Hello Cointribe! 🚀

Today is Thursday, 20 November 2025, and as every day from Tuesday to Saturday, we bring you a summary of the key news from the last 24 hours that you shouldn’t have missed!

But first…

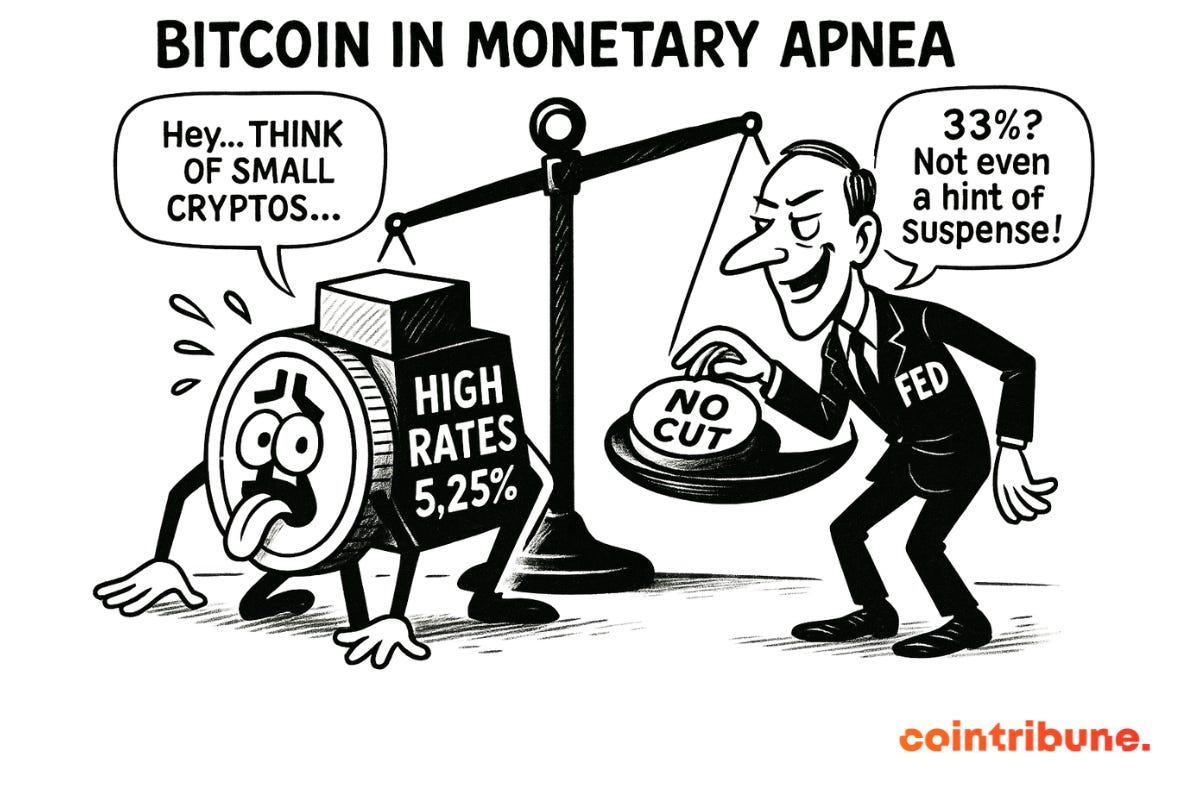

✍️ Cartoon of the day:

A quick look at the market…

🌡 Weather:

⛈️ Stormy

24h crypto recap! ⏱

🧾 France: Deblock raises €30M to become the first 100% blockchain bank

The crypto neobank Deblock has raised €30 million to accelerate its development and become the first bank operating entirely on blockchain.

👉 Read the full article

🚀 Solana: surge in token launches but stagnant revenues

On the Solana platform, more than 200,000 new tokens have been launched via pump.fun in recent days, while network revenues remain low and user engagement limited.

