📉 Bitcoin briefly drops below $109,000!

Welcome to the Daily for Friday, September 26, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, September 26, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the past 24 hours’ news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

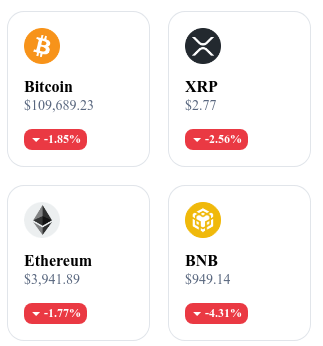

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🏦 Nine European banks launch a euro stablecoin

Nine European banks, including ING and UniCredit, announce a euro-backed stablecoin project compliant with MiCA regulation. The launch is scheduled for the second half of 2026 to provide an institutional alternative to existing stablecoins.

👉 Read the full article

📉 Bitcoin falls below $109,000 ahead of a key expiry

Yesterday, Bitcoin dropped below the $109,000 mark, hitting a three-week low. This decline comes on the eve of BTC options expiring with a total value of $22B.

👉 Read the full article

🇨🇳 A Chinese SME announces a $1B Bitcoin investment plan

Chinese company Jiuzi Holdings unveils a cryptocurrency investment plan of up to $1B. The firm specifies that this allocation will be gradually deployed into Bitcoin to diversify its treasury.

👉 Read the full article

📊 Crypto: Solana futures market reaches an unprecedented milestone

Solana futures contracts record an open interest high of 71.8 million SOL, equivalent to about $14.5B. At the same time, SOL’s price has dropped 18% in one week, marking one of the sharpest declines in the crypto top 20.

👉 Read the full article

📌 Crypto of the Day: Avalanche (AVAX)

Innovation and Added Value 🧠

Avalanche is a layer-1 blockchain designed to deliver fast, secure, and low-cost transactions. Its main innovation lies in a unique consensus mechanism, the Avalanche consensus, which enables near-instant finality (under 2 seconds) and high throughput capacity.

Avalanche also stands out for its multi-chain architecture: the C-Chain for EVM-compatible smart contracts, the X-Chain for creating and exchanging digital assets, and the P-Chain for managing validators and subnets. These subnets allow companies and projects to build customized blockchains, paving the way for diverse use cases in DeFi, gaming, and real-world asset tokenization.

The Token 💰

AVAX is the native token of the Avalanche network. It is used to pay transaction fees, for staking to secure the protocol, and for governance participation. Validators must lock up AVAX to take part in consensus and are rewarded in return, while delegators can delegate their tokens to validators in order to share rewards.

The token also has a deflationary dimension: part of the fees is automatically burned, reducing supply over time. AVAX thus combines transactional utility, an incentive role, and governance mechanisms, while strengthening the ecosystem’s sustainability.

Real-Time Performance 📊

💵 Current Price: 27.82 USD

📉 24h Change: −4.22%

💰 Market Cap: 11,756,094,009 USD

🏅 Rank on CoinMarketCap: #15

🪙 Circulating Supply: 422,886,709 AVAX

📊 Trading Volume (24h): 441,370,851 USD

Aster: The new crypto derivatives giant sparks debate

A new name is shaking up the world of decentralized exchanges: Aster. Recently launched on the BNB Chain, the platform is already boasting staggering figures. But behind this meteoric rise, contradictory signals are emerging. Between record volume, an aggressive acquisition strategy, and worrying token concentration, Aster intrigues as much as it raises questions.

Aster bursts onto the scene with record volumes

According to reported data, the Aster platform reached $36 billion in trading volume within 24 hours, catapulting its DEX among the most active in the market. This figure puts the player on a pedestal from its very first days, particularly in the perpetual derivatives segment. Aster is not limited to leveraged contracts: it also offers spot trading features, asset tokenization services, and gamification mechanisms.

These features aim to retain users through daily rewards, generated via missions and achievement tiers. The approach recalls loyalty models from gaming and play-to-earn, already proven in the Web3 ecosystem. This strategy seems to be working, given the reported volumes.

Another major factor boosting the project’s visibility: its backing by YZi Labs, the fund led by Changpeng Zhao, former CEO of Binance. This structural link, though not formalized through direct equity, is interpreted by many observers as a strong signal—if not an implicit continuation of the Binance ecosystem.

Centralization, incentives, and areas of concern

Aster’s rapid rise does not hide certain sensitive points. According to several on-chain analyses, 96% of the ASTER token supply is held by only six wallets. This distribution suggests massive control by a small circle of players, far from the decentralization ideals often associated with DEXs.

This imbalance raises questions about the protocol’s effective governance and the resilience of the ASTER market in the face of potential manipulation or destabilization. It also highlights concerns about the project’s transparency, at a time when users are increasingly demanding clarity on tokenomics mechanisms.

The intensive use of incentives, while effective at attracting early users, may also lose steam if the business model does not quickly evolve toward sustainable balance. Precedents like SushiSwap or dYdX have shown the limits of acquisition campaigns based solely on rewards.

Facing Aster, competitors such as Hyperliquid—often cited for their operational efficiency and lean model—could represent more stable alternatives in the medium term. Their ability to generate high net revenue per employee contrasts with Aster’s expansion-through-volume strategy.