📈 Bitcoin: a critical technical level to break before $95,000

Welcome to the Daily for Tuesday, December 16, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, December 16, 2025, and as every day from Tuesday to Saturday, we’re bringing you a summary of the must-know news from the past 24 hours!

But first…

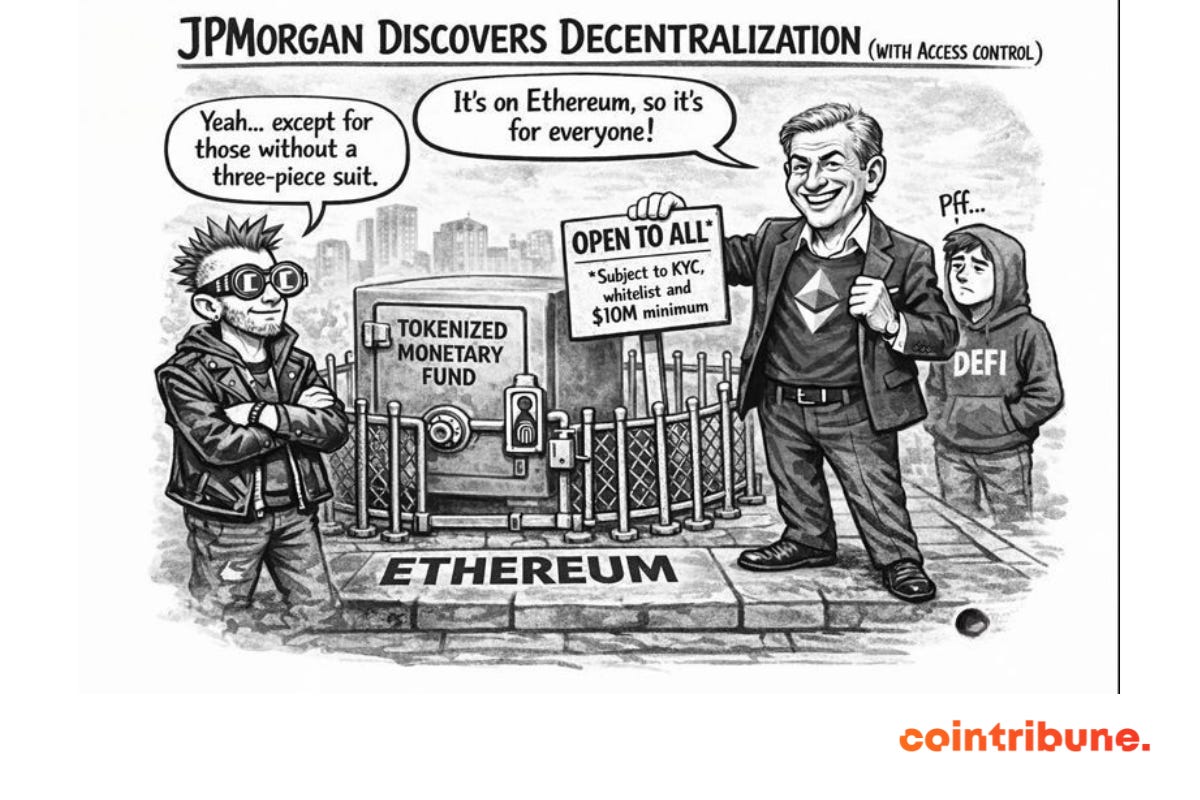

✍️ Cartoon of the day:

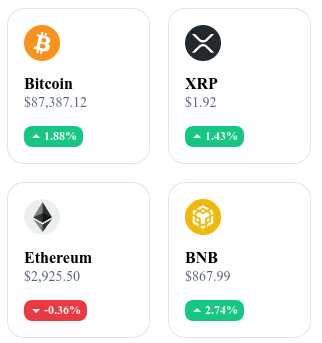

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

📈 Crypto ETPs continue to record net inflows for the third consecutive week

According to CoinShares, crypto ETPs posted $864M in net inflows over the latest measured week. Inflows were largely driven by US-based products with $796M, while Switzerland recorded outflows of $41.4M. Bitcoin ETPs attracted $522M, while Ethereum-based products saw $338M over the period.

