💸 Bitcoin ETF: Institutions Return with $219M in One Day

Welcome to the Daily for Wednesday, August 27, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, August 27, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the past 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

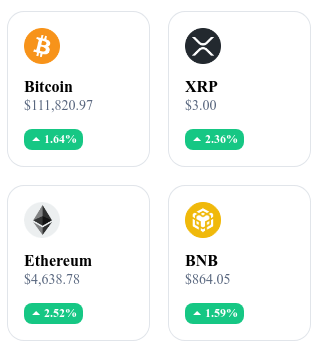

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🏗️ Trump Media, Crypto.com, and Yorkville launch a $6.42B project centered on CRO

The structure aims for a treasury listed in CRO under the ticker MCGA on Nasdaq. It combines $1B in CRO, $420M in cash and warrants, a $5B credit line, and plans for a validator on Cronos, while critics raise concerns over centralization.

👉 Read more

🟣 SharpLink buys 56,553 ETH, nearing 800,000 ETH in reserves

The company reports a weekly purchase of 56,553 ETH (week ending August 24) at an average price of $4,462, bringing reserves to 797,704 ETH. It also mentions 1,799 ETH earned through staking since June 2 and about $200M in cash allocated for future purchases.

📈 Ethereum reaches $500B faster than Apple or Bitcoin

ETH hit this historic threshold after an ATH of $4,946, pushing its dominance to ~15% and strengthening its narrative as an infrastructure asset beyond a mere “altcoin.” Glassnode notes an MVRV at 2.15, reflecting high unrealized gains and a short-term volatility risk.

👉 Read more

🗳️ Donald Trump Jr joins Polymarket’s advisory board after 1789 Capital’s investment

Polymarket announces Donald Trump Jr’s entry into its advisory board, alongside an equity stake from 1789 Capital where he is a partner. The move supports Polymarket’s return to the U.S. (buying QCEX and its clearinghouse for $122M), while he also remains an advisor at Kalshi.

Crypto of the Day: Algorand (ALGO)

🧠 Innovation & Value Proposition

Algorand is a Layer 1 blockchain designed to solve the blockchain trilemma — security, scalability, and decentralization — through its innovative Pure Proof-of-Stake (PPoS) consensus. This protocol uses a cryptographic random selection of validators, ensuring instant finality, fairness (1 ALGO is enough to participate), and energy efficiency.

With fast, low-cost transactions and immediate finality, Algorand is particularly suited for asset tokenization, digital payments, CBDCs, and DeFi/NFT applications.

💰 The ALGO Token: Utility & Benefits for Holders

The ALGO token is used to pay transaction fees, can be staked to secure the network, and allows participation in protocol governance (via governors). Staking rewards are distributed to all holders, encouraging broad and decentralized participation. Algorand stands out for its carbon neutrality and minimal energy consumption, making it attractive for sustainable applications.

📊 Real-Time Performance (August 27, 2025)

Current Price: $0.2529 USD

24h Change: +0.45%

Market Cap: ≈ $2.207B USD

CoinMarketCap Rank: #45

Circulating Supply: ≈ 8.723B ALGO

24h Trading Volume: ≈ $100.56M USD

Bitcoin Rebounds: $219M Injected Back Into ETFs After a Dark Week

Institutional investors appear to have turned the page on a gloomy week for Bitcoin. With $219 million reinjected in a single day into BTC ETFs, optimism is returning to the market. Behind this rebound: Jerome Powell’s strategic speech, a shift in market sentiment measured by the “Crypto Fear & Greed Index,” and an unexpected performance from Ethereum ETFs.

A Strong Signal from Institutions: Fidelity, BlackRock and ARK Revive the Flows

After six consecutive days of outflows totaling $1.2 billion, Bitcoin ETFs abruptly reversed the trend on August 25. The turnaround came with massive inflows of $219 million in just 24 hours, highlighting renewed institutional confidence. Three financial giants stood out: Fidelity added $65.56M, BlackRock $63.38M, and ARK Invest $61.21M.

This move coincided with Jerome Powell’s more conciliatory speech at the Jackson Hole conference. His softer tone resonated across markets, especially in highly volatile assets like crypto. Bitcoin, which had plunged from $124,128 to $111,636 (-11%), found support in this perceived monetary easing.

The Crypto Fear & Greed Index climbed back to 60 points (“Greed”), signaling renewed appetite among investors.

Ethereum Outpaces Bitcoin in ETFs: A Paradigm Shift?

While Bitcoin ETFs impressed with a sharp rebound, Ethereum ETFs did even better: $444 million of inflows in one day, $315M of which came from BlackRock. This overperformance raises questions about institutional preferences. With staking and smart contract utility, Ethereum is increasingly attracting attention.

The performance gap between BTC and ETH ETFs suggests that institutions now see Ethereum as a standalone investment vehicle rather than a secondary “altcoin.” This reflects a more mature institutional market, actively arbitraging based on fundamentals instead of mere dominance.

In the short term, the signals are encouraging, though caution remains warranted given the fragile macroeconomic environment.