A memecoin to pay off the American debt? Mark Cuban's crazy idea 🤔

Welcome to the Daily Tribune of Wednesday, January 22, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today, it is Wednesday, January 22, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you should not miss!

But first…

✍️ Cartoon of the day:

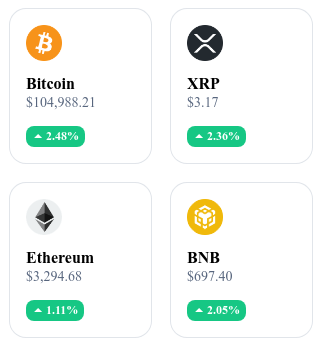

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🏦 MicroStrategy: A massive purchase of 11,000 BTC!

MicroStrategy hit hard at the beginning of 2025 with the purchase of an additional 11,000 bitcoins for a total amount of $1.1 billion. This brings its total reserves to 461,000 BTC, acquired for a cumulative value of $29.3 billion. Michael Saylor, a prominent figure in Bitcoin and co-founder of the company, views this acquisition as another step toward consolidating Bitcoin as a universal store of value.

Financed through the sale of 3 million MicroStrategy shares, this purchase demonstrates a bold strategy, but not without risk, given the inherent volatility of cryptocurrencies. Despite potential fluctuations, MicroStrategy continues its role as an institutional leader in the BTC market.

🛠️ Ramaswamy leaves DOGE: Musk the lone master at the helm

Vivek Ramaswamy, former presidential candidate, has left his position as co-director of the Department of Government Efficiency (DOGE), which he founded with Elon Musk. This departure results from internal disagreements and the announcement of his political ambitions for the position of governor of Ohio. Now alone at the head of DOGE, Musk must manage an organization already under fire and involved in legal actions challenging its legality.

Created to drastically reduce federal spending, DOGE faces growing obstacles, both legal and operational, and raises doubts about its ability to achieve its goals without robust structural support.

⚖️ The EU strengthens stablecoin regulation with MiCA

The European Union has intensified its control over non-compliant stablecoins under the MiCA framework, forcing their withdrawal from European platforms by March 31, 2025. The ESMA imposes drastic restrictions to ensure transparency and investor protection. Issuers must now obtain explicit authorizations to continue operating, under the supervision of national regulators.

These measures could lead to the exclusion of giants like Tether (USDT) from the European market and therefore raise concerns about the impacts on users and the adaptation challenges for platforms. The EU positions itself as a leader in crypto regulation and is resolutely seeking to build a safer and more structured ecosystem while paving the way for compliant alternative solutions.

💰 Mark Cuban wants a memecoin for the American debt

Mark Cuban, the famous American entrepreneur and investor, has proposed creating a memecoin aimed at reducing the national debt of the United States, which is approaching $36 trillion. Inspired by the recent speculative successes of the TRUMP and MELANIA tokens, this initiative would seek to raise funds while ensuring total transparency through a public wallet address. However, the volatility of memecoins and the small share this project could represent in the overall debt (about 0.03%) limit its potential impact.

This provocative idea nevertheless raises questions about the use of cryptos as public financing tools and highlights the dangers of speculative assets without real utility.

The crypto of the day: DeXe (DEXE)

DeXe is based on a blockchain infrastructure focused on decentralized finance (DeFi), facilitating automated and transparent management of digital assets.

Its native crypto, DEXE, is primarily used to reward participants, govern protocol decisions, and allow staking. Initially distributed through a fair system combining ICO and community allocations, DEXE offers benefits like voting rights and financial incentives for holders. It can be used in decentralized portfolio management strategies or to earn passive income through staking.

Recent performances

Current price: €20.56

Daily variation: +12.39% (increase over 24 hours)

Market capitalization: €1.72 billion

Rank on CoinMarketCap: 67

Bitcoin, the American debt, and Trump

The American debt has reached a record level of $36 trillion, which has led the Treasury to temporarily suspend its debt issuances.

This decision, aimed at controlling the budgetary crisis, generates tensions in the financial markets, affecting assets like Bitcoin. Although it is often perceived as a safe haven against economic instability, Bitcoin remains vulnerable to global liquidity contractions. Some analysts predict a significant correction in its price, with a potential peak at $110,000 followed by a drop below $70,000.

However, opinions differ on the implications of this crisis. While some anticipate short-term turbulence, others see it as an opportunity to strengthen Bitcoin's role as a hedge against monetary instability. Trump's impact, who has already influenced the markets through his past statements, could exacerbate Bitcoin fluctuations. His return to the political scene fuels speculation about measures that could be favorable or hostile to cryptos.

Institutional management will play a key role in Bitcoin's volatility. In the longer term, a recovery in the growth of the money supply could propel its price beyond $130,000 in 2025, according to some analyses. However, Bitcoin will need to prove its resilience in the face of complex market conditions and political adjustments.

Despite the uncertainty, Bitcoin retains significant potential. Ambitious projections, such as that of VanEck estimating its price at $180,000 after an initial correction, testify to the growing confidence in its global adoption. In a changing economic environment, marked by liquidity crises and political tensions, Bitcoin could solidify its role as a central player in the new global financial dynamics.