🧨 A $35 trillion correction? Gita Gopinath sounds the alarm

Welcome to the Daily for Friday, October 17, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, October 17, 2025, and as every day from Tuesday to Saturday, here’s a recap of the past 24 hours’ top news you couldn’t miss!

But first…

✍️ Cartoon of the day:

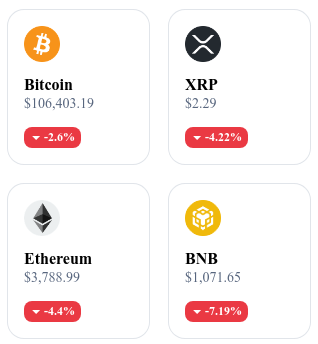

A quick look at the market…

🌡 Weather:

🌧️ Stormy

24h crypto recap! ⏱

🛡️ The Fed denounces critical flaws in the GENIUS stablecoin law

The Federal Reserve believes that the GENIUS Act, adopted to regulate stablecoins, contains loopholes that could allow certain players to bypass safety requirements. According to Fed experts, revisions are needed to ensure stability and prevent risks of manipulation or bankruptcy.

👉 Read the full article

📉 Bitcoin Fear Index drops to its lowest level of the year

The Bitcoin Fear Index has fallen to 24, its lowest point since the beginning of the year. This decline reflects overall market stagnation and growing investor anxiety amid economic and geopolitical uncertainty.

👉 Read the full article

📊 Polymarket expands with up/down markets for stocks and indices

Polymarket has launched a new feature allowing users to speculate on stocks and stock indices through up/down prediction markets. These new instruments aim to diversify the range of derivative products and pave the way for broader adoption of crypto-based prediction markets.

👉 Read the full article

💶 ODDO BHF launches a European alternative to dollar-dominated stablecoins

Franco-German bank ODDO BHF has announced the launch of a euro-backed stablecoin designed to challenge the dominance of dollar-based stablecoins. The initiative aims to create a cross-border payment tool and a more transparent governance model for European financial players.

👉 Read the full article

Crypto of the Day: Mina Protocol (MINA)

Innovation and Value Added 🧠

Mina Protocol is an ultra-light Layer-1 blockchain designed to provide a decentralized and accessible infrastructure for everyone. Thanks to its use of zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge), Mina maintains a constant size of about 22 KB, regardless of the number of transactions processed.

This unique characteristic allows any device — even a smartphone — to verify the entire history of the network, ensuring maximum decentralization. Since its launch in 2021, Mina has evolved to support decentralized applications (zkApps) that leverage the privacy and scalability enabled by zk-SNARKs.

The Token 💰

The MINA token is the native asset of the network. It is used to pay transaction fees, participate in staking, and contribute to the governance of the protocol. Holders of MINA can validate transactions and influence decisions regarding the future evolution of the network.

With a total supply of 1.2 billion MINA, the token plays a central role in incentivizing participants to secure and advance the Mina ecosystem.

Real-Time Performance 📊

💵 Current price: $0.1082

📈 24h variation: +7.0%

💰 Market cap: $136,790,000

🏅 Rank on CoinMarketCap: #348

🪙 Circulating supply: 1,257,518,245 MINA

📊 24h trading volume: $801,770

Gita Gopinath warns of an imminent crash!

A new warning is shaking the global financial sphere: Gita Gopinath, former Chief Economist of the IMF, believes that a market collapse could wipe out up to $35 trillion in assets. This prediction, reminiscent of the excesses of the dot-com bubble, raises crucial questions about the stability of markets currently fueled by the euphoria surrounding artificial intelligence.

An excess of technological optimism?

Gopinath points to overheating in global markets, driven, in her view, by excessive valuations of AI-related companies. In her analysis, she draws a direct parallel with the dot-com bubble of the 2000s, stressing that markets today are guided more by speculation than by fundamentals.

The figure she advances is staggering: $35 trillion could evaporate in the event of a sharp correction. The United States would bear the brunt, with estimated losses of $20 trillion, while $15 trillion could be wiped out across other global markets. This scenario, which Gopinath describes as “plausible,” is based on the hypothesis of a massive revaluation of stock prices following a trend reversal or an external shock.

How should investors adapt?

While artificial intelligence continues to fuel historic bullish momentum, Gita Gopinath’s warning calls for a deep strategic reassessment. The overconcentration of capital in a small number of tech assets mirrors the structural imbalances that preceded past financial bubbles.

In response, sector diversification is once again becoming a key risk management tool. Many fund managers are favoring a rebalancing toward sectors less exposed to speculation — such as infrastructure, commodities, or utilities. Simultaneously, capital is increasingly flowing into alternative asset classes, including logistics real estate, inflation-linked bonds, and structured products.

Cryptocurrencies, often seen as detached from traditional markets, are also drawing renewed attention. Yet, their role as a safe haven remains debated due to high volatility and a growing correlation with tech indices.

Another key factor: the rise of passive investment through tech ETFs, which increases market concentration. In a downturn, these automated flows could amplify the sell-off, worsening global contagion effects.

History shows that bubbles often form during periods of technological transformation, when innovation fuels powerful narratives sometimes disconnected from economic reality. The challenge for investors is not to flee innovation but to anticipate its excesses and adjust strategies accordingly.