📈 Bitcoin and Ethereum stir: will the U.S. CPI change everything?

Welcome to the Daily for Thursday, September 11, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, September 11, 2025, and just like every day from Tuesday to Saturday, we're bringing you a summary of the top news from the past 24 hours you shouldn't miss!

But first…

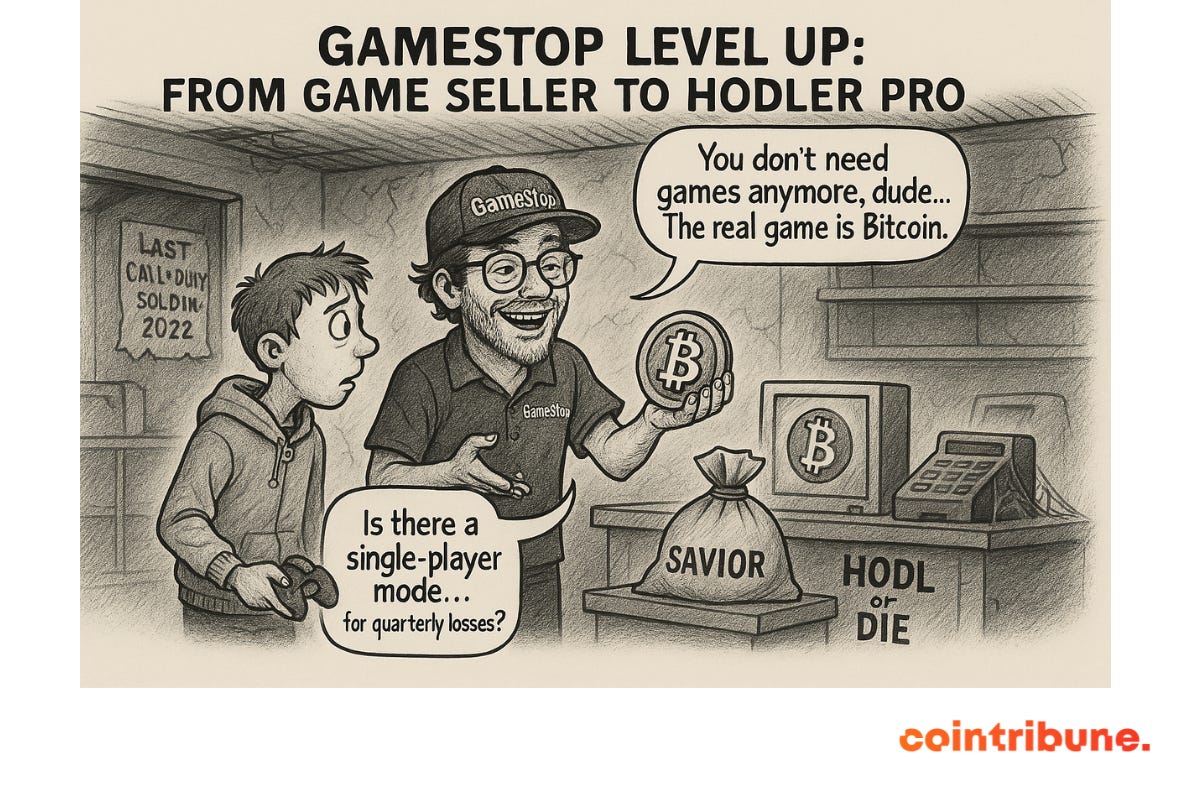

✍️ Cartoon of the day:

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🕹 GameStop narrows quarterly losses thanks to its bitcoin reserve

GameStop reduced its quarterly losses thanks to its reserve of 4,710 BTC (~$529M). The quarter shows an unrealized gain of approximately $28.6M, revenue of $673.9M, and a net loss of $18.5M.

👉 Read the full article

🇷🇺 Putin advisor accuses the U.S. of manipulating its debt via stablecoins

A senior advisor to Vladimir Putin accuses the United States of manipulating its national debt through stablecoins and gold reserves.

