📉 Binance empties its Bitcoins: A signal for the next bull run?

Welcome to the Daily Tribune of Friday, December 27, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, December 27, 2024, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

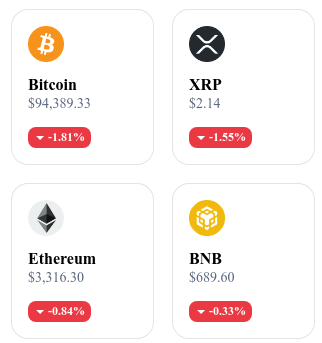

A quick look at the market…

🌡️ Temperature:

Stormy ⛈️

24h crypto recap! ⏱

🤖 AI agents revolutionize crypto payments

In 2024, autonomous AI agents redefine the crypto payments ecosystem by leveraging synergies between blockchain and artificial intelligence. Unlike traditional AI approaches, these agents operate like autonomous smart contracts, capable of managing wallets, signing keys, and executing transactions without continuous human intervention.

This automation enhances the user experience and makes payments smoother while circumventing the regulatory constraints of traditional financial systems. However, these innovations require human oversight to verify and ensure the reliability of decisions made by these agents, an imperative to maintain the security and integrity of operations. While complete autonomy remains a challenge, these technologies pave the way for new opportunities in the crypto universe.

📉 Bitcoin reserves on Binance reach an unprecedented level

Bitcoin reserves on Binance have fallen below the 570,000 BTC mark, a historic threshold since last January. This movement, often associated with a rise in withdrawals to private wallets, could be a precursor signal of a significant bull run. A similar situation occurred in January 2024, before a rally of 90% in BTC two months later.

Currently, Bitcoin's dominance remains at 58.4%, below the symbolic threshold of 60%, raising expectations around a potential resurgence in market momentum. Investors are showing increased confidence in Bitcoin long term, while traders remain cautious about diversification movements in the crypto market. If history were to repeat itself, BTC could reach new heights in the coming months.

🚀 Bitcoin takes off, but mining companies falter

Despite a spectacular 128% increase in Bitcoin’s price over a year, mining companies struggle to keep up with this momentum. Argo Blockchain, for example, recorded an 84% drop in its stock value over the year. Riot Platforms and Marathon Digital, despite being among the largest players in the sector, saw their values decline by 29% and 16%, respectively.

High energy costs, regulatory pressures, and operational inefficiencies largely explain this divergence between Bitcoin's rally and these companies' stock performances. However, some companies like TeraWulf (+152%) and Bitdeer (+131%) are managing to excel thanks to tailored and diversified strategies, underscoring the importance of proactive management in such a volatile sector.

🇮🇱 Israel embraces Bitcoin with six new regulated funds

Israel marks a turning point in its financial landscape by launching six regulated Bitcoin funds, accessible as of December 31 through local banks and investment companies. These funds, some of which are inspired by international ETFs like BlackRock's iShares Bitcoin Trust (IBIT), offer crypto exposure while staying within a secure framework. They aim to attract investors with competitive fees (0.25% to 1.5%) and varied strategies, including an actively managed fund seeking to outperform Bitcoin's performance.

This development fits into a broader dynamics of digital transformation in Israel, alongside the national digital currency project (Digital Shekel). By combining modernization and diversification, Israel is positioning itself as a key player in the adoption of digital assets.

The crypto of the day: XDC Network (XDC)

The XDC Network, based on hybrid blockchain technology, offers a combination of public and private solutions tailored for businesses. Its speed and low transaction costs make it ideal for financial applications like cross-border payments and asset tokenization.

The native crypto, XDC, serves as a means of exchange and fuel for transactions on the network. It is used to pay transaction fees and secure the network via masternodes. Distributed during its launch through an ICO, it also rewards holders for their participation in the network. Users benefit from energy efficiency and access to scalable decentralized finance (DeFi) solutions.

Recent performances

Current Price: €0.072

24h Change: -8.9%

Market Capitalization: €1.15 billion

Rank on CoinMarketCap: 90

Why XRP could outperform Bitcoin and Ethereum?

XRP, the flagship token of Ripple, captures investors' attention due to a promising technical setup. According to CredibleCrypto, a renowned analyst, XRP shows an "inverted head and shoulders" pattern, a precursor signal to a 65% rise from its current levels. This bullish potential is reinforced by XRP's stabilization at key support zones and increased interest from institutional investors. Moreover, XRP's movements against the dollar and Bitcoin offer interesting entry opportunities for traders and solidify its attractiveness in the market.

Unlike XRP, Ethereum remains in a phase of uncertainty. Although its price fluctuates between $3,000 and $3,800, analysts anticipate a correction to $2,800 before a potential rebound. The ETH/BTC pair, considered strategic, could also reach a low point around 0.027 BTC, thereby providing an opportunity for long-term investors. Despite this waiting phase, Ethereum's fundamentals remain strong, but any significant movement towards new highs may require several months.

The optimism surrounding XRP extends even to bold forecasts, with some envisioning a price of $100 by 2025. The launch of new products like the stablecoin RLUSD and increased interest in Ripple indicate a positive momentum for the token.

If these indicators materialize, XRP could not only compete with Bitcoin and Ethereum but also redefine expectations within the crypto ecosystem.