💡 Bitcoin can drop to $20,000 MicroStrategy is not worried!

Welcome to the Daily Tribune for Wednesday, December 4, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, December 4, 2024, and as with each day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

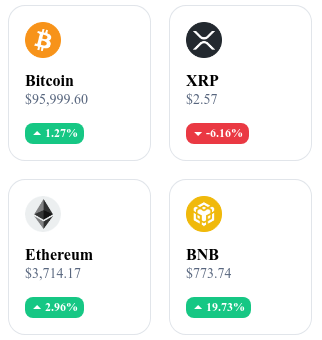

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

📉 MicroStrategy: Even at $20,000, Bitcoin does not worry them!

MicroStrategy, led by Michael Saylor, remains optimistic despite a possible drop of Bitcoin to $20,000. An analysis by Jeff Walton reveals that the company could survive without significant losses thanks to its robust investment structure. The critical threshold for MicroStrategy would be a BTC at $18,826, below which its assets would become less than its liabilities.

With a 40% increase in BTC in November, the company benefits from massive institutional support, in a context where 13.5% of bitcoins are held by institutions and ETFs. Charles Edwards from Capriole Investments anticipates a new surge, with mass FOMO expected to emerge after hitting $100,000. This institutional confidence continues to fuel MicroStrategy's bold strategy and long-term outlook.

🚀 Altseason: Stablecoins redefine the rules of the game

The cycles of altcoin season, where secondary cryptos outperform Bitcoin, are now dominated by stablecoins. According to CryptoQuant, the old model based on the flow of capital between Bitcoin and altcoins is giving way to massive exchanges between altcoins and stablecoins like USDT. This transformation reflects a more mature structuring of liquidity and increased dominance of institutional investors.

With 73% of the main altcoins outperforming BTC in the last three months, a new cycle seems imminent. However, to trigger a rise to new heights, fresh and massive capital will be necessary. Stablecoins thus become pillars of stability and attractiveness for altcoins, signaling a major evolution of the crypto market towards a more diversified and robust dynamic.

💶 Digital Euro: A future taking shape for 2025

The ECB is accelerating its digital euro project, an electronic currency aimed at complementing cash and modernizing payments in the euro zone. Scheduled for October 2025, pending validation, this currency emphasizes privacy: transactions, whether online or offline, will remain confidential and not accessible to third parties. The ECB is also exploring a "reverse waterfall" methodology to limit amounts held in digital euro, while balancing monetary and financial issues.

With a robust infrastructure planned to simplify cross-border payments, this project aims to enhance Europe’s technological autonomy. Upcoming steps include selecting providers and a final evaluation before launch. The digital euro promises to transform payment habits while integrating seamlessly into the existing banking system.

🌟 Chainlink: The true "Bank Coin" on the rise

Chainlink (LINK) marks a turning point with a 29% increase, reaching $25.32 on December 3, thanks to strategic partnerships with major financial institutions. Among the most notable collaborations: integration with Swift and UBAS to connect 11,500 banks to blockchains, participation in the Drex project (CBDC of the Central Bank of Brazil) and a partnership with Euroclear for the tokenization of company shares.

Considered a key player in the crypto market, Chainlink attracts attention with its innovative technological solutions, notably its oracles, which fuel projects for UBS, Fidelity, and Bancolombia. Unlike XRP, sometimes labeled as a "memecoin", LINK attracts investors with its seriousness and real use cases. By combining innovation and credibility, Chainlink establishes itself as an essential pillar of DeFi and traditional finance.

💥 XRP: Towards new heights with a target of $6.60 by 2025

XRP continues to shine with an impressive ROI of 297% in November 2024, reaching $1.95, its highest level in seven years. Analysts forecast a major increase, with some estimating that the token could reach $6.60 in 2025, doubling its previous record of $3.40. This renewed interest is accompanied by massive accumulation of tokens by whales, with 679.1 million XRP acquired in three weeks, representing $1.6 billion.

Active wallets reach a record of 5.5 million, demonstrating the enthusiasm of institutional and retail investors. This dynamic is supported by a 100% increase in volumes in futures markets. With XRP now third in market capitalization, Ripple consolidates its position among the leaders of the crypto market.

Crypto of the day: TRON (TRX)

TRON is a decentralized blockchain focused on smart contracts, offering high scalability, low latency, and reduced fees. Its value-added lies in its ability to support decentralized applications (DApps) and eliminate intermediaries in digital ecosystems.

Its native crypto, TRX, is used to execute contracts, make payments, and reward the Super Representatives who maintain the network. Launched after a successful ICO in 2017, TRX offers its holders staking opportunities and participation in governance via the DPoS (Delegated Proof-of-Stake) model. Users can also use it in various DApps and for asset tokenization.

Recent performances of TRON (TRX)

Current price: €0.3767

24h Change: +57.87%

Market Cap: €32.58 billion

Rank on CoinMarketCap: 11

Technical analysis: XRP (XRP)

XRP performed remarkably in November with a 286% increase, peaking at $2.90 – a high since January 2018. This price explosion is fueled by factors such as growing institutional interest, rumors of an XRP ETF, and strategic collaborations, notably with Ripple for a regulated stablecoin in New York.

Although the cryptocurrency is currently consolidating around $2.66, the 50 and 200-day moving averages confirm an upward trend. However, recent volatility signals suggest a possible correction before a potential breakout above $3.55, a major resistance level corresponding to its ATH.

Technical analyses show buying intensity, supported by long positions and significant liquidation of sellers. Upcoming targets to watch include staying above $2 for potential breaking above $3. Conversely, a breach of this threshold could lead to a correction down to $1.30. The liquidation zones identified between $1.55 and $2.15 accentuate short-term volatility risks.

In conclusion, despite encouraging signals, XRP remains subject to rapid fluctuations.

🔗 Read the full analysis here.