🧑💻Bitcoin Core Developers Under Fire

Welcome to the Wednesday, May 7, 2025, Daily Tribune ☕️

Hello Cointribe! 🚀

Today is Wednesday, May 7, 2025, and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

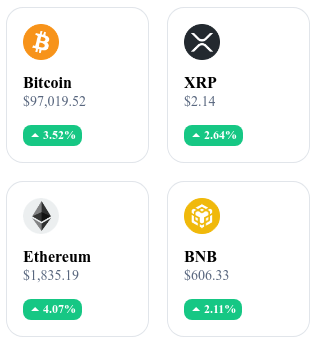

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

💶 The digital euro project quietly progresses

The digital euro aims to enable digital transactions throughout the eurozone. Unlike current systems, no digital tool today offers such a scope of application at the continental level. Despite the controversies, the project is moving forward.

⚙️ Bitcoin Core Developers Under Fire

Bitcoin Core is once again under fire. French developer Antoine Poinsot has stirred the pot by proposing to remove the limit on the amount of arbitrary data that can be inserted into transactions. This proposal sparks debates within the community, with some fearing a drift towards non-financial uses and centralization of technical decisions.

⚔️ USDT: The Tron vs Ethereum Duel Hits a New Peak

With a new issuance of 1 billion USDT on Tron, Tether narrows the gap with Ethereum. The Tron network is dangerously approaching Ethereum, the current leader. This resurgence marks a key step in the blockchain war to dominate the stablecoin market.

🤖 Tether Prepares a Decentralized AI to Revolutionize Crypto Payments

Tether is about to shake up the crypto universe with an unprecedented AI platform. Decentralized, open source, and compatible with Bitcoin and USDT, it aims to transform the uses of decentralized payment on a large scale.

Crypto of the Day: Quant (QNT)

Quant stands out with its Overledger protocol, an interoperability solution allowing the connection of different blockchains, whether public or private. This technology facilitates the creation of multi-chain applications (MApps), thus offering greater flexibility to developers and companies wishing to integrate various blockchain technologies.

The QNT token is used to access Quant network services, notably to pay fees related to the use of Overledger. QNT holders can also participate in network governance, thus influencing key decisions regarding protocol evolution. The initial distribution of QNT was carried out through a public sale in 2018, with a total supply capped at 14,881,364 tokens.

Recent Performances:

Current Price: $91.52 USD

24-hour Change: +11.6 %

Market Capitalization: approximately 1.1 billion dollars

Rank on CoinMarketCap: #66

BNB: Standard Chartered Forecasts a Spectacular Rise to $2,775 by 2028

Binance Coin (BNB), native token of the Binance platform, is the subject of a bold projection by British bank Standard Chartered. According to Geoff Kendrick, head of digital asset research at the bank, BNB could reach $2,775 by the end of 2028, an increase of more than 360% from its current price of around $600.

A Close Correlation with Bitcoin and Ethereum

Since May 2021, BNB has evolved in close correlation with an unweighted basket of Bitcoin and Ethereum, both in terms of returns and volatility. This dynamic suggests that BNB could benefit from the bullish trends of the two leading cryptocurrencies. Standard Chartered estimates this relationship should persist, thus supporting BNB’s growth.

The Solid Fundamentals of the Binance Ecosystem

BNB derives its value from its central role in the Binance ecosystem, notably for transaction fees, discounts, and new token launches. The BNB Chain, while considered more “traditional” than its competitors like Ethereum or Avalanche, remains a pillar for decentralized exchanges, lending protocols, and liquid staking. The stability and continued growth of Binance as a major centralized exchange reinforce BNB’s market position.

Standard Chartered’s projection places BNB among the digital assets to watch closely in coming years. If current trends continue and Binance maintains its dominant position, BNB could experience significant growth, potentially reaching $2,775 by 2028. However, as with any cryptocurrency investment, it is essential to consider associated risks and closely monitor market developments.