🔻After an unprecedented drop in October, will November save Bitcoin? 💹

Welcome to the Daily for Saturday, November 1, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, November 1, 2025, and as every day from Tuesday to Saturday, we bring you the key news from the last 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

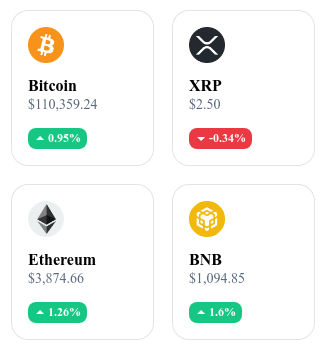

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🏦 The Basel Committee considers updating crypto standards for banks

The Basel Committee on Banking Supervision is preparing to revise its prudential standards to better regulate international banks’ crypto exposures. The new framework, currently under consultation, aims to adjust capital requirements and more clearly define high-risk digital assets.

👉 Read the full article

🧠 Bitcoin white paper turns 17

The Bitcoin white paper, published on October 31, 2008 by Satoshi Nakamoto, celebrates its 17th anniversary. This foundational document laid the groundwork for the decentralized payment system and blockchain technology that have since transformed the global digital economy.

👉 Read the full article

🔐 Cardano strengthens its security with the Ouroboros Phalanx update

The Cardano network has deployed the Ouroboros Phalanx update, improving resistance to network attacks and optimizing node synchronization. This upgrade enhances the protocol’s stability and prepares the ground for future on-chain governance features.

👉 Read the full article

⚡ Zcash surges 130 % in one month

Zcash (ZEC) has soared 130 % over the past month, driven by renewed interest in privacy-focused cryptocurrencies. Rising trading volumes and a new technology partnership announcement have contributed to this spectacular performance.

👉 Read the full article

Crypto of the Day: Bittensor (TAO)

Innovation and Added Value 🧠

Bittensor is a decentralized artificial intelligence (AI) network that transforms how AI models are created, shared, and monetized.

The protocol’s goal is to build an “Internet of AI,” where any developer or researcher can connect their machine learning model and be rewarded based on the real value of their contributions.

Bittensor’s AI models, called neurons, interact within a peer-to-peer evaluation system — the Yuma Consensus — which measures their relevance and allocates proportional rewards.

This approach paves the way for open, collaborative, and self-evolving AI — in contrast with the centralized model of major tech companies.

The ecosystem includes more than 30 specialized sub-networks (subnets): language, vision, data, finance, recommendation, and security.

The Token 💰

TAO is the economic core of the network.

It is used to reward participants (miners and validators), stake AI resources, and pay for access to models via the blockchain.

Holders can delegate their tokens to support specific subnets, thereby influencing their reputation and performance.

TAO also plays a role in protocol governance, with network upgrades voted according to staking power.

With a maximum supply of 21 million tokens, like Bitcoin, Bittensor combines monetary scarcity, technological utility, and computational value.

Real-Time Performance 📊

💵 Current Price: 369.82 USD

📈 24h Change: + 0.47 %

💰 Market Cap: 2,652,000,000 USD

🏅 CoinMarketCap Rank: #43

🪙 Circulating Supply: 7,172,370 TAO

Bitcoin disappoints in October: Could November mark a historic reversal?

October has traditionally been Bitcoin’s ally — until now. In 2025, the cryptocurrency ended a six-year streak of positive Octobers. Will November, historically the most bullish month for BTC, manage to reverse the trend?

An unusual October for Bitcoin

Bitcoin closed October down between –3.35% and –3.69%, an uncommon performance for this time of year. Since 2019, October had always been synonymous with growth for the cryptocurrency. You’d have to go back to 2018 to find a similar negative close — a year that was followed by a sharp –36.57% drop in November.

This reversal occurred amid a difficult broader crypto environment. Data shows that nearly $19 billion in liquidations took place in October. These forced sales amplified volatility, compounded by geopolitical tensions — particularly the ongoing U.S.–China trade war — which heightened uncertainty across risk markets.

Despite this challenging picture, long-term statistics offer some reassurance: since 2013, November has delivered an average gain of +42.51% for Bitcoin, making it historically the strongest month of the year.

Between promising stats and cautious optimism

Could Bitcoin’s historically strong November repeat itself? Several key factors will determine the outcome. First, the Federal Reserve’s monetary policy decisions will play a major role. Stable or lower interest rates could rekindle risk appetite and benefit digital assets.

Next, inflows into Bitcoin ETFs, recently approved across several jurisdictions, will serve as a crucial indicator of institutional confidence. The activity of whales — large holders capable of moving the market — as well as on-chain metrics tracking network activity, will also provide important signals.

November opens amid both hope and caution. While history favors a rebound, the current environment reminds investors that statistics alone are not destiny. Staying informed, adapting strategies, and closely monitoring market signals will be essential to navigate what could be a decisive month.