📉 Bitcoin dips, but fundamentals remain bullish

Welcome to the Daily for Wednesday, October 8, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, October 8, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the past 24 hours’ news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

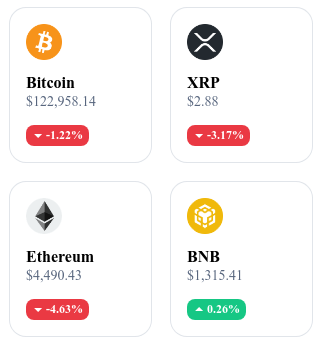

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🟡 BNB surpasses XRP to claim third place in crypto rankings

BNB has overtaken XRP in market capitalization, reaching $170 billion compared to Ripple’s $164 billion. Binance’s token is up 9% on the week, driven by strong demand on BNB Chain and renewed institutional interest.

👉 Read the full article

💰 114,000 BTC withdrawn from exchanges in two weeks

Over 114,000 bitcoins — roughly $13.6 billion at current prices — have been withdrawn from exchanges in recent days. These massive outflows, observed on Binance, Coinbase, and OKX, are interpreted as a shift toward long-term storage, reducing the available market supply.

👉 Read the full article

🟣 Sharplink nears $1 billion in unrealized gains thanks to Ethereum

Sharplink has reported holding 233,000 ETH, valued at nearly $980 million after the recent surge in ether’s price. The company, active in decentralized finance and oracle management, has seen its treasury grow by 36% in a single quarter.

👉 Read the full article

🦊 MetaMask launches a new loyalty rewards program

MetaMask has announced the launch of a rewards system called MaskPoints, allowing users to earn points redeemable for fee discounts and partner benefits. The program, deployed on Ethereum and Polygon, rewards consistent activity and the use of MetaMask Portfolio.

👉 Read the full article

📌 Crypto of the Day: Ethena (ENA)

Innovation and Added Value 🧠

Ethena is an innovative DeFi platform aiming to create a synthetic stablecoin called USDe, fully backed by delta-neutral positions in derivatives markets. In practice, Ethena maintains a 1:1 peg with the U.S. dollar without holding USD reserves, by combining deposits in ether (or staked ETH) with equivalent short positions on derivatives exchanges.

This mechanism eliminates dependence on traditional banking institutions while providing a high and stable yield. Ethena’s goal is to redefine on-chain finance through its “Internet bond” — an asset that combines stability, yield, and transparency.

The Token 💰

ENA is the governance token of the Ethena protocol. Holders can vote on key system parameters such as collateral management, hedging strategies, and the distribution of the Internet bond’s yield. The token also aligns incentives: users who participate in staking or use the USDe stablecoin can earn rewards in ENA.

A portion of the protocol’s fees — mainly from hedging operations — is allocated to a sustainability fund, ensuring long-term resilience. With a total supply of 15 billion tokens, Ethena aims to build an economy that balances yield, stability, and governance.

Real-Time Performance 📊

💵 Current Price: 0.537 USD

📈 24h Change: +1.94%

💰 Market Cap: 808,250,000 USD

🏅 Rank on CoinMarketCap: #92

🪙 Circulating Supply: 1,506,000,000 ENA

📊 Trading Volume (24h): 138,400,000 USD

Bitcoin pulls back, but fundamentals remain strong according to recent data

As Bitcoin experiences a notable correction after hitting a new all-time high, key market fundamentals continue to signal investor confidence. Between steady ETF inflows and the ongoing decline in BTC reserves on exchanges, the ecosystem appears resilient — in sharp contrast to price volatility.

Solid fundamentals supporting the market despite the dip

Bitcoin briefly surpassed $126,219 before entering a 4.2% correction phase, part of a broader technical consolidation following a strong rally. Despite selling pressure, several indicators confirm a structurally bullish backdrop.

Spot Bitcoin ETFs continue to attract investors, with weekly net inflows reaching $3.55 billion and total assets under management rising to $195.2 billion. This institutional demand underscores Bitcoin’s growing role as a long-term portfolio asset.

Meanwhile, available supply on exchanges continues to shrink. Bitcoin reserves have dropped to their lowest level in five years — around 2.38 million BTC. This outflow reflects a move toward long-term holding outside liquid markets, often associated with expectations of future price appreciation.

The derivatives market, another key health indicator, reinforces this sentiment. Futures contracts show moderate premiums around 8%, while open interest remains high at roughly $72 billion — a sign of active but controlled participation, far from the speculative excesses of past cycles.

Bullish forecasts and market psychology

Major investment banks have issued optimistic projections for the months ahead. Citibank expects Bitcoin to reach $181,000 within 12 to 18 months, while JPMorgan targets $165,000 over the same horizon. These forecasts rest on structural factors: sustained ETF inflows, supply scarcity, and Bitcoin’s deeper integration into global financial strategies.

Beyond models and metrics, market psychology will remain key. Periods of euphoria and caution tend to shape short-term movements. The current restraint observed in derivatives suggests a more rational phase, as traders await macroeconomic or regulatory catalysts.

With fundamentals strengthening, recent volatility may simply represent a pause in an evolving market. As Bitcoin cements its position as a reference asset, short-term fluctuations give way to longer-term valuation dynamics.