Hello Cointribe! 🚀

Today is Wednesday, 26 November 2025, and as every day from Tuesday to Saturday, we bring you a summary of the key news from the last 24 hours that you shouldn’t have missed!

But first…

✍️ Cartoon of the day:

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🏛️ Texas becomes the first U.S. state to officially invest in Bitcoin

Texas has acquired 10 million dollars via the iShares Bitcoin Trust (IBIT) ETF in order to officially include Bitcoin in its strategic public reserves. The purchase, made on 20 November at a price of around 87,000 dollars per BTC, marks a historic first for a U.S. state.

👉 Read the full article

👤 Kevin Hassett could become the next head of the Federal Reserve

The potential nomination of Kevin Hassett as the leader of the Fed is drawing attention amid significant macroeconomic tensions and increased interest in crypto. His proximity to the crypto ecosystem and his economic profile would reshape U.S. monetary policy.

👉 Read the full article

🇨🇦 QCAD becomes Canada’s first fully compliant CAD stablecoin

The QCAD stablecoin has obtained full regulatory compliance in Canada, paving the way for broader distribution to the general public and institutions. This compliance marks an important step in the adoption of Canadian dollar-backed stablecoins.

👉 Read the full article

✅ The CFTC approves Polymarket’s return to the U.S. market

The CFTC has granted Polymarket the right to resume its operations in the United States, opening the door to a return of regulated prediction markets in the country. This decision comes in a context of strengthening crypto regulation in the United States.

👉 Read the full article

Crypto of the day: Mina Protocol (MINA)

🧠 Innovation and added value

Mina Protocol is a unique blockchain built on a revolutionary concept: being a lightweight blockchain whose size remains constant (around 22 kB), even as the network continues to grow.

This performance is made possible thanks to zk-SNARKs, an advanced cryptographic technology that allows verification of the entire blockchain state without downloading the full history.

In practice, Mina offers:

ultra-light nodes capable of running on a smartphone;

fast verification of the network state;

a strong foundation for developing zk applications (zkApps) focused on privacy.

Thanks to strong privacy guarantees and zero-knowledge proofs, Mina positions itself as an ideal infrastructure for sensitive applications: identification, biometric data, private finance, automated compliance.

💰 The token

MINA is used to pay transaction fees, participate in governance and secure the network through staking.

Holders can delegate their tokens to validators, enabling them to contribute to network security while receiving rewards.

The economic model of MINA is designed to encourage broad participation, including through accessible lightweight nodes, making decentralisation more tangible than on many other blockchains.

📊 Real-time performance (CMC)

💵 Current price: $0.1105

📈 24h change: +2.71%

💰 Market cap: $139.64M

🏅 CoinMarketCap rank: #228

🪙 Circulating supply: 1.26B MINA

📊 Trading volume (24h): $24.05M

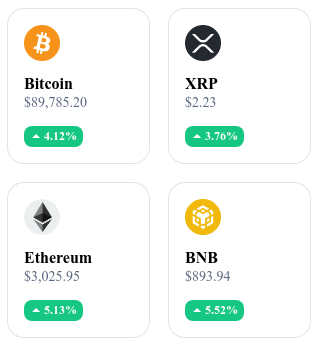

Bitcoin climbs back above $90,000!

The cryptocurrency market is recovering, with Bitcoin once again crossing the symbolic threshold of 90,000 dollars. This rebound comes amid a broader market recovery ahead of Thanksgiving, following a turbulent period marked by investor caution.

An unexpected surge: Bitcoin and altcoins regain strength

Tonight, Bitcoin briefly crossed the 90,000 USD level, confirming an increase of more than 10% over the past seven days. This rebound comes after a marked decline that saw BTC fall as low as 81,000 USD, its lowest level in several weeks.

This recovery is not limited to the king of cryptocurrencies. Ethereum has regained the 3,000 USD mark, while Solana has risen by more than 5%. XRP, although lagging behind its past performances, is also following this recovery trend. These coordinated movements suggest a short-term bullish trend driven by renewed optimism in the market.

Why the market is rebounding: economic and technical factors

Several factors explain this dynamic. First, markets are anticipating a possible interest rate cut by the U.S. Federal Reserve (Fed). A more accommodative monetary policy generally encourages investors to take on more risk, which benefits volatile assets such as cryptocurrencies.

In addition, the market had sharply declined at the beginning of November due to profit-taking, a temporary drop in institutional interest and macroeconomic tensions. This current rebound could therefore reflect a simple return to the mean, but the speed and scale of the movement suggest the potential for a more durable reversal.

Bitcoin’s return above 90,000 USD could mark a turning point in the current cycle. If monetary policies become more favourable and positive momentum builds among altcoins, a more sustainable bullish phase could be taking shape.