⏳ Bitcoin: A programmed shortage threatens 42% of the circulating supply

Welcome to the Daily for Wednesday, September 17, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, September 17, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the past 24 hours of news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

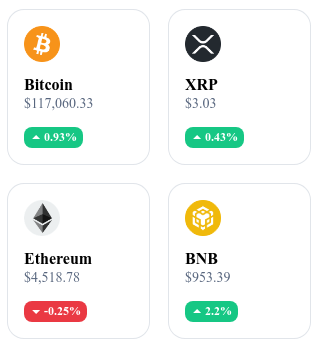

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

💰 Solana reaches $4 billion in corporate treasury reserves

Solana has amassed more than 17.11 million SOL tokens in corporate treasuries, valued at over $4.03 billion, according to the Strategic Solana Reserve. Forward Industries holds 6.8 million SOL (≈ $1.61 billion USD), and the reserves account for nearly 3% of SOL’s circulating supply.

👉 Read the full article

🤖 AI: Google lays the groundwork for a new transactional model

Google introduces an open-source protocol that allows AI agents to make payments to each other via bank cards or dollar-pegged stablecoins, as part of the Agent-to-Agent (A2A) project. Coinbase, Salesforce, American Express, and more than 60 companies are participating in this initiative designed to automate financial exchanges between intelligent software.

👉 Read the full article

🚀 US Bitcoin ETFs record $2.3B in inflows, a three-month high

U.S. spot Bitcoin ETFs captured $2.3 billion in inflows during the week of September 8–12, the strongest weekly performance in three months. BlackRock, Fidelity, and Ark Invest accounted for more than $2 billion of these flows, amid expectations of Fed rate cuts.

👉 Read the full article

🛡️ MiCA regulation: France considers blocking certain crypto firms

France is threatening to deny the “MiCA passport” to crypto firms licensed in EU member states deemed too lenient, to counter “regulatory shopping.” The AMF and other regulators are calling for an enhanced role for ESMA to harmonize the supervision of crypto platforms across the European Union.

👉 Read the full article

📌 Crypto of the Day: The Graph (GRT)

🧠 What innovation and added value?

The Graph is a decentralized protocol for blockchain data indexing and querying. It allows developers to create subgraphs — open APIs that organize and filter on-chain events — so that dApps can efficiently retrieve data.

The innovation lies in its ability to make blockchain data accessible, structured, and queryable like a traditional database, but in a decentralized version. The Graph is thus a critical infrastructure for DeFi, NFTs, and Web3.

💰 The GRT Token: Utility and Benefits for Holders

GRT is at the core of the protocol as a utility token.

Indexers must stake it to secure the network and are incentivized to provide reliable services. Curators use GRT to signal relevant subgraphs, guiding indexing. Delegators can delegate their GRT to indexers and earn a share of rewards. Finally, consumers pay for queries in GRT.

For holders, the token offers concrete benefits: staking or delegation to generate income, protocol governance, and participation in ecosystem growth.

📊 Real-time Performance (September 17, 2025)

💵 Current price: 0.093504 USD

📉 24h change: −0.58%

💰 Market capitalization: 979,944,146 USD

🏅 CoinMarketCap rank: #80

🪙 Circulating supply: 10,480,187,013 GRT

📊 24h trading volume: 33,761,633 USD

Bitcoin: A programmed vanishing supply?

Bitcoin is often associated with its volatility and spectacular market cycles. Yet another factor could profoundly transform its future: the progressive scarcity of its available supply. A report by Fidelity Digital Assets highlights a trend that is worrying for some, promising for others: nearly 42% of circulating bitcoins could become inaccessible by 2032.

42% of bitcoins soon off the market

According to Fidelity, around 8.3 million BTC could become “illiquid” over the next ten years. In other words, these units would remain stored without ever returning to the market, mechanically reducing available liquidity.

Two categories of actors are behind this phenomenon:

Long-term holders, whose wallets have remained inactive for at least seven years.

Public companies accumulating massive volumes of BTC, each with a minimum of 1,000 units.

Currently, 105 listed companies hold nearly 969,000 BTC, around 4.61% of the total supply. Fidelity points out that these two groups combined could control more than six million bitcoins by the end of this year, or 28% of the maximum possible supply.

The report specifies that long-term holders have never reduced their stock since 2016, and companies have only experienced one significant decline: in the second quarter of 2022. These figures reflect a well-entrenched accumulation logic, which contributes to freezing an increasing share of supply.

Rare opportunity or systemic risk?

The programmed scarcity of bitcoin could create an unprecedented valuation dynamic. Less liquidity theoretically means upward pressure if demand holds. But Fidelity also warns of another risk: the extreme concentration of holdings in a limited number of hands.

Today, these institutional portfolios and long-term holders already represent $628 billion worth of BTC, at an average price of $107,700. This sustained accumulation could fuel a strong bullish trend… but it also makes the market vulnerable to massive sell-offs.

The last few weeks provide a concrete example: $12.7 billion worth of BTC was liquidated in just 30 days, the largest wave since mid-2022. These moves, orchestrated by a minority of players, are enough to influence the overall trend.

Two scenarios therefore emerge:

If historical holders continue their accumulation, bitcoin could benefit from an amplified scarcity effect.

Conversely, a partial reversal or a wave of liquidations could trigger a brutal correction, with a systemic impact on the entire crypto market.

Fidelity’s report illustrates a double reality: bitcoin is becoming structurally scarcer, but also increasingly dependent on the decisions of a handful of players. For investors, this means navigating between two poles: the opportunity of a valuation reinforced by scarcity, and the risk of heightened instability due to concentration.