An English macroeconomist claims to be the creator of Bitcoin 🕵️

Welcome to the Daily tribune of Sunday, November 3, 2024 ☕️

Hello Cointribe! 🚀

Today is Sunday, November 3, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't have missed!

But first…

✍️ Cartoon of the day:

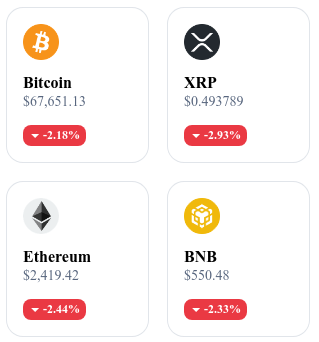

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

SafePal and Telegram: the Swiss crypto-friendly bank account is here! 🏦

SafePal is launching a new crypto-friendly application integrated directly into Telegram, offering users the ability to open a Swiss bank account compatible with cryptos. In partnership with Fiat24, a regulated Swiss provider, this solution offers a secure portfolio management experience, compliant with FINMA security standards.

With an integrated KYC service, users can not only store and transfer cryptos but also spend them via a crypto Visa card, thus avoiding barriers between traditional and digital currencies. SafePal is focusing on a CeDeFi model, which combines the benefits of centralized and decentralized finance while maintaining strict compliance and user autonomy. By planning to extend this functionality to over 100 blockchains and to expand in Europe and Asia-Pacific, SafePal and Telegram aim to revolutionize digital finance for everyday use, facilitating increased adoption of cryptocurrencies by the general public.

Arthur Hayes abandons Bitcoin for Solana in anticipation of the U.S. elections 🗳️

Arthur Hayes, co-founder of BitMEX, is adopting a new strategy by prioritizing Solana over Bitcoin. He considers Solana to be more reactive and capable of taking advantage of the expected volatility from the elections and any decisions from the Federal Reserve. Bitcoin, often seen as a stable and secure asset, lacks flexibility according to him to capture the swift movements of the market.

In contrast, Solana, with its agile structure, is described by Hayes as a "high beta" choice, offering opportunities for outperformance in bullish market conditions. This preference also highlights a criticism of Ethereum, viewed as too heavy and inefficient in comparison. Hayes sees Solana as the embodiment of a new generation of dynamic digital assets, attracting investors seeking quick returns. His change in orientation underscores the evolution of expectations in the sector, where reactivity increasingly prevails over stability.

Bitcoin explodes against the devaluation of the Naira in Nigeria 💹

In Nigeria, the devaluation of the Naira, which has fallen to a historic level of 1,670 NGN for a dollar, has pushed local investors to turn to Bitcoin as a safe haven asset. The decline in dollar liquidity and economic pressures, amplified by dependence on imports and falling oil revenues, have exacerbated the monetary crisis.

In this context, Bitcoin reached a historic peak of 120 million NGN in early November 2024, surpassing its previous record from 2021. The Nigerian crypto market is experiencing significant growth and is attracting a young and tech-savvy population, although the sector remains subject to regulatory challenges due to authorities' concerns about potential illicit activities. BTC is establishing itself as an alternative solution for wealth protection and could well become a pillar for the Nigerian digital economy.

A macroeconomist declares himself Satoshi Nakamoto, but doubts remain 🤔

Stephen Mollah, a British macroeconomist of Asian descent, has reignited the mystery surrounding the identity of Satoshi Nakamoto by publicly claiming to be its creator at an event in London. In front of a curious but skeptical audience, Mollah promised to prove his identity with a demonstration of a transfer from the Bitcoin Genesis block, an act that only the creator of Bitcoin could accomplish.

However, this promise was not accompanied by tangible evidence during the event, causing impatience and distrust among the participants. Mollah also made surprising statements by claiming the creation of the Twitter logo, the Eurobond, and even ChatGPT, further reinforcing doubts about his credibility. While awaiting concrete evidence, this announcement fuels fascination around Satoshi Nakamoto's identity, while reactivating speculation and skepticism within the crypto community.

Crypto of the day: Theta Network (THETA)

Theta Network is an innovative blockchain for decentralized video content delivery. By offering a distributed network where users share their bandwidth and resources, it reduces transmission costs for streaming platforms while improving quality for end users.

The native crypto, THETA, serves to secure the network by allowing holders to become validators or delegate their tokens for staking. Initially distributed through a token sale, THETA offers rewards to active holders, encouraging staking participation and contribution to the ecosystem. It is primarily used for transactions within the network and staking, with benefits such as earning participation and an active role in Theta governance.

Recent performances:

Current price: $1.04 (approximately €0.98)

24-hour change: - 5.26%

Market capitalization: $1.04 billion

Rank on CoinMarketCap: #62

Dogecoin: Towards a new explosive rally in November? 🚀

In October, Dogecoin posted an impressive performance with a rise of 41.4%, driven by a surge of interest from retail investors and the influence of figures like Elon Musk. This increase was accompanied by growing trading volume, reaching 1.17 billion, and sparked positive expectations for November, despite its historically unpredictable nature.

Ali Martinez, a crypto analyst, believes that Dogecoin could experience a parabolic upward trend if its price exceeds the $0.20 mark, thus suggesting a possible replication of October's performance.

However, November remains a contrasting month for Dogecoin, with marked increases in 2017 and 2023, but also notable declines in other years. Observing historical patterns, some analysts note a triangular pattern which, if broken, could lead to a new surge, reminiscent of the increases of 2017 and 2021. Despite this optimism, cautious signals urge investors to remain vigilant.

🔗 Read the full analysis here.