🔥 Bitcoin collapse: A necessary evil according to Peter Brandt

Welcome to the Daily for Friday, 21 November 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, 21 November 2025, and as every day from Tuesday to Saturday, we bring you a summary of the key news from the last 24 hours that you shouldn’t have missed!

But first…

✍️ Cartoon of the day:

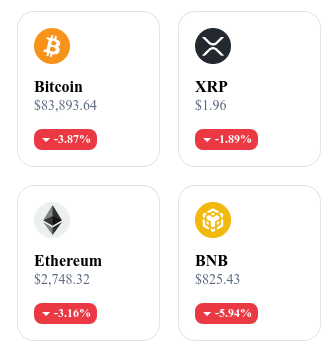

A quick look at the market…

🌡 Weather:

⛈️ Stormy

24h crypto recap! ⏱

🛠️ Bitcoin mining: The United States suspects Bitmain of espionage 📡

Chinese giant Bitmain, the world leader in ASIC chips for Bitcoin mining, is under investigation by the Department of Homeland Security for potential espionage or sabotage risks linked to its equipment.

👉 Read the full article

📉 Record withdrawals from U.S. Bitcoin ETFs: $3.79B vanished in November

U.S. Bitcoin-related ETFs recorded cumulative net outflows of $3.79 billion in November, with BlackRock’s IBIT at $2.47 billion and Fidelity’s FBTC at $1.09 billion (63% of the total).

👉 Read the full article

🧊 World Liberty Financials (WLFI) criticised after freezing compromised crypto wallets

WLFI’s governance is being questioned after the unilateral freezing of wallets affected by a compromise, raising concerns about the project’s transparency and community engagement.

👉 Read the full article

💼 Kalshi raises $1B: The battle of prediction markets intensifies

The U.S. prediction markets platform Kalshi has completed a one-billion-dollar funding round, bringing its valuation to $11 billion and highlighting investor interest in the sector.

👉 Read the full article

Crypto of the day: Oasis Network (ROSE)

🧠 Innovation and added value

Oasis Network is a Layer-1 blockchain specialised in privacy, data protection and the secure execution of smart contracts.

It relies on a unique two-layer architecture:

ParaTime Layer: parallel execution of smart contracts, fast and isolated;

Consensus Layer: network security through a robust PoS consensus.

Its main strength lies in confidential computing: thanks to Trusted Execution Environments (TEEs), Oasis enables developers to build applications where data is processed privately, without ever being publicly exposed.

This approach opens the door to sensitive use cases: confidential decentralised finance, digital identity, healthcare, biometric data, privacy-preserving AI…

Oasis thus positions itself as one of the most advanced blockchains for global privacy and Web3 applications requiring true data protection.

💰 The token

ROSE is the network’s native token. It is used to:

pay transaction fees;

secure the network through staking;

reward validators on the Consensus Layer;

participate in certain governance functions.

The protocol’s design also foresees a use of the token to power ParaTimes, including Emerald (EVM) and Cipher (confidential smart contracts), extending ROSE’s utility beyond simple payments.

The token economy relies on a balance between real-world usage, staking and the development of privacy-oriented applications.

📊 Real-time performance

💵 Current price: $0.01648

📉 24h change: –8.68%

💰 Market cap: $123.38M

🏅 CoinMarketCap rank: #239

🪙 Circulating supply: 7.48B ROSE

📊 Trading volume (24h): $13.56M

Bitcoin at $200,000: Peter Brandt bets on 2029

While flamboyant predictions about Bitcoin continue to multiply, Peter Brandt chooses to swim against the tide. The renowned technical analyst believes BTC will not reach 200,000 dollars before the third quarter of 2029, a projection that runs counter to dominant scenarios. His approach, based on the study of historical cycles, challenges the current haste and suggests a much slower pace for the market.

Peter Brandt breaks with the bullish consensus

Peter Brandt published an unexpected prediction on X: according to him, the next major Bitcoin bull cycle will not allow the asset to hit 200,000 dollars before the second half of 2029. This view contrasts with those of Arthur Hayes or Tom Lee, who mention this threshold as early as 2025. Other prominent figures such as Brian Armstrong and Cathie Wood go even further, envisioning a 1-million-dollar BTC by 2030.

This discrepancy highlights a divergence in approach: while some rely on fast catalysts (institutional adoption, favourable regulation, ETFs), Brandt prefers a reading grounded in technical analysis. He relies in particular on the study of previous cycles to identify a slower but more stable growth rhythm.

A healthy collapse for a sustainable recovery

While Bitcoin fell from 126,000 to 82,000 dollars within a month — a drop of more than 20% — Brandt sees an encouraging signal. Far from sounding the alarm, he considers this correction a cleansing of the market. According to him, this decline is even “the best thing that could have happened to bitcoin,” as it flushes out excesses before a sustainable rebound.

To support his thesis, he draws an instructive parallel with a notable episode in the commodities market. In the 1970s, soybean prices soared before losing 50% of their value due to oversupply. This dynamic — surge, sharp correction, then structural rebound — corresponds to a well-known pattern among technical analysts, in which a deep consolidation prepares the ground for a stronger bullish phase.

By comparing Bitcoin to this type of cycle, Brandt invites investors to exercise patience. For him, speed is not what matters, but the quality of market construction. His stance therefore challenges overly enthusiastic predictions and recentres the debate on the importance of gradual development supported by solid technical foundations.