⚠️ Bitcoin crash: Should we worry about Strategy?

Welcome to the Daily for Thursday, November 6, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, November 5, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the top news from the past 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

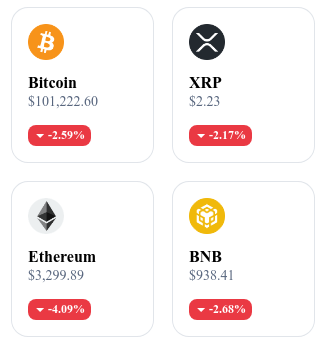

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🧭 AI: Google revolutionizes Maps with Gemini integration

Google integrates its Gemini AI into Google Maps to enhance navigation and contextual search. The assistant analyzes over 250 million locations to offer personalized routes and real-time voice recommendations.

👉 Read the full article

📊 Robinhood: Profits up +217 % in Q3 thanks to the crypto trading boom

Robinhood reported a net profit of $556 million for Q3 2025, compared to $150 million a year earlier. Revenue reached $1.2 billion, driven by a threefold increase in crypto trading income.

👉 Read the full article

🏛️ U.S. Senate continues crypto bill talks with David Sacks

Senators John Boozman and Cory Booker continue working on a bill to regulate digital assets. They are scheduled to meet with David Sacks to refine provisions related to market oversight.

👉 Read the full article

🔍 Europe dismantles a €600 million fraud network

Eurojust and Europol have arrested nine individuals across three countries, accused of running a scam network tied to fake investment platforms. Since 2018, victims have reportedly lost more than €600 million in this transnational fraud.

👉 Read the full article

Crypto of the Day: Stellar (XLM)

🧠 Innovation and Added Value

Stellar is a blockchain designed to enable fast, low-cost, and interoperable value transfers between financial institutions, businesses, and individuals. Founded by Jed McCaleb (co-founder of Ripple), it aims to connect traditional financial systems with Web3 through an open-source architecture.

Its main innovation lies in the Stellar Consensus Protocol (SCP) — an energy-efficient, high-speed mechanism that enables near-instant transactions with fees under one cent.

Stellar also plays a key role in Real-World Asset (RWA) tokenization, including stablecoins, local currencies, and bonds. Numerous fintechs and NGOs already use its network for cross-border payments and microfinance in emerging markets.

💰 The Token

XLM (Lumen) is the native token of the Stellar network. It is essential for transaction validation and network fluidity: every operation requires a small amount of XLM to prevent spam and secure the system.

It also acts as a bridge between currencies, enabling instant conversion from one asset to another without intermediaries. Users can use XLM to transfer funds, create or trade tokenized assets, or support Stellar Foundation operations.

XLM thus embodies Stellar’s mission: making global payments more accessible, faster, and inclusive — while supporting the governance of an open financial ecosystem.

📊 Real-Time Performance

💵 Current price: ≈ 0.2971 USD

📉 24h change: -0.19 %

💰 Market cap: ≈ 8.796 billion USD

🏅 Rank on CoinMarketCap: #16

🪙 Circulating supply: ≈ 32.10 billion XLM

📊 24h trading volume: ≈ 907.50 million USD

MicroStrategy faces the Bitcoin storm: assessing the real risks

The recent drop in Bitcoin has shaken the markets, but for some players, the stakes are far more structural. MicroStrategy — a long-time Bitcoin accumulator — is once again at the center of attention. Beyond price volatility, what do the numbers actually reveal about the company’s strategic resilience?

A debt structure built to weather market turbulence

Despite Bitcoin losing nearly 10 % in a week and MicroStrategy’s stock falling 6.7 % in a single session, analysts say the panic is mostly media-driven rather than grounded in fundamentals. According to on-chain expert Willy Woo, “MicroStrategy will not be forced to liquidate its Bitcoins during the next bear market.” The key reason: the structure of its debt.

The company, led by Michael Saylor, has issued senior convertible notes, a form of debt that offers strategic flexibility, particularly regarding repayment conditions. To avoid repaying these notes in cash, MicroStrategy’s stock only needs to stay above $183.19 by September 15, 2027. Based on current models, that would correspond to a Bitcoin price of roughly $91,502.

At present, that threshold remains below Bitcoin’s historical highs — providing MicroStrategy with a notable safety margin. As long as BTC’s cyclical bull runs continue to appear, this debt structure strengthens the company’s resilience.

A high-stakes bet if Bitcoin stagnates

However, the model is not without its weaknesses. Even Willy Woo notes that a “partial liquidation” could occur if Bitcoin fails to rise again before 2028. A prolonged period of price stagnation would put pressure on the company’s leverage strategy, which relies heavily on long-term appreciation assumptions.

This stress scenario underscores Michael Saylor’s calculated gamble: a sustained, multi-cycle appreciation of Bitcoin. MicroStrategy’s massive accumulation strategy has become a case study for publicly traded firms exposed to digital assets. It also sends a clear signal to the broader market: if the model holds, it could become a blueprint for institutional adoption. But if the market turns against it, it could stand as a cautionary tale.