👉 Read the full article

🧑⚖️ Samourai Wallet co-founder Keonne Rodriguez could be granted a pardon

Donald Trump stated that he would review the case of Keonne Rodriguez, co-founder of Samourai Wallet, among several cases considered for a presidential pardon. Rodriguez was sentenced to five years in prison for operating an unlicensed money transmission service.

👉 Read the full article

🏦 JPMorgan launches a tokenized money market fund on Ethereum called MONY

JPMorgan Asset Management introduces the My OnChain Net Yield Fund (MONY) on Ethereum, with $100M in initial internal capital. The money market fund is tokenized, with tokens representing fund shares and enabling subscriptions or redemptions in USDC or cash. Access is limited to qualified investors with a minimum investment of $1M.

👉 Read the full article

🦊 MetaMask adds native Bitcoin support to its wallet

MetaMask announced native support for Bitcoin transactions (buying, sending, receiving and swapping) directly within the app. Before this update, MetaMask only supported EVM-compatible assets or wrapped versions of BTC.

👉 Read the full article

🎮 Kraken and Cointribune launch a Read2Earn quest with a PS5 and BTC prizes to win

Cointribune and Kraken launch a new Read2Earn quest. This time, the main prize is a custom Kraken PS5 console, along with 20 prizes of $50 in Bitcoin, totaling $1,000 in rewards.

👉 Read the article for more details

Crypto of the Day: Kaspa (KAS)

🧠 Innovation and Added Value

Kaspa is a proof-of-work blockchain built on the GHOSTDAG protocol, an approach that enables multiple blocks to be processed in parallel. This architecture removes the bottleneck of linear chains and offers high throughput with fast finality.

The network aims to deliver an experience close to instant payments while preserving the security and decentralization of PoW. Kaspa positions itself as a technically credible alternative for payments, micro-transactions, and use cases requiring speed and resilience, without compromising censorship resistance.

💰 The Token

The KAS token serves as the network’s native currency. It rewards miners, secures the blockchain, and facilitates value transfers between users. Its issuance follows a decreasing schedule, gradually reducing the creation of new tokens.

KAS is mainly used for fast, low-cost transactions. The token’s utility depends directly on network adoption and on-chain activity.

📊 Real-Time Metrics (CMC)

💵 Current price: €0.03835

📈 24h change: +7.27%

💰 Market capitalization: €1.03 B

🏅 CoinMarketCap rank: #53

🪙 Circulating supply: 27.02 B KAS

📊 24h trading volume: €24.59 M

Bitcoin: The Liquidity Battle Could Open the Path Toward $95,000

As Bitcoin consolidates below $90,000, the market faces growing tension between buyers and sellers. This strategic standoff, clearly visible in the order books, reveals intense competition around key liquidity zones. Amid ambiguous macroeconomic data and diverging behaviors between long-term holders and new entrants, some analysts suggest a possible breakout toward $95,000 if current resistance levels are breached.

Liquidity Concentrated Around Strategic Technical Zones

At the opening of U.S. markets, BTC’s price found itself trapped in a narrow channel, with strong buy orders around $85,000 and sell orders above $87,000. This setup points to a potential imbalance: sellers appear to be capping short-term upside momentum, while buyers are defending key support levels like the 100-week simple moving average (SMA).

This pattern unfolds in an economic environment where job creation outperformed expectations, yet unemployment also rose. Such mixed signals are fueling uncertainty around the direction of risk assets — Bitcoin included.

Some market players cite recent pullbacks triggered by profit-taking from long-term holders and sell-offs in Bitcoin-related ETFs. These moves may have temporarily stalled bullish momentum, ushering in a new cycle dominated by retail investors.

A Bullish Window Toward $95,000 if Resistance Breaks

Despite visible resistance, several technical signals point to a more optimistic outlook. Analyst exitpump notes the presence of deep passive orders in the order book, which could support a strong rebound if the price manages to clear the $87,000 and $90,000 thresholds. Beyond these levels, there appear to be few technical barriers until the $95,000 zone — opening the door to a potentially smooth rally.

This outlook is based on a detailed mapping of order books and liquidity clusters across trading platforms. Orders placed well above the current price reflect underlying confidence in a continued uptrend, provided volume supports a clean breakout.

If Bitcoin manages to decisively break through the $90,000 resistance zone, the path to $95,000 would become more credible. However, this scenario hinges on a confluence of factors: breaking current resistance levels, sustained consolidation above the 100‑SMA, and a favorable market reaction to upcoming economic data.