🚀 A “Santa Rally” for Bitcoin? The signals pointing to a sizzling year-end

Welcome to the Daily for Tuesday, November 11, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, November 11, 2025, and as every day from Tuesday to Saturday, we summarize the last 24 hours of news you shouldn’t miss!

But first…

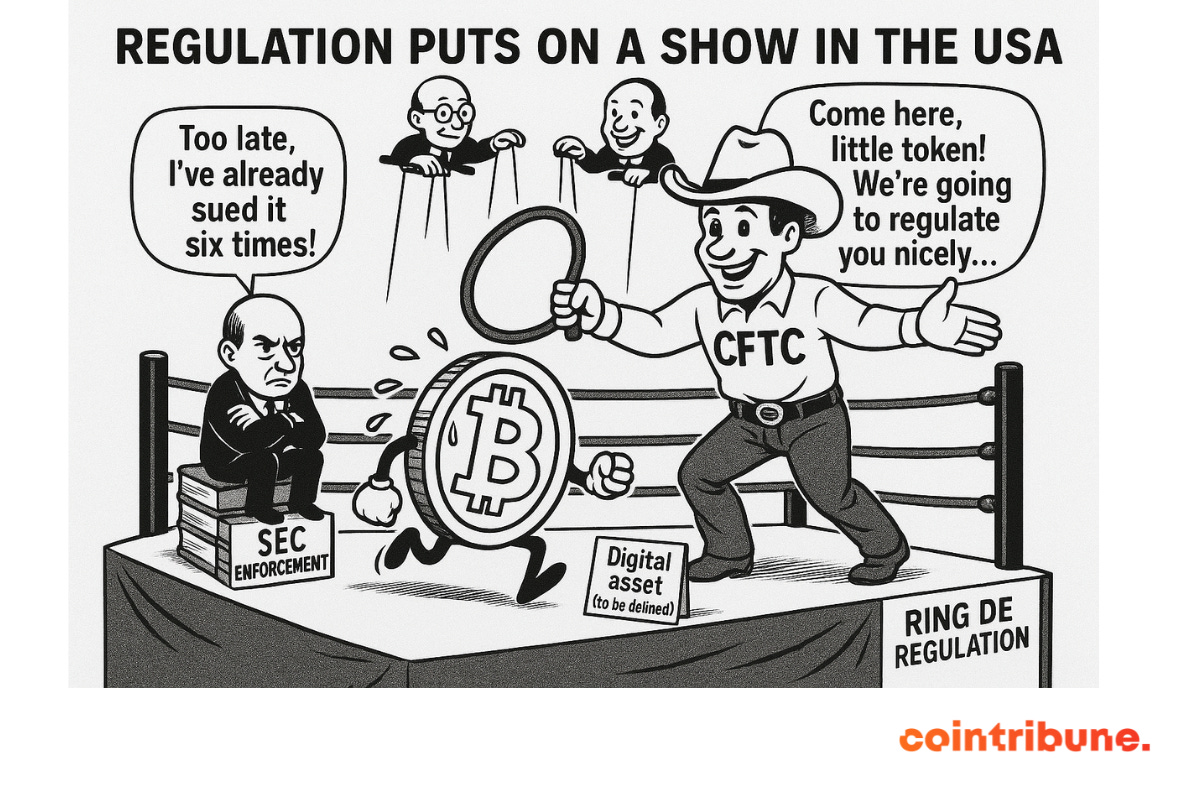

✍️ Cartoon of the day:

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

⚙️ Staking Finally Approved for Ethereum ETFs

U.S. regulators have given the green light for integrating ether staking into ETFs. This major development opens access to new institutional inflows and strengthens the legitimacy of the crypto market in the United States.

👉 Read the full article

🏛️ U.S.: Toward Clear Crypto Market Regulation with the Boozman-Booker Bill

Senators John Boozman and Cory Booker have introduced a bipartisan bill to establish a federal framework for digital assets. The proposal clarifies the division of authority between the SEC and the CFTC and sets out the obligations for trading platforms.

