🚨 Binance sold in secret? CZ denies and accuses competition of misinformation!

Welcome to the Daily Tribune of Tuesday, February 18, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Tuesday, February 18, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

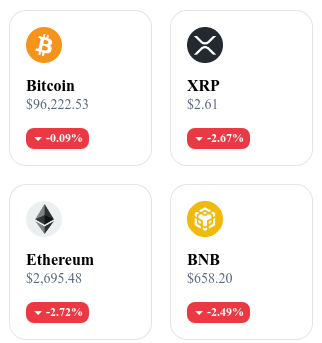

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

🚫 CZ firmly denies rumors of Binance's sale!

In the face of growing speculation about a potential sale of Binance, Changpeng Zhao (CZ) categorically denied it on X (formerly Twitter). He accuses an Asian competitor of being behind these false rumors, asserting that he remains the principal shareholder and that Binance is not up for sale. Doubts are nevertheless fueled by recent massive asset movements on the platform, as well as by the regulatory difficulties it faces in France and the United States. Binance has, however, clarified its financial situation, explaining that it was merely an accounting adjustment. 🔗 Read the full article

💰 California and 11 other states massively invest in Bitcoin via Strategy!

Twelve U.S. states, including California, Florida, and Wisconsin, have just injected $330 million into Strategy (formerly MicroStrategy) for indirect exposure to Bitcoin. California, with $150 million, is the largest investor through its public pension funds. This decision marks a massive institutional adoption of Bitcoin, driven by confidence in Michael Saylor's aggressive strategy, which now holds 478,740 BTC. With a 383% increase in the Strategy stock over the year, these states are betting on a potentially highly profitable wager, but one that remains extremely volatile. 🔗 Read the full article

📊 Ether options send a mixed signal!

The market for ETH options shows strong optimism, with 70% of contracts oriented upwards and targets set between $3,000 and $4,000. However, a major risk looms: if ETH drops below $2,600, it could trigger a massive liquidation of $500 million, amplifying a brutal correction. Economic tensions and increasing volatility add uncertainty, pushing some investors to hedge against a potential crash. The period of February-March will thus be decisive for the trajectory of ETH. 🔗 Read the full article

🏦 Bitcoin, Ethereum, and Cardano soon obsolete against GAFAM?

Charles Hoskinson, founder of Cardano (ADA), warns of an imminent threat: the arrival of tech giants (GAFAM) in blockchain. According to him, Google, Apple, Microsoft, and Amazon could dominate the industry, relegating decentralized blockchains to the background. By integrating native blockchain solutions into their services (Google Pay, Apple Pay, mobile OS), they would make traditional cryptos less attractive. With their financial power and massive user base, these companies could impose centralized solutions, jeopardizing the initial spirit of crypto. 🔗 Read the full article

Today's crypto: Maker (MKR)

MakerDAO is a decentralized autonomous organization (DAO) operating on the Ethereum blockchain. It created the Maker protocol, which allows users to generate Dai, a decentralized and impartial stablecoin backed by collateral and pegged to the U.S. dollar. The protocol uses smart contracts to manage collateralized debt positions, thus ensuring the stability of Dai without relying on a central authority. This decentralized approach provides a transparent and secure alternative to traditional stable currencies.

The native token of MakerDAO, MKR, plays an important role in the governance of the Maker protocol. MKR holders can vote on proposals affecting the protocol, such as adding new types of collateral or adjusting stability fees. Each MKR token represents one vote, and decisions are made based on the total number of votes. Additionally, stability fees paid in Dai are used to buy back and burn MKR, thereby reducing the total supply and potentially increasing the value of the remaining tokens.

Recent performance:

Current Price: $1,091.31 (approximately €1,030)

24-hour Change: +8.94%

Market Capitalization: $913.75 million

Rank on CoinMarketCap: #76

Is Bitcoin in danger? "Death crosses" signal a new major correction

Bitcoin is going through a critical phase after several weeks of consolidation in a narrow range. Technical indicators signal a potential acceleration of selling pressure, notably with the appearance of several "death crosses" on the daily chart, a bearish crossover between short and long-term moving averages. According to Material Indicators, these signals could prompt a correction towards $92,000, a level identified as a key support in Binance's order book. However, the presence of a strong buying liquidity at this threshold could cushion the drop and offer an attractive entry point for investors.

A market waiting for a bullish catalyst

Despite these bearish signals, some analysts downplay the threat of a brutal collapse. Keith Alan, co-founder of Material Indicators, sees this decline as an accumulation opportunity rather than an alarming signal. However, the market lacks positive catalysts to reverse the trend, especially since institutional investors are currently reducing their exposure. Furthermore, the closing of Wall Street for President’s Day has amplified the lack of volume and traders' wait-and-see attitude.

A crucial test of supports at $92,000 and $95,000

If the supports at $95,000 and $92,000 hold, Bitcoin could bounce back and renew a bullish cycle. Conversely, a break below these thresholds could risk accelerating the correction towards lower levels. The market remains suspended to the buyers' reaction, waiting for a strong macroeconomic or institutional signal capable of restoring a bullish momentum to Bitcoin.