👉 Read the full article

📜 SEC no longer classifies most tokens as securities and supports crypto super apps

The SEC has declared that the majority of tokens no longer fall under the securities regime and has introduced Project Crypto. The initiative aims to create a unified framework for trading, lending, and staking through “super apps,” with references to MiCA and investor protection requirements.

👉 Read the full article

🏦 Nasdaq seeks approval for tokenized securities on Wall Street

Nasdaq has filed a proposal with the SEC to allow the listing of shares and ETPs in tokenized form. The submission is part of efforts to modernize market infrastructure and includes safeguards aligned with traditional securities.

👉 Read the full article

📌 Crypto of the Day: Worldcoin (WLD)

🧠 Innovation and Added Value

Worldcoin is an ambitious project aiming to create the world’s largest decentralized digital identity system. Its flagship product is the World ID, a digital passport that proves a user is human without revealing their identity or personal data. This verification is performed via the Orb, a biometric device that scans the iris and generates a unique cryptographic proof.

The key innovation lies in the use of zero-knowledge proofs (ZKPs), allowing the validation of a user’s uniqueness without disclosing sensitive information. This opens up massive use cases: fighting bots and fraud in Web3, universal authentication for dApps, secure access to digital services, and even integration in economic redistribution systems (like universal basic income). Backed by Sam Altman (OpenAI), the project combines cutting-edge tech, social ambition, and decentralized governance.

💰 WLD Token: Utility and Benefits for Holders

The WLD token is central to the Worldcoin ecosystem. Its use extends beyond payments:

Inclusion and incentives: verified users earn WLD allocations.

Governance: holders vote via the Worldcoin Foundation.

Web3 economy: usable in apps that support World ID.

📊 Live Data (September 11, 2025)

Current Price: $1.75 USD

24h Change: –5.34%

Market Cap: ≈ $3.538 billion USD

CoinMarketCap Rank: #34

Circulating Supply: 2,021,285,044 WLD

24h Trading Volume: ≈ $1.061 billion USD

Crypto: A cautious rebound under the watch of the CPI

Crypto investors are catching their breath ahead of a key economic indicator: the U.S. Consumer Price Index (CPI). While the market shows some signs of recovery, macroeconomic signals remain mixed and caution prevails.

PPI revives interest without dispelling doubts

The recent 0.1% decline in the Producer Price Index (PPI) for August triggered an immediate reaction in financial markets. Bitcoin rose by about 0.5% within an hour of the announcement, while Ethereum followed with a more modest gain of around 0.2%. This slight relief in producer prices boosted hopes of slowing inflation.

But the details of the report temper this optimism: the "core" PPI, excluding volatile items such as energy, increased by 0.3%, indicating that inflationary pressures persist in the structural components of the economy. This divergence creates uncertainty that markets will have to navigate in the coming days.

Investors anticipate a monetary shift from the Federal Reserve. According to CME FedWatch, nearly 88% of traders are betting on a 25 basis point cut at the next FOMC meeting, while about 12% expect a steeper 50 basis point cut.

CPI awaited: between catalyst and barometer

Attention now turns to the imminent release of the Consumer Price Index (CPI), which could reshuffle the deck. In a context where monetary policy expectations are highly sensitive to even minor variations in inflation data, the CPI could either reinforce the bullish momentum or trigger a new correction phase.

On the psychological front, the Crypto Fear & Greed Index fell from 70 to 49, signaling a return to neutral territory after a period of marked optimism. This shift reflects latent volatility, which the CPI release could amplify.

The financial prediction markets reflect this duality: nearly 72% of bettors believe Bitcoin will stay above $105,000 by the end of September, a sharp contrast with the more pessimistic outlook seen earlier in the month.

If the CPI confirms inflationary pressures, a negative reaction from cryptocurrencies is expected, despite the current technical rebound. Conversely, a lower-than-expected reading could give digital assets a second wind, amid hopes for a lasting easing of U.S. monetary policy.