👉 Read the full article

📊 Bitwise Asset Management submits the final version of its XRP ETF

Bitwise has filed the final version of its application with U.S. regulators to launch an ETF based on the XRP token, marking a major step in the institutionalisation of this asset.

👉 Read the full article

📈 Bitcoin: ETFs return to inflows after a red week

After a week of outflows, Bitcoin-related ETFs are once again showing incoming flows: the Solana ETF recorded $55.6M and the XRP ETF $15.8M, while BTC is trading around $92,200.

👉 Read the full article

Crypto of the day: Fetch.ai (FET)

🧠 Innovation and added value

Fetch.ai is a protocol that combines artificial intelligence, blockchain and autonomous agents to create a decentralised network of “AI Agents”.

These agents can perform tasks automatically: searching for data, optimising transportation, managing autonomous services, executing transactions or negotiating prices with each other.

The project aims to build a machine-to-machine (M2M) economy where services can operate without human intervention, thanks to a secure, interoperable and AI-optimised network.

Fetch.ai stands out for its ability to automate complex operations in sectors such as supply chain, mobility, financial services or data analysis.

💰 The token

The FET token powers the entire Fetch.ai network. It is used to:

pay for transactions carried out by autonomous agents;

reward nodes that validate and secure the network;

fund the execution of AI algorithms on the protocol;

participate in governance and community decisions.

Holders can delegate their tokens to support validators while receiving rewards.

FET therefore represents a combination of utility (AI usage), incentives (rewards) and governance (voting), making it a central asset of the Fetch.ai ecosystem.

📊 Real-time performance

💵 Current price: $0.3096

📈 24h change: +6.49%

💰 Market cap: $730.69M

🏅 CoinMarketCap rank: #77

🪙 Circulating supply: 2.35B FET

📊 Trading volume (24h): $351.43M

Inflation holds firm, the Fed delays: Bitcoin plunges into extreme fear

Recent adjustments in expectations from the U.S. Federal Reserve are shaking the markets, especially Bitcoin. The prospect of monetary easing in December is fading, altering investor sentiment and technical signals across the crypto market.

The Fed’s shifts reshape the monetary landscape

In early November, markets were still expecting a 25-basis-point rate cut, with a probability of 67%. Today, that outlook has dropped to 33%, according to data from the Chicago Mercantile Exchange. This reversal is driven by Jerome Powell’s cautious remarks and inflation that is more resilient than expected. Platforms such as Kalshi or Polymarket present more optimistic figures, but the overall momentum remains cautious.

In this environment, cryptocurrencies — particularly Bitcoin — are showing signs of fragility. Without short-term monetary support, the crypto market is directly reflecting this macroeconomic pressure.

Unfavourable technical signals and growing investor concerns

Technically, Bitcoin recently crossed a critical threshold by losing the 90,000-dollar support and now trading below 80,000 dollars. Even more concerning, the cryptocurrency has remained for several days below its 365-day moving average, a level closely watched by analysts.

The bearish crossover between the 50-day and 200-day moving averages — also called the “death cross” — reinforces this signal of weakness. Analyst Benjamin Cowen recalls that if the current cycle is not over, a short-term rebound is possible; otherwise, a drop toward 75,000 dollars could occur before a recovery expected by late 2025.

The “Crypto Fear & Greed” index confirms this pessimistic mood, stagnating at 16 points, indicating extreme fear. Institutional investors are also affected: Bitcoin ETFs recorded 1.1 billion dollars in net outflows.

Bitcoin’s current situation illustrates the crypto market’s sensitivity to U.S. monetary policy decisions. The fall in the probability of a December rate cut — from 67% to 33% — has revived investor caution and weakened BTC’s technical indicators. In a context where inflation remains persistent and the Fed maintains a restrictive stance, digital assets appear headed for a consolidation phase. Nevertheless, past cycles have shown that periods of extreme fear can precede significant rebounds.