🚀 America returns pro-crypto!

Welcome to the Daily Tribune of Wednesday, February 05, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Wednesday, February 05, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

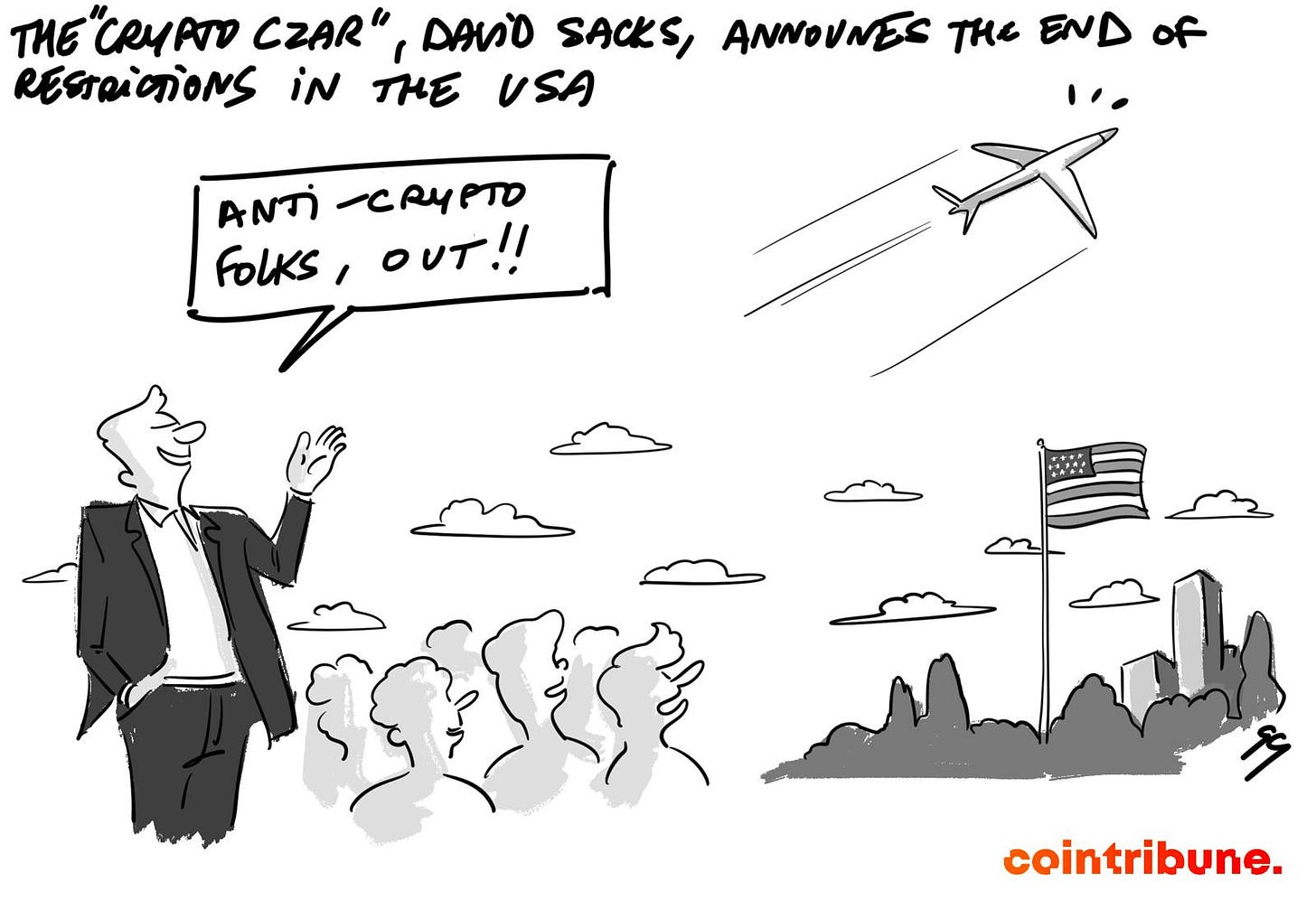

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

🇺🇸 David Sacks announces the end of crypto restrictions in the United States!

During a historic conference yesterday, February 4, 2025, David Sacks, appointed "Czar of Crypto" by the Trump administration, officially announced the end of restrictions on cryptocurrencies in the United States. He stated that the era of hostile regulations and excessive lawsuits was over and promised a clear regulatory framework. Among the measures announced: a clarification of the legal status of cryptos, the end of abusive lawsuits against certain companies, and enhanced dialogue with federal authorities. This announcement marks a decisive turning point for the sector, which could see a massive return of crypto companies to the United States. 🔗 Read the full article

⚡ Ethereum Pectra: The update that will revolutionize the network!

