🚀 Bitcoin crash: what if the real rebound starts now?

Welcome to the Daily for Wednesday, August 20, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, August 20, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the past 24 hours’ top news you shouldn’t miss!

But first…

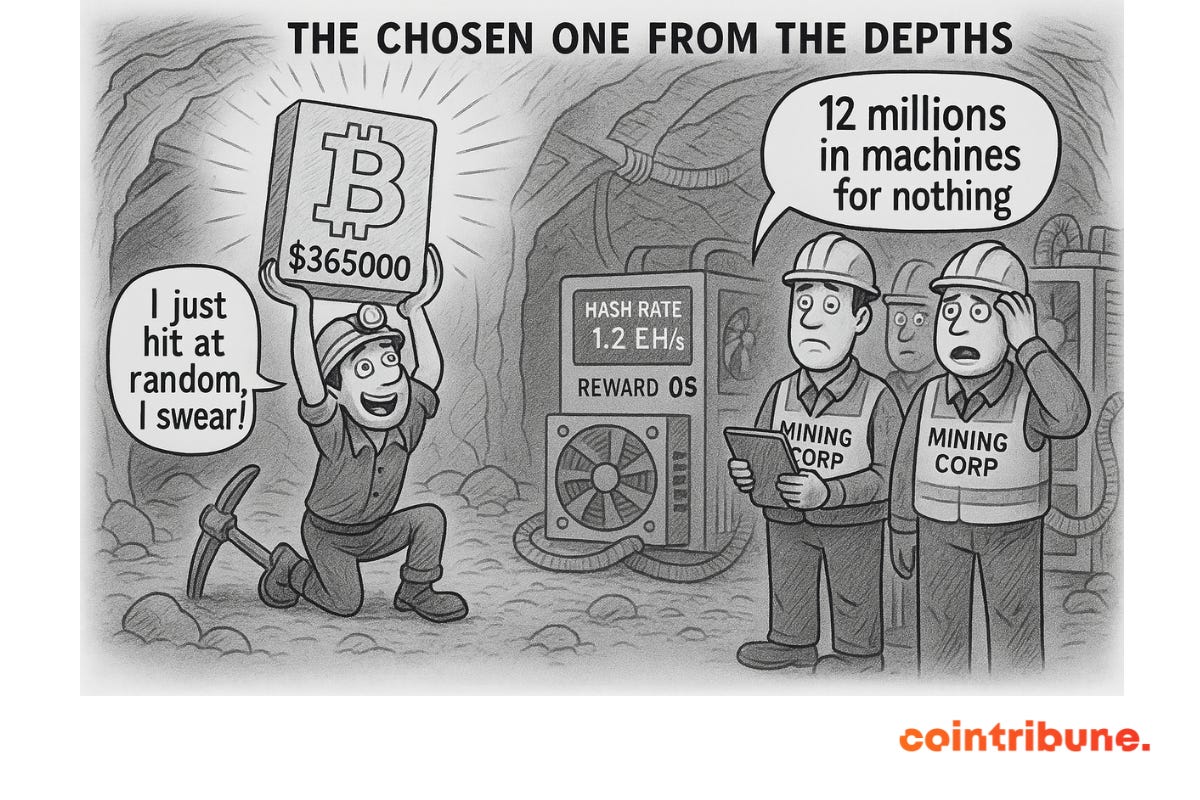

✍️ Cartoon of the day:

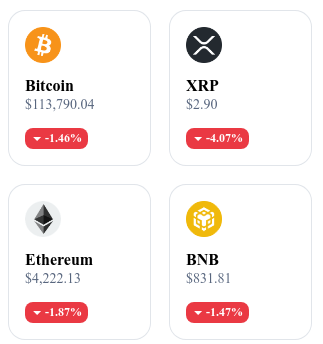

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🏛️ Tether appoints Bo Hines to lead its U.S. digital asset strategy

Tether has appointed Bo Hines, former head of the White House crypto council, to oversee its U.S. digital asset strategy. His mission covers regulatory advocacy, public-private partnerships, and driving USDT adoption in the U.S., with a clear focus on compliance and innovation.

