🚀 84 % chances for a Solana ETF in 2025: VanEck boosts investor hopes!

Welcome to the Daily Tribune of Saturday, January 4, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Saturday, January 4, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

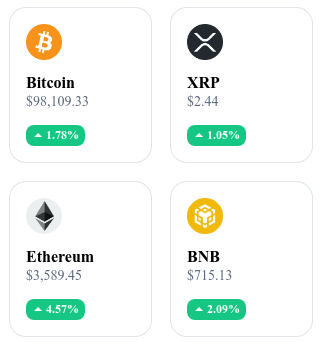

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

📊 A Solana ETF on the horizon 2025? An 84% probability according to VanEck!

Matthew Sigel, director of research at VanEck, estimates the chances of a Solana ETF being approved in the United States in 2025 at 84%, exceeding initial forecasts from Polymarket (77%). This optimism is based on factors such as increasing support from regulators and the pro-crypto stance of the new Trump administration. However, challenges remain, particularly the SEC's concerns about classifying Solana as a financial security, a key point for regulatory approval.

If this ETF were to come to fruition, it would mark a turning point in the integration of cryptos into institutional portfolios and increase their adoption and legitimacy on a large scale, while providing simplified access to traditional investors.

💸 Imminent launch of X Money?

A code leak has revived rumors around the early launch of X Money, the payment system integrated into the X platform (formerly Twitter). Shared by a researcher, this leak reveals a message indicating limited availability in certain U.S. states where X Payments LLC already holds licenses. Originally scheduled for 2025, this launch could happen sooner.

This payment system, likely to include Bitcoin and Dogecoin, aims to transform the digital payment ecosystem and offer innovative tools for content creators. However, regulatory obstacles persist, particularly in key states like New York. X Money could mark a turning point in the adoption of cryptos and digital transactions if these challenges are met.

⚖️ Do Kwon extradited: The first stages of a historic trial

Do Kwon, co-founder of Terraform Labs, has been extradited to the United States and appeared before a New York court on January 2, 2025, where he pleaded not guilty to charges of fraud and money laundering. The case, which arises in the wake of the collapse of the Terra ecosystem, involves nine counts, including suspicious transactions of over $10,000.

After his arrest in Montenegro for using false documents, Kwon remains in custody without bail pending the status conference scheduled for January 8. This trial, among the most closely watched in the crypto world, could have a major impact on the regulation of cryptocurrencies and the fight against financial crimes globally.

🚀 BlackRock's Bitcoin ETF shatters records!

In just 11 months, BlackRock's iShares Bitcoin Trust (IBIT) has reached $50 billion in assets under management, setting a historical record for ETFs. This success illustrates a radical shift in institutional investors' perception of cryptocurrencies. The approval of BlackRock's Bitcoin ETF in 2024 marked a decisive turning point, contributing to the surge in BTC's price, which has surpassed $100,000.

With massive trading volumes and the introduction of innovative trading options, IBIT has transformed the landscape of digital assets, consolidating Bitcoin's position as an essential financial asset. This milestone reflects the maturation of the crypto market and the gradual convergence between traditional finance and digital assets.

The crypto of the day: The Graph (GRT)

The Graph revolutionizes access to blockchain data by offering a decentralized indexing infrastructure. Through its protocol based on GraphQL, it enables developers to create decentralized applications (dApps) using structured and accessible data.

Its native crypto, GRT (Graph Token), is the economic engine of the ecosystem. It rewards indexers and curators for maintaining and organizing data reliably. Distributed during an ICO and other programs, GRT offers advantages such as passive income through staking and active participation in the ecosystem by signaling useful subgraphs. This combination makes The Graph essential for the growth of Web3.

Recent performances

Current price: 0.242 €

24h variation: +11.48 % (increase)

Market capitalization: 2,311,804,271 €

Rank on CoinMarketCap: 67

XRP: A surge powered by 5 key indicators

Ripple's XRP is displaying bullish momentum at the start of 2025, with a 7% increase since January 1, driven by favorable indicators. Long-term holders (LTH) dominate trading, massively accumulating XRP and strengthening buying pressure on major platforms like Binance and Bitstamp. On-chain data also confirms a growing demand, manifested by net outflows of XRP from exchanges, indicating sustained interest from institutional and retail investors.

Technically, XRP recently broke through a major resistance, moving beyond a symmetrical triangle pattern. This movement could lead it to test a key resistance threshold at $2.9. Additionally, positive regulatory developments are notable: the possible appointment of Paul Atkins, a pro-crypto figure, as head of the SEC. This prospect would reduce regulatory hurdles for Ripple and further enhance the asset's credibility. Furthermore, profits realized by investors this week, exceeding $1 billion, have not been enough to curb the bullish momentum due to the persistence of long-term accumulators.

However, a shadow looms with Ripple's announcement of the imminent release of 300 million dollars in XRP, which could lead to downward pressure on prices due to increased supply. Despite this risk, XRP remains well-positioned to capitalize on its bullish trend. If current conditions hold, XRP could not only surpass the $2.9 mark but also aim for more ambitious highs in the coming months.