Hello Cointribe! 🚀

Today is Saturday, May 24, 2025, and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours that you should not have missed!

But first…

✍️ Cartoon of the day:

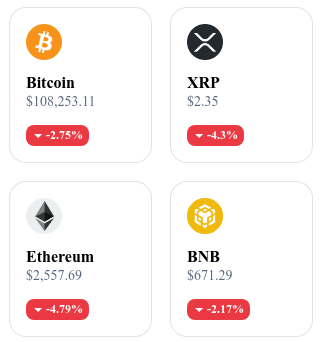

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

📈 Combined flows of Bitcoin and Ethereum ETFs reach historic highs

On May 23, 2025, Bitcoin and Ethereum ETFs recorded investment flows of more than one billion dollars in a single day, marking a historic high since January.

💰 Bitcoin: $11.6 billion in profits in one month for short-term investors

Over the past month, short-term investors realized profits totaling $11.6 billion in the Bitcoin market, according to Glassnode. This amount sharply contrasts with the $1.2 billion in profits recorded during the previous 30 days.

🔓 Coinbase reveals the scale of the latest crypto hack: nearly 70,000 victims

Coinbase revealed that an internal breach on December 26, 2024 exposed the personal data of nearly 70,000 users. The incident was only discovered in May 2025.

⚖️ Binance wins a key legal battle in the United Kingdom

The UK Court of Appeal partially dismissed a $11.9 billion class action lawsuit against Binance. The plaintiffs alleged a loss of opportunity for gains related to the potential growth of crypto. The Court recalled that investors had a duty to limit their losses by reallocating their funds.

📱 Ozapay: IDO ends in 6 days at a price of $0.03

Ozapay will close its IDO in 6 days. The OZA token is currently offered at a price of $0.03.

The project will be listed on Raydium at the end of this period.

Ozapay is developing a super-payment application compatible with euro and crypto, featuring Mastercard cards, terminalless payments, QR codes, cashback, partner discounts, and a "click-to-earn" system.

Pre-registered users can access a test version via APK (Android) or TestFlight (iOS) from ozapay.me.

Crypto of the day: Render (RNDR)

Render is a decentralized graphic rendering network based on blockchain, designed to connect artists and creative studios with unused computing resources. By leveraging the power of GPUs available worldwide, Render allows for faster and more economical 3D rendering, visual effects, and other graphic tasks.

The protocol uses smart contracts to manage transactions between computing power providers and users, ensuring greater transparency and security. This decentralized approach reduces costs and delays associated with traditional graphic rendering while offering a scalable solution for the growing needs of the industry.

💰 RNDR Token: Utility and distribution

The RNDR is the native token of the Render network. It is used as a means of payment for rendering services, allowing users to pay computing power providers. RNDR holders can also participate in network governance, influencing key decisions regarding the protocol's evolution.

The initial token distribution was designed to support the ecosystem and encourage user participation. Some tokens were allocated to developers, investors, and strategic partners, with lockup and vesting periods to ensure progressive distribution aligned with network growth.

📊 Market data (as of May 24, 2025)

Current price: $3.64 USD

24-hour change: -$0.25 (-6.43 %)

Market capitalization: approximately $1.35 billion

CoinMarketCap rank: #78

Circulating supply: 371 million RNDR

24-hour trading volume: approximately $75 million

Trump threatens Europe with massive tariffs: Bitcoin not spared from geopolitical shock

On May 22, 2025, Donald Trump triggered a new episode of trade tension by announcing his intention to impose 50% tariffs on all imports from the European Union starting June 1. This verbal show of force, typical of Trumpian economic diplomacy, immediately shook global markets.

While major U.S. indices sharply corrected, Bitcoin, often seen as an alternative store of value, paradoxically declined nearly 4%, wiping out more than $300 million in long positions.

A strong political signal, a return to transatlantic structural tensions

Trump's statements came to an end after several months of negotiations deemed "unproductive" between Washington and Brussels. In familiar rhetoric, the former president accused the European Union of "commercially exploiting the United States" and justified his move by the need to restore balance.

The threat of a 50% tariff surcharge targets both German car manufacturers and the French and Italian agri-food sectors. It comes a few months before the U.S. presidential election, where Trump seeks to consolidate his image as a defender of industrial protectionism.

On the markets, the reaction was immediate:

The Dow Jones lost 0.91%,

The Nasdaq fell 1.28%,

The S&P 500, broader, retreated 0.98%.

In Europe, the CAC 40 and DAX opened sharply lower on May 23 amid tariff and diplomatic uncertainty.

Bitcoin corrected in a movement of global distrust of risk

Far from playing its role as a safe haven, Bitcoin followed the correction movement initiated by equity markets. Within a few hours, the BTC price fell from $111,900 to a low of $107,300 before attempting a slight rebound.

On the derivatives markets, the reaction was violent:

More than $300 million of long positions were liquidated,

The funding rate briefly plunged into negative territory,

Implied volatility jumped, especially on short-term options.

Traders interpreted this correction not as a questioning of Bitcoin’s fundamentals but as a "quick deleveraging" reaction to unexpected geopolitical stress. In times of exogenous shock, even uncorrelated assets can suffer precautionary declines.

Trump’s threat on European tariffs abruptly reminds us that geopolitics can still disrupt the global economy — and by extension, crypto markets. While Bitcoin has shown its ability to absorb shocks over the years, it no longer operates in isolation.

Now integrated into the global financial system, BTC reacts to macro catalysts like any strategic asset. Investors will have to deal with this new reality: institutional adoption provides liquidity, but not immunity.