Scheduled for March 2025, Ethereum's Pectra update introduces major innovations that will transform the user experience and improve the scalability of the network. Among the most anticipated changes: EIP-7702 smart accounts, which allow for simplified wallet use, without cumbersome migration, and increased capacity for blobs, facilitating Layer 2 solution optimization. Meanwhile, Ethereum is revising its staking system by multiplying the stake limit by 64 per validator. Vitalik Buterin estimates that Pectra could mark a historic advance for the massive adoption of Ethereum by making its use smoother and more accessible. 🔗 Read the full article

💰 Semler Scientific buys 871 additional BTC!

The company Semler Scientific (NASDAQ: SMLR) continues its aggressive accumulation of Bitcoin, with a purchase of 871 BTC, bringing its total to 3,192 BTC. The company invested $88.5 million between January and February 2025, using convertible bonds to finance this acquisition. Its average purchase price is $101,616 per BTC, with a return of 152.2% since July 2024. Now, Bitcoin represents more than half of its market capitalization ($484 million), a strategic choice that transforms the medical company into a major player in BTC investment. 🔗 Read the full article

🔥 Bitcoin's hashrate reaches a historic record!

The Bitcoin network has just reached a new historic peak of 833 EH/s, an increase of 9% in just a few days. This explosion of computational power is fueled by massive investments from miners, who are strengthening their infrastructure to compensate for the reduction in rewards after the April 2024 halving. However, a paradox emerges: despite this increase, transaction fees drop to $0.69, which weakens miners' profitability. If this trend continues, the least efficient companies may be forced to shut down, leading to increased centralization of mining. 🔗 Read the full article

Today's crypto: Ultima (ULTIMA)

Ultima aims to provide a global financial infrastructure, facilitating instant cross-border payments. This project offers a range of innovative products, including modern crypto wallets, a unique crypto debit card, a crowdfunding platform, and its own online marketplace. These solutions aim to enhance user interaction with cryptocurrencies and provide globally accessible financial services.

The native token, ULTIMA, serves as an infrastructure token within the Ultima ecosystem. It is used to access various offered features, such as payments with the crypto debit card, participation in crowdfunding campaigns, and transactions on the dedicated online marketplace. The initial token distribution is not specifically detailed in available sources. ULTIMA holders benefit from seamless integration into a diverse ecosystem, allowing them to make quick and secure payments, as well as to engage in a variety of innovative financial services.

Recent performances:

Current price: $17,051.69 (around €15,000)

Percentage increase/decrease: +19.7% over the last 24 hours

Market capitalization: $745,683,231 (around €660,000,000)

Rank on CoinMarketCap: 116

RWA: The tokenization of Real-World Assets revolutionizes the crypto market with record growth

The market for real-world assets (RWA) is experiencing unprecedented expansion due to their tokenization, with a total value locked (TVL) reaching $17.1 billion, marking a 94% increase in one year. This surge, driven by increasing interest from financial institutions, marks a strategic turning point in the adoption of cryptocurrencies by traditional investors. Major companies, including BlackRock, are investing heavily in this evolving market, paving the way for a restructuring of investment models. Meanwhile, several RWA-related tokens are showing spectacular performances: Ondo Finance (+27%), Chintai (+38%), Mantra (+23%), and Chainlink (+22%). This dynamic reflects a profound change, where decentralized finance (DeFi) and traditional markets are increasingly converging.

The rise of RWA not only benefits projects specialized in asset tokenization. The entire crypto market is reaping the rewards of this momentum, with a 7% increase in total market capitalization over 24 hours. This enthusiasm is bolstered by favorable macroeconomic factors, such as the postponement of tariff increases between the United States, Canada, and Mexico, as well as more favorable U.S. regulations for cryptocurrencies. The diversification of tokenized assets is reflected in their distribution: 70% of the on-chain value of RWA is concentrated in private credit, while 21% concerns U.S. government bonds. This structure highlights the maturity of the market and the growing interest of institutional investors in blockchain-based financial instruments.

The future of RWA looks promising, especially as experts like Hunter Horsley, CEO of Bitwise, anticipate an even deeper transformation of financial markets through artificial intelligence and tokenization. This technological convergence could facilitate access to funding for small businesses and encourage even broader adoption of blockchain in traditional financial systems. With growing institutional demand, better regulation, and continuous technological advancements, RWA could establish itself as one of the major pillars of the next great wave of financial innovation in the crypto universe.