📉 Bitcoin drops after Scott Bessent’s remarks

Welcome to the Daily for Friday, August 15, 2025 ☕️

Hello Cointribe! 🚀

Today is Friday, August 15, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the most important news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

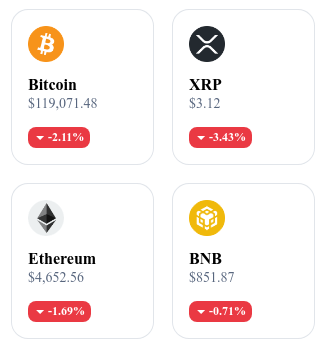

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🟠 Bitcoin drops after Scott Bessent’s statements

On August 14, 2025, BTC fell from $124,457 (intraday high) to below $118,000 after Treasury Secretary Scott Bessent confirmed the halt of bitcoin purchases for U.S. strategic reserves. This shift removes symbolic support for public demand and rekindles doubts about short-term institutional adoption.

👉 Read the full article

📱 Google Play reassures: non-custodial wallets remain allowed

Google stated its new policy will not affect non-custodial wallets, while starting late October, custodial apps will need licensing in over 15 countries (U.S., EU, UK). In the U.S., publishers must be MSB/FinCEN-registered or a licensed bank; in the EU, they must be registered as crypto-asset service providers (MiCA), clarifying Play Store distribution.

👉 Read the full article

🟣 Grayscale may launch a Cardano ETF, investors excited

Grayscale registered a “Cardano Trust ETF” in Delaware; ADA rose about 17%, with open interest +26% and ~$3.4B in volume. This step strengthens the case for institutional ADA exposure, pending U.S. regulatory approval.

👉 Read the full article

🦊 MetaMask set to launch a new stablecoin this week

MetaMask plans to announce mUSD, a dollar-pegged token, with initial rollout Thursday and full ramp-up by month-end. The design captures reserve yield (T-Bills) and involves partners such as Stripe (on-ramp), M^0 (issuance), and Blackstone (custody), in a stablecoin market nearing $280B.

👉 Read the full article

Crypto of the Day: Theta Network (THETA)

🧠 Innovation and Value Proposition

Theta Network is a blockchain specialized in decentralized video streaming and digital content delivery. It aims to reduce infrastructure costs for streaming platforms through a peer-to-peer network where users share bandwidth and computing resources.

Its technology enables higher video quality, lower latency, and fairer monetization for creators and broadcasters, while offering integration possibilities with metaverses, e-sports, and Web3 multimedia applications.

💰 The THETA Token: Utility and Holder Benefits

The THETA token is used for on-chain governance, staking, and network security. Holders can become validators or delegate their tokens to earn rewards. THETA also plays a key role in the platform’s economic ecosystem, supporting the development and adoption of its decentralized streaming solutions.

📊 Real-Time Performance (August 15, 2025)

Current Price: $2.08 USD

24h Change: +0.96%

Market Cap: ≈ $2.08B USD

CoinMarketCap Rank: #47

Circulating Supply: ≈ 1B THETA

24h Trading Volume: ≈ $41.9M USD

Bitcoin Plunges: Heading for a Rebound or a Collapse?

Bitcoin has just experienced a roller-coaster ride. After surpassing $124,000 and briefly overtaking Google in market capitalization, it plunged back to $117,000. This volatility reignites the debate over its resilience as a global asset.

A Historic High Followed by a Sharp Drop

The symbolic threshold of $124,457 was short-lived. This surge briefly allowed Bitcoin to overtake Google’s market cap, generating strong enthusiasm among investors. But the subsequent fall to $117,000 revived long-standing concerns over the cryptocurrency’s volatility.

Three main factors are being blamed: short-term speculation, global economic adjustments, and unexpected events. On top of that, a still-unclear regulatory framework continues to fuel uncertainty. This structural instability in the crypto market calls for cautious risk management.

Regulation and Competition: Barriers to BTC’s Dominance

Despite its exceptional performance, Bitcoin failed to surpass Apple in market cap — a milestone that would have marked a symbolic shift towards its positioning as a global reference asset. The main obstacle remains regulatory uncertainty. Without a clear stance from financial jurisdictions, large investors are likely to remain cautious.

Another source of pressure is Ethereum’s rise. With its smart contracts and DeFi ecosystem, Ethereum is attracting a growing share of institutional and developer interest. This shift challenges Bitcoin’s historic dominance, which is based mainly on scarcity and first-mover advantage.

From a technical perspective, two key levels define the current trajectory: a drop below $110,000 could intensify selling pressure, while a move back above $120,000 would signal recovery. These thresholds are now critical markers of market sentiment.

Bitcoin’s position in the global financial landscape can no longer be reduced to its price. Its legitimacy will depend on stronger institutional adoption, a clear regulatory framework, and its ability to coexist with other innovative blockchain ecosystems. The current period of sharp fluctuations is acting as a stress test for the market’s first cryptocurrency.