🚀 Bitcoin ETF: 15 days of uninterrupted entries!

Welcome to the Daily tribune Thursday, June 6, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, June 6, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

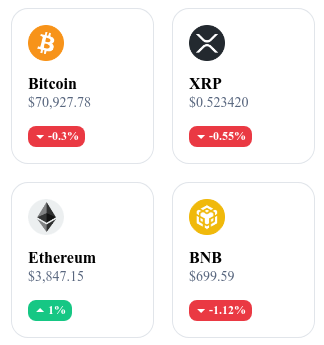

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

Bitcoin ETF: When gains become routine! 🚀

Bitcoin ETFs have recorded an impressive 15 consecutive days of gains, indicating increased investor confidence in this type of financial product. Sosovalue data shows cumulative inflows reaching $105 million on June 3, with players like Fidelity and Bitwise leading the way. Despite Grayscale's GBTC fund stagnating with no inflows, Fidelity's ETFs attracted around $77 million and Bitwise's attracted $14.3 million. These performances highlight the growing appeal of investors for exposure to Bitcoin through traditional financial vehicles, positioning ETFs as a potential pillar for the democratization and widespread adoption of Bitcoin. 🔗 Read the full article here.

Binance and MiCA: Stablecoins in the spotlight! 💬

Binance has spoken out about the impact of the new MiCA regulations, which will come into effect on June 30, 2024, in the European Economic Area (EEA). These regulations aim to strictly regulate stablecoins to protect investors and ensure financial stability. Binance assures that despite the new requirements, users will still be able to use their preferred stablecoins, such as USDT, for deposits, withdrawals, and trading on its Spot trading platform. Compliant alternatives will be offered for incompatible stablecoins, and Binance is actively working to minimize disruptions in the market. The company is also committed to transparent communication and offering viable solutions to users affected by these changes. 🔗 Read the full article here.

Bitcoin NFTs surpass $4 billion in sales! 💥

Bitcoin NFTs achieved a historic milestone by exceeding $4 billion in global sales, surpassing Ethereum and Solana last May. Despite a 54% drop in the overall NFT market, Bitcoin Ordinals recorded an exceptional sales volume of $171 million, overshadowing Ethereum's $159 million and Solana's $90 million for the same period. The Ordinals, thanks to their unique protocol assigning numbers to satoshis, allow the creation of distinct digital assets directly on the Bitcoin blockchain. Their intrinsic value is based not only on the artwork but also on the scarcity and history of the satoshis to which they are attached. This breakthrough marks a decisive turning point in the history of NFTs and signals a potential revolution in this constantly evolving space. 🔗 Read the full article here.

BNB at $700: A new era for Binance Coin! 🌟

Binance Coin (BNB) has reached a new high by surpassing the $700 mark, despite major regulatory challenges. BNB's market capitalization now exceeds $100 billion, surpassing giants like UBS, Dell, and Starbucks. This dramatic rise comes as Binance faces disputes with Nigerian authorities and a $4.3 billion fine settled with the US Department of Justice, which led to the resignation of its founder Changpeng Zhao and his conviction to several months in prison. Despite these obstacles, BNB continues to attract investor attention, positioning itself as a major player in the global economy. 🔗 Read the full article here.

Crypto of the day: Stacks (STX)

Stacks is an innovative blockchain that aims to bring smart contract functionality to Bitcoin, enabling decentralized applications (dApps) and complex transactions while benefiting from the security and stability of Bitcoin. Its native cryptocurrency, STX, is primarily used to power these smart contracts and pay transaction fees within the network. Initially distributed through a public sale and developer allocations, STX offers advantages such as the ability to \"stack\" tokens to earn rewards in Bitcoin. STX holders can actively participate in securing the network and benefit from the growth of the Stacks ecosystem.

Recent performance

Current price: €2.38

Percentage increase/decrease: +6.89% (in 1 day)

Market capitalization: €3,488,758,690

Rank on CoinMarketCap: #30

Crypto analysis: Solana (SOL)

After an impressive peak at $211, Solana experienced a severe correction, dropping over 40% to stabilize around $120. However, this level has served as strong support, allowing for a significant bullish recovery. Currently, Solana is trading around $173, with favorable technical indicators. The 50-day and 200-day moving averages confirm a bullish trend in the medium and long term, while oscillators show increasing positive momentum. This stability at $173 could be a sign of sustainable buying interest, ready to push Solana to new heights.

Analysis of SOL/USDT derivative contracts reveals marked bullish pressure, with a notable increase in funding rates. This indicates that speculators are mostly inclined towards buying, reinforcing the bullish conviction. Recent liquidations of short positions have contributed to this positive momentum. The liquidations heatmap shows key areas around $160 and $185-195, where significant price movements could occur. These areas represent crucial points of interest for investors, suggesting opportunities and increased volatility risks.

If Solana manages to maintain its price above $170, we could see a bullish continuation towards $190 or even $200. The next major resistance would be around $210, with potential to reach the all-time high of $265, representing an increase of over 50%. On the other hand, if the price fails to hold this level, a decline towards $145 or $125 could be expected, with critical support at $110, marking a decrease of nearly 37%.