Hello Cointribe! 🚀

Today is Friday, August 1, 2025, and as every Tuesday through Saturday, we bring you the must-know news from the past 24 hours.

But first…

✍️ Cartoon of the day:

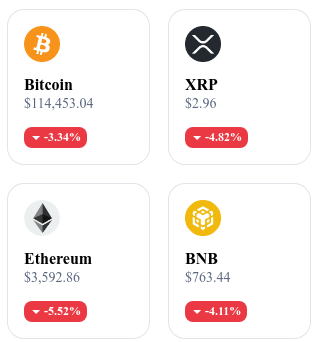

A quick look at the market…

🌡 Weather:

⛈️ Stormy

24h crypto recap! ⏱

📉 Pi Network at Risk of Breaking Historic Support After Continued Drop

Pi Network’s price is nearing the critical $0.40 level, with technical indicators (MACD, momentum, loss of intermediate supports) suggesting persistent weakness. Community disengagement and the lack of clear positive catalysts make a short-term rebound unlikely.

👉 Read the full article

🪙 Base Surpasses Solana with Token Creation Surge

Base generated 51,575 new tokens in a single day—far outpacing Solana—which highlights intense activity across its ecosystem. However, this rapid pace raises concerns about potential future dilution and the quality of newly launched projects.

👉 Read the full article

🔓 Token Unlocks Set to Drop to Around $3 Billion in August

Scheduled token unlocks for August are estimated at $3 billion, likely easing sell pressure and helping stabilize prices. Despite the slowdown, significant unlock events are expected in the coming months, warranting close monitoring of market liquidity.

👉 Read the full article

💰 Strategy Reports $10 Billion Profit Thanks to Bitcoin Rebound

The recent rise in Bitcoin’s price enabled Strategy to post an estimated $10 billion profit, strengthening confidence in its hybrid model that combines indirect BTC exposure and dividend distribution through STRC. The strong performance positions the fund as an appealing option for investors seeking a balance between returns and Bitcoin-linked exposure.

👉 Read the full article

🎯 Naoris Protocol Kicks Off Major Read2Earn Contest with Over €2,000 in Rewards

To celebrate its Token Generation Event (TGE) on July 31, 2025, Naoris Protocol has teamed up with Cointribune to launch a special Read2Earn contest. From July 31 to August 14, 2025, readers can compete for a share of over €2,000 in prizes, including:

$NAORIS tokens (four prizes: $400, $300, $200, $100 at TGE price)

5 Ledger Nano S Plus

5 collector hoodies

5 exclusive t-shirts

5 caps

5 mugs

📝 How to Participate

Create or log into a Cointribune account.

Complete the Naoris Protocol quest in the Read2Earn section: answer the quiz correctly to earn points.

Link a crypto wallet (e.g., MetaMask) to your profile to receive token rewards.

Exchange your points for a ticket in the Read2Earn marketplace—this unlocks the entry form.

Share the article on at least one social media platform (Twitter/X, LinkedIn, or Facebook) following the rules: required accounts, hashtags (e.g., #ReadToEarnNaoris), and proper mentions.

Submit your entry by filling out the form and providing the link to your social media post.

🏆 Winner Selection and Prize Distribution

Winners will be selected by random draw from eligible and fully completed entries. Only participants who follow all steps—quest, ticket, wallet, and valid social share—will be considered.

👉 Read the full article and participate

Crypto of the Day: Toncoin (TON)

🧠 What’s the innovation and added value?

Toncoin is the native token of The Open Network (TON), a Layer 1 blockchain originally developed by Telegram and now maintained by the TON Foundation. It features dynamic sharding (masterchain, workchains, shardchains), an efficient Proof-of-Stake consensus, and hypercube routing to achieve extremely high throughput—processing thousands of transactions per second—with near-instant finality.

TON’s integrated ecosystem includes TON DNS, Storage, Proxy, and Sites, forming a decentralized infrastructure designed as a supercomputer. Its seamless integration with Telegram drives adoption through real-world use cases such as payments, content monetization, and reward systems.

💰 The TON Token: Utility and Benefits for Holders

The token is used to cover transaction fees, gas, and storage. Holders can stake or delegate their TON to secure the network and earn passive rewards. TON is also the native currency across the entire ecosystem—powering dApps, NFTs, microservices, and enabling on-chain governance to influence the protocol’s development.

📊 Recent Performance (as of August 1, 2025)

Current Price: $3.44 USD

24h Change: –1.48%

Market Cap: ≈ $8.35 billion USD

CoinMarketCap Rank: #19

Circulating Supply: ≈ 2.416 billion TON

24h Trading Volume: ≈ $578 million USD

📉 Bitcoin Falls Below $115,000!

After recently flirting with new all-time highs, Bitcoin faced a sharp reversal triggered by a tariff announcement from Donald Trump. While dramatic, the move reflects a more complex mix of macroeconomic uncertainty, speculative adjustments, and growing institutional interest.

Liquidations, Uncertainty, and the Trump Effect: What’s Behind the Drop?

Bitcoin’s swift dip below the symbolic $115,000 threshold came as a surprise. On August 1, the price dropped to around $114,250—down 2.6% in just 12 hours. The correction followed an executive order from presidential candidate Donald Trump, who proposed new tariffs. While aimed at reassuring U.S. markets, the announcement had the opposite effect.

As a result, over $110 billion exited the spot markets, and 158,000 leveraged positions were liquidated—mostly longs. The wipeout cost investors roughly $630 million, exposing the market’s extreme sensitivity to political news perceived as aggressive or destabilizing.

Some analysts argue this pullback doesn’t signal a lasting trend reversal. The mid-July high of $122,800 and the record monthly wick at $115,784 suggest the broader uptrend remains intact in the medium term. The market may simply be digesting excessive leverage built up in recent weeks.

Strategic Accumulation and Corporate Treasury Moves Signal Long-Term Confidence

Amid the correction, corporate treasuries appear to be strengthening their crypto exposure. According to the latest data, publicly listed companies invested over $7.8 billion in digital assets within a short timeframe—an indication of growing structural confidence in the sector’s potential.

MicroStrategy—now rebranded as Strategy—acquired 21,021 BTC through a $2.5 billion bond issuance. This move reflects a broader trend, with other firms also targeting assets like Ethereum, Solana, Tron, BNB, and SUI. Altogether, nearly $2.7 billion was poured into Bitcoin during this latest accumulation wave.

This contrast—between short-term panic selling and large-scale institutional buying—highlights a dual narrative shaping the market: heightened volatility driven by global politics on one hand, and strategic consolidation that could fuel the next bullish cycle on the other.