🔥 Bitcoin ETFs Hit Records, Microsoft Ponders BTC

Welcome to the Daily Tribune of Saturday, October 26, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, October 26, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

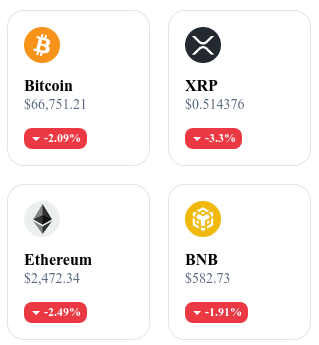

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

Bitcoin ETFs at the Symbolic Threshold of One Million BTC Under Management 🏦

Bitcoin exchange-traded funds (ETFs) are nearing the historical milestone of one million BTC under management, having already accumulated 97% of this volume. BlackRock, the main player with nearly 400,000 BTC, dominates the market, followed by Grayscale and Fidelity. This phenomenon, accelerating since January, reflects an unprecedented institutional enthusiasm for Bitcoin. These massive investments are driving the price of BTC up, creating scarcity in the market.

With the approval of American regulators, ETFs are bringing Bitcoin a new legitimacy as a financial asset. Analysts anticipate a continuation of this trend, supported by an increasingly favorable regulatory framework, paving the way for greater integration of crypto into the traditional finance world. The imminent crossing of this symbolic threshold could mark a turning point for the institutional adoption of Bitcoin.

Microsoft and Bitcoin: Towards a Historic Turning Point in December? 💥

Microsoft could soon mark a turning point in its approach to cryptocurrencies with a proposal for investment in Bitcoin, to be voted on during its general assembly in December 2024. Submitted by a conservative think tank, this initiative invites Microsoft to diversify its investments by including crypto. However, the board remains reserved and recommends rejecting the proposal, emphasizing that the company is already regularly assessing cryptos in its investment strategy.

If the vote passes, Microsoft would become the largest public company to invest in Bitcoin, joining Tesla and MicroStrategy and potentially affecting the valuation of Bitcoin. Beyond financial considerations, this decision could also encourage other tech giants to follow this model, reinforcing the position of cryptos in the institutional world. The verdict in December could therefore set a milestone for the institutional recognition of crypto in the high-tech sector.

Shiba Inu Shatters Records with Shibarium: 430 Million Transactions Recorded 🚀

The layer 2 of Shiba Inu, Shibarium, crosses a historic milestone by reaching over 430 million processed transactions, solidifying its position in the ecosystem of scaling solutions. Despite the current pessimism surrounding SHIB, Shibarium continues to grow with nearly 2 million active wallets and over 7.5 million blocks.

This adoption demonstrates a strong commitment from users, despite the recent 6% drop in SHIB and a general downward trend. The ongoing advancements of Shibarium and its popularity could nonetheless prepare the ground for a potential rebound, as traders hope that this enhanced infrastructure revitalizes the value of the token.

Chainlink in Strength: Exchange Withdrawals Reach Records 🚀

Chainlink is seeing a record outflow of its LINK tokens from trading platforms, a potential sign of accumulation by investors. Data from IntoTheBlock shows significant negative flow, indicating that holders prefer to store their LINK off exchanges, which reduces selling pressure. Meanwhile, the social sentiment around Chainlink is at its lowest, a contrast that could paradoxically herald a bullish reversal.

As LINK has already seen its price rise by 4% this week, these massive withdrawals contribute to creating a scarcity that could stimulate its value in the coming weeks. This accumulation trend, combined with surrounding pessimism, seems to be preparing Chainlink for a rebound, and investors are closely watching this development for signs of a potential increase.

Crypto of the Day: Celestia (TIA)

Celestia stands out in the blockchain ecosystem by adopting a modular architecture, separating the consensus layer and the data layer, allowing for increased scalability and customization of blockchains built on its network. This innovation aims to offer a lighter and more flexible solution compared to traditional monolithic blockchains, such as Ethereum.

Its native crypto, TIA, is primarily used to secure the network and for transaction fees related to data. Initially distributed to investors and contributors to the project, it is now available through exchange platforms. TIA holders benefit from staking rewards and governance rights, encouraging active participation in the management of the Celestia ecosystem.

Recent Performances

Current Price: €5.37

Percentage Increase/Decrease: +9.3% (increase over 1 day)

Market Capitalization: €1.18 billion

Rank on CoinMarketCap: #60

Solana: Record Revenues and Activity Redefining DeFi 🚀

Solana is recording unprecedented performances, with revenue records and increased activity. On October 23, 2024, for example, the network reached a peak of $8.7 million in daily revenues. This performance is partly due to the rise of memecoin trading platforms, such as Pump.fun and Moonshot, which boost transaction volume on the Solana blockchain.

The total value locked (TVL) in Solana has exploded, reaching $6.8 billion, a significant jump from $250 million at the beginning of 2023.

In direct competition with Ethereum, Solana is leveraging its popularity in decentralized finance (DeFi) to capture a growing market share. In July, the network generated $25 million in weekly revenues, surpassing the $21 million of Ethereum, demonstrating its impressive growth dynamic. Solana stands out as a high-performing alternative, particularly thanks to attractive transaction fees and fast processing times.

The potential for Solana's integration into ETFs in the United States adds further interest for this asset among institutional investors. This could reinforce the legitimacy of SOL in traditional financial markets, alongside Bitcoin and Ether. With these advances, Solana is establishing itself as a major player in the crypto sector, and its rise represents a challenge for other blockchain platforms, particularly Ethereum.

🔗 Read the full analysis here.