💥Bitcoin breaks through $124,000, setting a new ATH

Welcome to the Daily for Thursday, August 14, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, August 14, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the last 24 hours’ news you can’t miss!

But first…

✍️ Cartoon of the day:

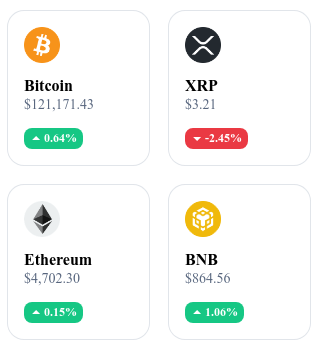

A quick look at the market…

🌡 Weather:

🌤️ Partly sunny

24h crypto recap! ⏱

📈 Google Trends reveals a surge of interest in Ethereum, Solana, and Chainlink

Search queries related to ETH, SOL, and LINK hit a peak, confirming renewed attention from both the public and investors. This spike in curiosity aligns with a more liquid market environment and a narrative favoring major altcoins.

👉 Read the full article

🟠 Bitcoin breaks $124,000 and sets a new ATH

BTC surpasses its all-time high at $124,000, driven by sustained inflows and more visible institutional demand.

👉 Read the full article

📊 Wall Street rallies after release of US inflation data

US indices rise after inflation figures are seen as more favorable, easing concerns about the rate hike trajectory. The risk window narrows for growth assets, and sentiment improves for tech and crypto stocks.

👉 Read the full article

📱 App Store: Elon Musk denounces favoritism toward ChatGPT

Musk accuses Apple of granting preferential visibility and treatment to ChatGPT-related apps in the App Store. He demands equal conditions for xAI and other players, along with clearer approval rules.

👉 Read the full article

Crypto of the Day: Immutable (IMX)

🧠 Innovation and Added Value

Immutable is a blockchain infrastructure specialized in Web3 gaming and NFTs. Built on Ethereum using zkEVM (Zero-Knowledge Ethereum Virtual Machine) technology in partnership with Polygon, Immutable enables fast, low-cost, and carbon-neutral transactions. The platform provides comprehensive tools for game developers — including marketplaces, APIs, and SDKs — to create, manage, and monetize digital assets while ensuring on-chain ownership and security.

💰 The IMX Token: Utility and Benefits for Holders

IMX is used to pay transaction fees, participate in governance, and reward users through a staking system. Holders can stake their tokens to earn IMX rewards and enjoy benefits within the ecosystem, such as discounts, early access, and incentives tied to partner games. This model promotes community engagement and platform growth.

📊 Real-Time Performance (August 14, 2025)

Current Price: $1.49 USD

24h Change: +2.18%

Market Cap: ≈ $2.19 billion USD

CoinMarketCap Rank: #45

Circulating Supply: ≈ 1.47 billion IMX

24h Trading Volume: ≈ $76.8 million USD

Solana flirts with $205: strong momentum, but fragile

After a spectacular 18% rebound, Solana (SOL) briefly crossed the $205 mark, reviving speculation about a potential push toward $250. While on-chain data points to thriving activity, DEX trading volumes and caution in derivatives markets call for a more measured outlook. Is the current momentum truly capable of propelling Solana to new highs, or is it still dependent on missing catalysts?

On-chain activity surges, but mixed signals emerge

Solana shows a clear increase in network activity, with the number of transactions rising 48% over the past 30 days and fees collected up 43%. This uptick in interactions underscores growing traction, in sharp contrast with BNB Chain, where transactions have fallen 41% in the same period. These figures highlight Solana’s growing appeal amid a broader market consolidation.

However, there are limitations behind this performance. On decentralized exchanges, trading volumes remain modest — capping at $20.6 billion over the past month, far behind Ethereum’s $116.2 billion and the $91.7 billion combined from its layer-2 solutions. This gap raises questions about Solana’s real market depth, despite its apparent dynamism.

Derivatives markets reinforce this caution: perpetual futures funding rates remain stable at around 12%, indicating a neutral to slightly bullish sentiment, but without strong conviction. At this stage, speculative pressure does not appear capable of catalyzing a sustained rally toward $250.

Can $250 be reached without institutional catalysts?

The symbolic $200 level was briefly crossed on July 22 but failed to hold, with SOL quickly retreating below that threshold — highlighting the technical fragility of this level. The recent breakout, though positive, raises doubts about its durability without structural support.

As of now, no major institutional catalyst is in sight. Unlike Ethereum or Bitcoin, which benefit from increased market attention through spot ETFs and large-scale integrations, Solana remains outside these dynamics. The prospect of a spot SOL ETF — which could trigger institutional capital inflows — has yet to materialize.

This lack of external drivers leaves price progress largely dependent on internal fundamentals and market sentiment. While Solana’s ecosystem continues to evolve technically, its short-term market valuation seems contingent on the emergence of new growth triggers. Stronger adoption, strategic partnerships, or regulatory recognition could play that role.

The $250 target remains theoretically reachable, but only if the right catalysts appear. For now, the market seems to be waiting, balancing optimism from on-chain indicators against caution born from recent volatile peaks.