🌐 Binance reaches 275 million users

Welcome to the Daily Tribune of Thursday, June 5, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, June 5, 2025 and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours that you should not miss!

But first…

✍️ Cartoon of the day:

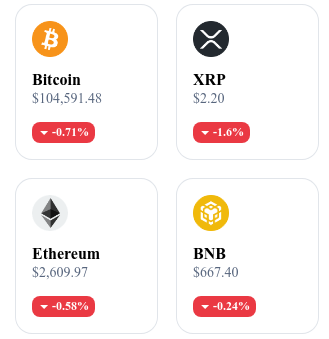

A quick look at the market…

🌡️ Temperature:

⛈️ Stormy

24h crypto recap! ⏱

🌐 Binance surpasses 275 million users worldwide

Binance announced that it has passed the milestone of 275 million users, with 80 million new registrations in the last five months. This growth reflects the ongoing rise of cryptocurrencies in global finance.

💸 The USD1 stablecoin supported by the Trump family struggles to convince markets

The USD1 stablecoin, launched by World Liberty Financial and supported by the Trump family, reached a capitalization of 2.2 billion dollars in less than two months. Despite this initial success, the project faces criticism regarding its lack of transparency and political ties.

🇰🇷 South Korea elects a Bitcoin-friendly president

Lee Jae-myung has been elected president of South Korea. His program includes the development of a stablecoin backed by the won, the integration of Bitcoin into the national pension fund, and the creation of a Bitcoin ETF.

🏦 Russia's largest bank issues its first Bitcoin bonds

Sberbank, Russia's largest bank, has issued its first Bitcoin-backed bonds, reserved for wealthy investors. These financial products allow benefiting from the rise of Bitcoin and the decline of the ruble against the dollar. The bank plans to expand this offer to other cryptocurrencies as part of Russia's strategy to circumvent financial sanctions.

🎮 Ultra challenges the giants: why the future of video games will not take place on Steam

Ultra positions itself as a blockchain-based video game distribution platform and aims to offer an alternative to sector giants such as Steam. It offers a unified ecosystem integrating features such as launchers, leaderboards, digital wallets, NFTs, and tournaments. This approach aims to simplify the user experience by centralizing various gaming-related services. Ultra also emphasizes digital ownership and enables players to truly own their games and digital content through blockchain technology.

By integrating Web3 elements, Ultra seeks to redefine how video games are distributed and consumed. The platform offers developers new monetization opportunities and players greater transparency over the origin and value of their digital assets. Relying on blockchain, Ultra aims to create an environment where users have increased control over their data and interactions while fostering a fairer economy for content creators.

Crypto of the day: Ethereum Name Service (ENS)

🧠 Technology and innovation

Ethereum Name Service (ENS) is a decentralized domain name system built on the Ethereum blockchain. It allows replacing long alphanumeric Ethereum wallet addresses with readable and memorable names, such as alice.eth.

This simplification facilitates transactions and interactions on the blockchain, reducing errors and improving user experience. ENS uses smart contracts to manage the registration, resolution, and management of domain names, thus ensuring a secure and decentralized infrastructure.

💰 ENS Token – Utility and distribution

The ENS is the native token of the Ethereum Name Service protocol. It is used for:

Governance: holders can participate in decisions regarding the protocol's evolution.

Fee payment: the token is used to pay fees related to domain name registration and renewal.

The initial ENS distribution was carried out via an airdrop to users who registered .eth domain names, thus encouraging broad community participation.

📊 Market data (as of June 5, 2025)

Current price: $21.62 USD

24-hour change: -$0.24 (-1.10%)

Market capitalization: approximately 790 million dollars

Rank on CoinMarketCap: #87

Circulating supply: 36,455,104 ENS

24-hour trading volume: approximately 66 million dollars

Ethereum: towards a major reversal? Technical signals align

While Ethereum's (ETH) price seems stuck below $2,600, a series of advanced technical indicators are now drawing the attention of market analysts. One of them, crypto analyst Kevin, signals a possible trend reversal comparable in scale to that of 2020.

Rare long-term technical signals

Three converging elements support the hypothesis of an imminent reversal:

Monthly Rare Demand Candle: detected in April 2025, this type of structure has only been observed twice since 2020. Each time, it preceded a major bullish acceleration phase.

Monthly stochastic RSI forming a “V” shape: historically associated with exiting a bear market, this movement signals the return of buying momentum on a wide time scale. This crossover appeared just before the 2020–2021 rally.

MACD compression in a symmetrical triangle: after four years of convergence, the indicator shows an accumulation of energy. A breakout could propel the price well beyond current levels.

These elements alone deserve attention. But their simultaneous appearance reinforces the idea of a structural momentum change, barely noticeable on short time frames but potentially significant for the coming months.

ETH/BTC, dominance, volume: a market-wide shift underway

The technical argument is complemented by a favorable inter-market reading. The ETH/BTC ratio, often used to measure altcoins’ relative strength compared to Bitcoin, has returned to the 0.5 Fibonacci retracement level of the last bullish cycle.

This level had already served as the base for the 2020 altseason, and its current maintenance suggests that sector rotation could repeat.

Other key indicators:

Appearance of green monthly Heikin-Ashi candles on a historic long-term support;

Increase in VWAP and monetary volume circulating on Ethereum;

Bullish inflection of ETH dominance, indicating a gradual return of confidence on major altcoins.

In parallel, on-chain data shows a slow but steady accumulation by large entities (whales), a typical configuration of discreet accumulation phases before a rally.

Ethereum may be at the dawn of a major reversal, not driven by a new narrative, but validated by a rarely seen conjunction of long-term technical indicators.

If these signals are confirmed by a technical breakout and volume revival, ETH could not only initiate a new bullish wave but also resume its role as a driver for the altcoin market.