⚠️ Bitcoin and Stablecoins: Coinbase’s Shocking Predictions for 2026

Welcome to the Daily for Saturday, December 20, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, December 20, 2025, and as we do every day from Tuesday to Saturday, we bring you a summary of the top news from the past 24 hours!

But first…

✍️ Cartoon of the day:

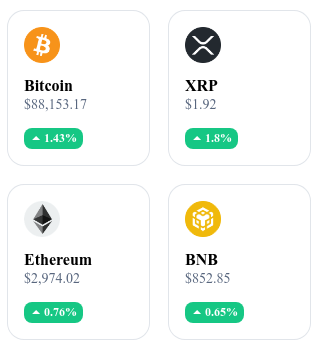

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

Cynthia Lummis to Retire from the Senate — A Pro-Crypto Voice Steps Down

U.S. Senator Cynthia Lummis, known for her strong support of the digital asset industry, has confirmed that she will not seek re-election and will leave the Senate in January 2027. Elected in 2020, Lummis introduced key legislation such as the GENIUS Act on stablecoins and the Bitcoin Act, which proposed integrating BTC into federal reserves.

🇵🇱 Polish Parliament Overrides Presidential Veto on Controversial Crypto Law

The Polish Parliament has voted to revive the “Crypto-Assets Market Act,” defying President Karol Nawrocki’s veto and sending the bill to the Senate for review. The proposed legislation aims to strictly regulate digital assets in Poland, despite presidential objections. Nawrocki had initially rejected the bill, citing concerns over individual freedoms and economic stability. 👉 Read the full article

📉 Bloomberg’s Mike McGlone Warns of Possible 2026 Market Crash

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, suggests that current crypto market signals could foreshadow a broader financial market downturn in 2026. He highlights the increasing correlation between Bitcoin and U.S. equities, which may reclassify the crypto as a “risk asset” rather than a safe haven. McGlone warns that this trend could expose Bitcoin and other digital assets to similar reactions as traditional markets under liquidity tightening.

📊 Bitwise Files S-1 with SEC for Spot SUI ETF in the U.S.

Bitwise Asset Management has submitted an S-1 filing to the U.S. Securities and Exchange Commission for a spot ETF based on the native token of the Sui blockchain. The proposed ETF would track the spot price of SUI, with Coinbase Custody expected to act as the asset custodian if approved. Similar filings from Canary Capital and 21Shares indicate growing interest in launching SUI ETFs in the U.S. market. 👉 Read the full article

Crypto of the Day: Uniswap (UNI)

🧠 Innovation and Added Value

Uniswap is the leading decentralized exchange protocol based on the AMM (Automated Market Maker) model. It allows users to swap tokens directly from their wallets, without intermediaries or order books, through automated liquidity pools.

Uniswap has significantly shaped DeFi by standardizing on-chain trading. The protocol is a core component of the Ethereum ecosystem and its layer 2 solutions, with high liquidity and massive integration across decentralized financial applications.

💰 The Token

The UNI token plays a central role in protocol governance. Holders participate in decisions regarding technical upgrades, treasury usage, and key strategic parameters.

UNI also serves as a coordination tool for the community around one of the largest DeFi protocols by total value locked (TVL). The token’s utility depends on Uniswap’s influence in decentralized finance and overall activity on its liquidity pools.

📊 Real-time Performance (CMC)

💵 Current Price: €5.33

📈 24h Change: +19.78%

💰 Market Cap: €3.36 B

🏅 CoinMarketCap Rank: #25

🪙 Circulating Supply: 630.33 M UNI

📊 24h Trading Volume: €473.17 M

Will 2026 mark the entry of financial giants into Web3?

Is the crypto space on the brink of a new era? Coinbase Institutional unveils its 2026 forecast in a report that challenges traditional paradigms. Regulatory frameworks, evolving use cases, renewed value for Bitcoin… all indicators point to a deep reconfiguration of the global financial landscape.

Coinbase’s bet: regulation and institutional finance in focus

In its 70-page strategic report published mid-December, Coinbase Institutional outlines a bold scenario for 2026: the next wave of crypto growth will be led by institutions, not retail investors. This vision is based on a key assumption — that regulation will become a catalyst, not a constraint, for market expansion.

Initiatives like the U.S.-based GENIUS Act, a bill focused on stablecoin oversight, embody this shift. Coinbase’s analysis highlights the structural role of upcoming legal frameworks: “clearer regulatory frameworks will provide stronger policy safeguards, promoting long-term innovation and market maturity.”

This transformation would reshape three core pillars of institutional finance:

Risk management: integration of crypto into existing control frameworks

Transparency standards: heightened requirements for custody and KYC compliance

Asset allocation strategies: gradual portfolio diversification with increased exposure to digital assets

Stablecoins and Bitcoin: the new pillars of real-world adoption

Coinbase is not betting on regulation alone. The report emphasizes that practical use cases will be just as crucial in driving digital asset adoption. At the heart of this shift: stablecoins.

Their growth potential is deemed massive, with total capitalization projected to hit $1.2 trillion by 2028. Far from being speculative tools, these stable assets are expected to play key roles in:

daily payments

salary disbursements

cross-border settlements

The report notes that stablecoins offer a unique combination of “transactional efficiency” and “relative monetary stability,” making them strategic adoption tools for institutions.

Another major development is Bitcoin’s declining volatility. Once considered highly unstable, its 90-day volatility dropped to 35–40% by late 2025, compared to over 60% in mid-2024. Coinbase argues this shift brings BTC closer to high-growth tech stocks — a sign that the market is maturing, despite ongoing uncertainties around Bitcoin’s regulatory status.

From speculation to infrastructure: a paradigm shift underway

The roadmap outlined by Coinbase points to a major strategic shift in the crypto ecosystem. 2026 could mark a historic inflection point — the beginning of a new era where traditional finance fully integrates digital assets into its core systems.

This shift is not a passing trend. It brings together:

a robust regulatory structure that makes the landscape more predictable for institutions

evolving use cases anchoring crypto in the real economy

and technical market maturity, embodied by a more stable Bitcoin

If these forecasts come true, the decade ahead may witness blockchain moving from the fringes to the very heart of global finance.