💰 Bitcoin attracts 1 billion dollars in one week!

Welcome to the Daily Tribune Wednesday, May 22, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, May 22, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't have missed!

But first…

✍️ Cartoon of the day:

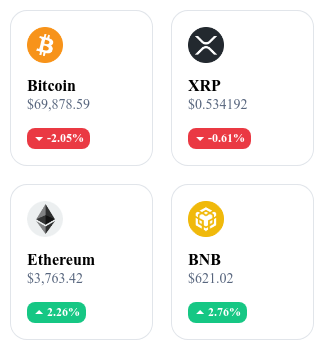

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24h crypto recap! ⏱

🚀 Ethereum jumps 18% after a shocking ETF announcement

The announcement by the US Securities and Exchange Commission (SEC) regarding the possible approval of an Ethereum spot ETF caused a surge in Ether prices, which jumped 18%. If approved, this ETF would allow trading of Ether on traditional financial markets, opening the way for wider adoption and a potentially significant revaluation of the cryptocurrency. Investors see this decision as a turning point that could improve access to Ethereum and strengthen its position in the market. 🔗 Read the full article here.

⚖️ SEC vs Ripple: A historic outcome for the crypto future

The trial between the SEC and Ripple is approaching a crucial verdict. The SEC alleges that Ripple sold unregistered securities through its XRP token, while Ripple argues that XRP is a currency and not a security. The judge could make a decision that has profound consequences for the entire crypto market, determining whether cryptocurrencies similar to XRP are securities subject to strict SEC regulation. 🔗 Read the full article here.

💸 Bitcoin: Nearly 1 billion dollars in inflows in one week

Last week, Bitcoin investment products attracted nearly one billion dollars. This surge is fueled by expectations of a relaxation of the Fed's monetary policies after lower-than-expected inflation figures in April. Institutional investors, in particular, have shown increased interest with significant reinvestments, marking a turning point for Bitcoin and digital assets. 🔗 Read the full article here.

Solana Soars and Surpasses $180 Mark

Solana (SOL) has experienced a spectacular rise, surpassing $180 and reaching a key resistance at $188. This bullish movement is supported by strong fundamentals and growing investor interest. Technical indicators show positive momentum, with support at $175 and immediate resistance at $185. Sustained momentum could lead Solana to test new highs. 🔗 Read the full article here.

Coin of the day: Ronin (RON)

Ronin is a blockchain specially designed for gaming by Sky Mavis, creators of Axie Infinity. It offers near-instant transactions and low fees, optimizing Web3 games.

The native crypto, RON, is used to pay transaction fees and secure the network through staking. RON was initially distributed through a pool on the native DEX Katana and through liquidity incentive programs. Holders benefit from staking rewards and privileged access to Ronin ecosystem applications.

Recent performance:

Current price: €2.93

Increase: +6.56% (in 1 day)

Market capitalization: €961,136,780

Rank on CoinMarketCap: 84

Technical analysis of the day: Ethereum (ETH)

After a period of strong downward pressure that pushed Ethereum's price to $2,900, the crypto experienced a significant rebound of nearly 20%, reaching a peak of $3,700. This increase was mainly triggered by optimistic expectations of imminent approval for Ethereum spot ETFs by institutions such as VanEck, 21Shares, and ARK. This increased volatility allowed Ethereum to reposition above its 50-day moving average, a reassuring indicator for investors.

The current technical analysis, conducted in collaboration with Elie FT, shows a notable recovery in Ethereum's momentum. Open interest in ETHUSDT perpetual contracts surged by 40% in a few hours, signaling a speculative buying orientation. This euphoria is corroborated by a slight rebound in the funding rate, reflecting increased pressure on the contracts. The liquidation heatmap reveals critical zones between $3,600 and $3,700, with significant liquidation levels above $4,100 and below $2,850. These zones are crucial points of interest for investors, signaling potential periods of high volatility.

For future outlook, if Ethereum holds above $3,400, a breakout above $3,700 could lead to resistance at $3,900 and $4,100. If the bullish momentum continues, a new peak at $4,400 or even $4,800 could be reached, representing an increase of over 31%. Conversely, if the price falls below $3,400, a decline towards $3,100 or even $3,050 could occur, marking a decrease of nearly 17%. It is crucial to observe price reactions at these levels to confirm or refute current assumptions, while remaining cautious of possible market "fake outs" and "squeezes".