📈 Bitcoin at $100,000: an explosive deadline approaching!

Welcome to the Daily Tribune for Friday, November 15, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, November 15, 2024, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

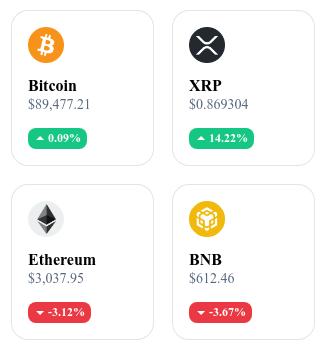

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

🚨 Dramatic turn of events: The FBI targets Polymarket and its CEO!

The FBI recently searched the home of Shayne Coplan, CEO of Polymarket, a decentralized prediction platform. This intervention, conducted early in the morning in New York, takes place in a tense political context following the presidential elections of 2024. Authorities seized electronic equipment, but no arrests were made.

Polymarket, accused of market manipulation and favoritism toward Donald Trump, denounces this operation as a political retribution aimed at intimidating the platform, which saw massive bets rise to $3.7 billion to predict electoral outcomes. Already sanctioned in 2022 by the CFTC for non-compliant activities, the company finds itself once again under pressure, highlighting the tension between U.S. regulation and prediction platforms.

💰 Bitcoin at $100,000: An explosive deadline in sight!

December 27, 2024 marks a crucial date for the crypto market, with the expiration of $11.8 billion in Bitcoin options. This deadline fuels speculation about a possible crossing of the symbolic threshold of $100,000. Call options (buys), representing $7.9 billion, significantly outnumber put options (sells), which amount to $3.92 billion, indicating strong optimism among investors.

If the price holds above $90,000 at expiration, the majority of put options will become inoperative, thus strengthening the bullish momentum. However, bearish positions are trying to limit Bitcoin's progress by keeping it below $75,000. As this battle for influence intensifies, the impact of this expiration could redefine market trends for 2025, in a context where regulations and the political climate in the United States evolve in favor of cryptocurrencies.

🏦 Bitcoin: American banks orchestrate their profits post-elections!

Following the presidential elections of 2024, American banks have made massive gains in Bitcoin derivatives markets, reaching $1.4 billion solely on futures contracts. JPMorgan, Goldman Sachs, and SG Americas Securities have increased their long positions on the Chicago Mercantile Exchange (CME), reaching $3 billion with an average entry price of $65,800. These institutions, although hampered in directly holding BTC, leverage derivative products to benefit from market volatility.

Donald Trump’s re-election has amplified Bitcoin's bullish momentum, with anticipation of a more favorable federal policy. The effect has also been felt on Coinbase's shares, which are up by 20%, and on the total market capitalization of cryptocurrency, which now exceeds $3.17 trillion, marking an annual growth of 119%. Banks continue to capitalize on this favorable political and economic environment.

🏛️ The Bank of France: an unexpected support for Bitcoin

François Villeroy de Galhau, Governor of the Bank of France, surprised by softening his stance on Bitcoin, affirming that everyone is free to invest in it despite the risks. He highlighted the balance between return and risk, with numerical arguments: Bitcoin shows a Sharpe ratio greater than 1, thus surpassing the American stock market and gold. This turnaround marks the end of fierce criticism, reinforced by the political context.

The re-election of Donald Trump and his promise to create a strategic reserve in Bitcoin have alleviated fears about the future of cryptocurrencies in the face of the fiat system. Bitcoin, though risky, is now seen as an accessible asset for all, likely to reduce inequalities in the face of inflation. This change of tone reflects a growing recognition of the value of Bitcoin as an alternative reserve to gold, while allowing financial institutions to adapt to this technological revolution.

The crypto of the day: XRP (XRP)

XRP is based on the XRP Ledger (XRPL), a blockchain technology designed to provide fast, low-cost, and energy-efficient transactions. Unlike traditional consensus mechanisms, it uses the Ripple Protocol Consensus Algorithm (RCPA) to validate transactions without mining.

XRP, the native crypto, primarily serves to simplify and accelerate cross-border payments. Pre-mined with a total of 100 billion tokens, it has been partly distributed to institutions and used to boost its adoption. Its advantages include minimal transaction fees ($0.00001 XRP) and an execution speed of 4 seconds, making it a preferred tool for financial institutions.

Recent performances

Current price: $0.879 (~€0.81)

24h change: +20.82%

Market capitalization: ~ $49.88 billion (~€46.1 billion)

Rank on CoinMarketCap: 7

💡 Trump and Bitcoin: a bold bet to save America?

Donald Trump proposes a bold approach to tackle American economic challenges: integrating Bitcoin into a national strategic reserve. While this project generates significant interest, experts like Mike Novogratz from Galaxy Digital highlight major obstacles. According to him, the United States does not need to back the dollar with a Bitcoin reserve, given their economic and military supremacy. However, such an initiative could propel Bitcoin to unprecedented heights, up to $500,000, but the lack of political unity makes this vision difficult to achieve in the short term.

If a strategic reserve in Bitcoin were to come into existence, it could trigger a global race for crypto accumulation, encouraging other countries to follow suit. Pioneers like El Salvador and Bhutan are already demonstrating the benefits of this strategy. Despite the economic urgency, marked by a debt of $36 trillion and soaring inflation, this solution remains speculative. For Trump and his supporters, Bitcoin symbolizes not only an economic lever but also an opportunity to assert the position of the United States as a technological and financial leader. However, the future of this proposal relies on the emergence of a strong political consensus.

🔗 Read the complete analysis here.