🔥 A French trader in the spotlight: Polymarket facing massive bets on Trump

Welcome to the Daily Tribune of Friday, October 25, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, October 25, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you couldn't miss!

But first…

✍️ Cartoon of the day:

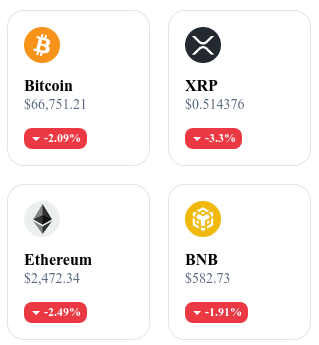

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

💥 Polymarket accuses a French trader of manipulation

Polymarket, the famous prediction platform, has discovered that a French trader was influencing bets regarding Donald Trump's reelection chances. Under various pseudonyms such as Fredi9999, Theo4, PrincessCaro, and Michie, this trader wagered nearly 28 million dollars, a colossal amount that raised concerns about possible market manipulation.

However, Polymarket found no evidence of intentional manipulation; it seems that the trader simply took a bold and strategic position in favor of Trump. The case raises questions about the influence of big bettors, especially regarding the general perception of platform users, who could be misled by these massive betting volumes.

🚀 Ripple's XRP ETF: Towards an imminent boom?

Ripple's CEO, Brad Garlinghouse, claims that an XRP ETF is "inevitable," opening ambitious prospects for this crypto. After the approval of the first Bitcoin and Ethereum ETFs, attention now turns to XRP, especially with Bitwise's recent application for an XRP ETF in the United States. Despite the legal conflict with the SEC, this news could revitalize Ripple's image and attract the attention of institutional investors.

In parallel, Ripple is also developing its stablecoin RLUSD, aiming to compete with giants like USDT, by focusing on compliance and security to appeal to businesses. If Garlinghouse's expectations materialize, the adoption of an XRP ETF could mark a key step for Ripple and initiate an era of institutional trust in the crypto market.

💸 Ethereum: A drastic drop in gas fees in sight!

Vitalik Buterin announced a reduction in gas costs on Ethereum, aiming to make transactions up to four times cheaper. By lowering the costs of opcodes on the Ethereum Virtual Machine (EVM), this initiative will optimize the network's efficiency, thus increasing the number of transactions per second (TPS) and making the network more accessible.

The reduced fees will attract more users and facilitate the development of smart contracts, making deployment more economical. This project is part of a series of continuous improvements to solidify Ethereum's position as a leader in blockchains, in collaboration with other players in the crypto sector. This advancement could transform the user experience and stimulate an even broader adoption of the Ethereum blockchain.

🌉 Uniswap simplifies multi-chain transfers with a new bridge

Uniswap revolutionizes crypto transfers by launching an innovative multi-chain bridge, which facilitates the movement of assets between Ethereum, Base, Arbitrum, Polygon, and other blockchains. In collaboration with Across Protocol, this bridge allows transfers in a matter of seconds, without the usual complications of external bridges. This permissionless system ensures enhanced security through liquidity pools and decentralized relays, meeting the growing expectations of its six million users.

Currently, only native assets like ETH and certain stablecoins are eligible, but future developments will expand the list of supported assets. This new infrastructure marks a significant advancement for Uniswap, which aspires to simplify exchanges in an increasingly multi-chain ecosystem.

Today's crypto: Chainlink (LINK)

Chainlink is an innovative blockchain that revolutionizes oracles, allowing reliable connections between smart contracts and real-world data. Its added value lies in its ability to provide off-chain information to blockchains in a secure and decentralized manner, thus filling a crucial gap for more advanced decentralized applications (dApps).

The native crypto of Chainlink, LINK, is primarily used to pay node operators providing data and securing the network. Initially distributed via an ICO, LINK offers holders the opportunity to participate in governance and benefit from staking rewards, reinforcing their role in the Chainlink ecosystem.

Recent performances

Current price: €11.75

1-day change: +3.20 %

Market capitalization: €7.37 billion

Rank on CoinMarketCap: 14

🌩️ FUD in the crypto market: Major altcoins wobble under pressure!

The crypto market is currently engulfed in an atmosphere of FUD (Fear, Uncertainty, and Doubt), particularly impacting major altcoins. According to an analysis by Santiment, several leading cryptocurrencies are experiencing steep declines, reflecting a sentiment of caution, even skepticism, among investors. Shiba Inu and Pepe, two very popular tokens, are facing declines of 719% and 574%, respectively. More established cryptos like Filecoin (-380%) and Chainlink (-371%) are also down significantly, highlighting a general downward trend across the altcoin sector.

The analysis attributes this correction to a set of global economic factors weighing on speculative assets, including cryptos. However, this volatility does not necessarily indicate a deterioration of the underlying projects; it could result from an emotional reaction to an unstable market. Despite this gloom, some tokens like EigenLayer stand out, showing a 20% increase in the midst of the storm. This contrast highlights the sustained interest in innovative and solid projects, even in a bear market.

Santiment analysts remind investors to remain cautious against increased speculation in crypto markets. The rise of FUD exposes holders to impulsive selling, which could exacerbate the current correction. Nonetheless, history shows that such periods of turbulence can be followed by unexpected recoveries. For those considering long-term positions, it may be wise to stay calm amid market fluctuations, relying on solid fundamentals.

🔗 Read the full analysis here.