👉 Read the full article

🐋 Ethereum: Whale Activity Returns Ahead of the Fusaka Upgrade

Wallets holding more than 10,000 ETH are seeing their largest accumulation increase since June 2023. This renewed interest comes ahead of the “Fusaka” upgrade, which is expected to boost speed and lower network costs.

👉 Read the full article

💰 Strategy: 487 New BTC for Michael Saylor

Michael Saylor’s company has added 487 bitcoins to its portfolio, bringing the total to over 233,000 BTC. This latest purchase reflects the executive’s steady accumulation strategy despite ongoing market volatility.

👉 Read the full article

Crypto of the Day: Uniswap (UNI)

🧠 Innovation and Added Value

Uniswap is a decentralized finance (DeFi) protocol that allows users to trade cryptocurrencies without intermediaries. Launched in 2018 by Hayden Adams, it relies on an automated market maker (AMM) — a model replacing traditional order books with liquidity pools provided by users.

This innovation revolutionized Ethereum trading by making it open, automatic, and transparent. With version V3, Uniswap introduced concentrated liquidity, optimizing returns for liquidity providers while reducing impermanent loss.

The protocol has since expanded to other blockchains such as Polygon, Arbitrum, Optimism, and Base, becoming a pillar of DeFi and a key driver of Web3 interoperability.

💰 The Token

UNI is Uniswap’s governance token, giving holders decision-making power over the protocol’s evolution — including upgrade proposals, treasury allocations, and strategic direction.

Holders can submit and vote on proposals without any central authority, reinforcing Uniswap’s self-governance model.

The token isn’t used to pay transaction fees; instead, it ensures decentralization and transparency in protocol development. Trading fees are redistributed to liquidity providers, strengthening the network’s internal economy.

📊 Real-Time Performance

💵 Current price: 8.63 USD

📈 24 h variation: +18.66 %

💰 Market cap: 5.44 billion USD

🏅 Rank on CoinMarketCap: #24

🪙 Circulating supply: 630.33 million UNI

📊 24 h trading volume: 4.19 billion USD

Bitcoin: Is a “Christmas Rally” on the Horizon?

Could Bitcoin end the year on a high note? Several indicators point toward the possibility of a “Santa Rally,” a well-known phenomenon in financial markets. Backed by historical data and a favorable economic context, this scenario is attracting investor attention, eager to understand the conditions that could trigger such an upward move — while keeping the necessary caution in mind.

Historical trends and bullish signals for December

Over the past eight years, Bitcoin has closed December in positive territory six times, with gains ranging from 8 % to 46 %. Though rooted in history, this statistic highlights a cyclical pattern that many refer to as the Santa Claus Rally — a year-end uptrend often driven by general optimism and portfolio rebalancing before fiscal closing.

This year, several elements fuel the hypothesis of a rebound. After a volatile October, Bitcoin seems to be regaining stability — a plateau that could serve as a springboard if conditions align. Among those, investor behavior plays a key role. Data shows a notable shift: smaller holders (under 1,000 BTC) keep accumulating, while larger ones slightly trim exposure. This redistribution of liquidity from whales to smaller investors could provide a solid base should new capital inflows arrive.

Macro levers and analysts’ caution

A major factor is the U.S. Federal Reserve’s upcoming decisions. Markets expect a pause — or even a rate cut — which would ease pressure on risk assets. Such monetary relaxation could release more capital into digital assets like Bitcoin.

Current volatility, partly driven by leveraged trading, increases the likelihood of sharp moves. If an external catalyst boosts demand, a snowball effect could follow swiftly.

However, analysts urge caution. History may favor a December rally, but it offers no guarantees. Markets remain highly sensitive to multiple variables: geopolitical tensions, real interest rates, institutional behavior, and potential ETF announcements. Past rallies were often sparked by unpredictable external events.