🌟 Bitcoin breaks records: Over a billion transactions processed!

Welcome to the Daily Tribune on Tuesday, May 7, 2024 ☕️

Hello Cointribe! 🚀

Today is Tuesday, May 7, 2024, and like every day from Tuesday to Saturday, we'll summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

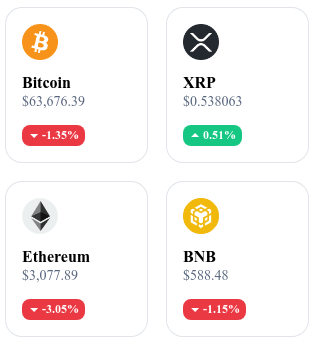

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

🚀 Bitcoin surpasses one billion transactions!

Bitcoin has just reached a new historical milestone by surpassing one billion transactions since its launch in 2009. This record comes after a significant spike in activity on April 23, which saw nearly 926,000 transactions in a single day, thanks in part to the launch of the Runes protocol.

Although Bitcoin's main network has not yet surpassed Ethereum in terms of total transaction volume (2.4 billion transactions for that network), innovation continues on the Bitcoin network with additions such as Bitcoin Ordinals and Runes protocols. 🔗 Read the full article here.

🚀 Pension funds: New era for Bitcoin ETFs!

Pension funds, traditionally cautious, are starting to show a keen interest in Bitcoin ETFs, marking a potential historic turning point for institutional adoption of cryptocurrencies. This recent opening is made possible in particular by the creation of Bitcoin spot ETFs, which have changed the perception of risk associated with these investments, previously considered too volatile.

With over $4 trillion managed by US pension funds alone, even a small allocation to Bitcoin could inject billions of dollars into the market, driving up prices and accelerating the adoption of cryptocurrencies by the general public. 🔗 Read the full article here.

🌐 Stablecoins aim for the throne of Visa!

Stablecoins, with a transaction volume of $2.2 trillion in April, are seriously threatening to surpass Visa in the field of cross-border transfers. According to the analysis by Jan-Erik Asplund of the Sacra research firm, the total volume of payments made in stablecoins could reach $4 trillion this quarter, thus surpassing Visa's volumes.

These dollar-backed cryptocurrencies stand out for their transaction speed and lower costs, offering an efficient alternative to traditional systems, even on weekends and holidays. Visa responded to these claims by pointing out that the majority of stablecoin transactions were automated and not the result of human interactions, a criticism that the crypto community still needs to address. 🔗 Read the full article here.

🚀 XRP about to explode: Heading towards a $2.61 billion market capitalization!

XRP is about to experience its "3rd Kaboom" a surge that could propel its market capitalization to $2.61 trillion. EGRAG CRYPTO, a renowned analyst, bases these bold predictions on in-depth technical analysis, particularly the observation of the 21-day Exponential Moving Average.

This pattern has historically marked periods of stability followed by surges in growth for XRP, with previous Kabooms in 2017 and 2021 signaling massive increases in XRP value. 🔗 Read the full article here.

Coin of the day: Jito (JTO)

Jito stands out in the cryptocurrency landscape through its integration on the Solana blockchain, known for its speed and energy efficiency. Jito provides significant added value by optimizing DeFi transactions and facilitating staking and DAO systems, thus offering a robust platform for decentralized financial transactions.

Jito presents itself as a utility currency mainly in the DeFi ecosystem, where it is used for staking and participating in community decisions through DAO structures. The distribution of Jito has been carried out following fair distribution methods, aiming to enhance user engagement and participation in the ecosystem. Token holders benefit from voting rights and staking rewards, increasing their influence in platform governance while receiving returns on investment.

Recent performances

Current price: €3.72

Percentage increase/decrease: 5.76% increase in one day

Market capitalization: €452,029,722

Rank on CoinMarketCap: #146

Bitcoin ready to take off: Targeting $73,000!

After a significant correction period that saw Bitcoin's price drop 22% from its annual peak at $72,756 to a low of $56,500, the leading cryptocurrency market seems ready for a significant rebound. This correction, which occurred between March and April 2024, is interpreted by experts as a necessary phase to purge speculative exuberance after months of rapid gains. By stabilizing the market, this phase has allowed investors to recalibrate their strategies before the next wave of growth. This consolidation is seen not only as a normalization after price surges but also as preparation for the next bullish cycle.

According to the latest technical analysis, Bitcoin shows convincing signs of recovery. It has solidly surpassed the 50% retracement level, a critical threshold often observed to evaluate the strength of a trend. Furthermore, breaking out of the bearish channel where Bitcoin was confined offers a strong signal of a possible return to an upward trajectory. The recent crossing of the 20-day and 50-day moving averages reinforces this outlook, indicating a renewed dynamism. These developments suggest that Bitcoin could quickly reach and potentially surpass the $73,000 threshold by the end of May, creating an atmosphere of renewed optimism among market participants.