance remains a challenge to overcome.