👉 Read full article

🦬 Wyoming’s “Frontier” stablecoin launches on Ethereum and Solana

The state of Wyoming is rolling out Frontier, a dollar-pegged 1:1 stablecoin now issued on Ethereum and Solana. Supervision lies with the Wyoming Stable Token Commission, with dollar reserves and controls designed for public payments and enterprise use.

👉 Read full article

🦊 TRON integrates with MetaMask, opening access to TRC-20 dApps

MetaMask now supports TRON via Snaps, including TRX and TRC-20 tokens in the wallet. Users can send funds and connect to TRON dApps without switching tools, significantly lowering access friction.

👉 Read full article

⛏️ Solo miner strikes Bitcoin block and earns ~$365,000

A solo miner found a block through a “solo” pool, earning 3.125 BTC plus fees for a total of around $365,000. The feat, very rare under record difficulty, highlights the lottery-like nature of Proof-of-Work and the strong concentration of hashrate.

👉 Read full article

Crypto of the Day: Stacks (STX)

🧠 Innovation and Added Value

Stacks is a Layer 1 solution on Bitcoin that enables the execution of smart contracts, DeFi, and NFTs through its unique Proof of Transfer (PoX) mechanism. By anchoring directly to Bitcoin’s security, Stacks transforms BTC into a truly programmable base layer without altering its core protocol. Its Clarity language, readable and predictable, aims to strengthen the security of decentralized applications.

💰 The STX Token: Utility and Benefits for Holders

The STX token is used to pay transaction fees, execute smart contracts, and support consensus via PoX. Holders can stack their STX to earn rewards directly in BTC, a mechanism that aligns Stacks’ economy with the Bitcoin ecosystem while enhancing the network’s resilience.

📊 Real-Time Performance (August 20, 2025)

Current price: $0.6609 USD

24h change: –3.20 %

Market cap: ≈ $1.185 billion USD

Rank on CoinMarketCap: #72

Circulating supply: ≈ 1.792 billion STX

Trading volume (24h): ≈ $45.33 million USD

Is Bitcoin Ready to Rebound? What On-Chain Data Reveals

As Bitcoin corrects after hitting an all-time high, technical indicators are sending mixed yet intriguing signals. A closer look at on-chain data and market behavior provides clues of a potential short-term rebound.

The Exchange Whale Ratio: A Growing Technical Signal

Bitcoin recently dropped 7%, pulling its value back under $120,000 after reaching a new high above $124,000. While the correction seems sharp, certain technical signals urge caution against reading it purely as bearish. Leading among them is the Exchange Whale Ratio, an on-chain indicator measuring the share of deposits made by large holders (or whales) on exchanges.

According to analyst SunflowrQuant via CryptoQuant, the indicator currently sits around 0.48, a level historically close to local market bottoms. When the ratio nears 0.50, the market has often entered a consolidation phase followed by a bullish reversal. This suggests whales prefer holding rather than selling, thereby reducing selling pressure.

Past cases reinforce this view: similar Whale Ratio levels have coincided with accumulation phases. If confirmed, such dynamics may point to a rebound—provided no other technical or contextual factors reverse the trend.

Liquidity Zones: The Hidden Drivers of Price Action

Beyond behavioral indicators, technical liquidity plays a central role in price direction. Data from Coinglass shows liquidity clusters forming around $120,000. These zones act like magnets, pulling the price toward them due to the concentration of buy and sell orders. The market naturally seeks such friction points to absorb liquidity before continuing its trajectory.

In this setting, a move back toward $120,000 seems plausible, especially if selling pressure eases in the coming days. The proximity of this key zone alone could trigger a technical rebound, even without a major fundamental catalyst.

Some optimists even foresee a potential return toward $150,000, though this would require a favorable mix of factors, including renewed market sentiment and supportive macroeconomic conditions. This speculative outlook highlights the role of institutions, quantitative models, and high-frequency traders.

Historical cycles show that post-ATH corrections are often followed by uncertainty, then impulsive recoveries. Today’s setup could therefore be a mere pause within a broader uptrend.

On-chain data leans toward an imminent rebound, supported by historically reliable indicators. Whether the current momentum will be enough to reignite the bullish trend remains to be seen. If whales hold their positions and liquidity zones keep shaping the market, a return to previous levels—or even higher—cannot be ruled out.