🚨 Bitcoin ETFs in Danger: The FBI Sounds the Alarm!

Welcome to the Daily Tribune Friday, September 13, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, September 13, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

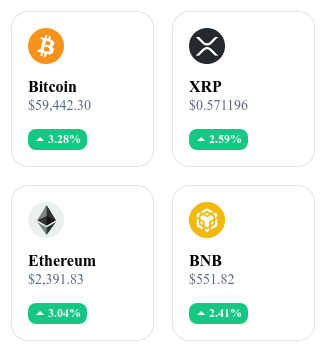

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🚀 BNB Chain Introduces Restaking: Is BNB Ready to Explode?

BNB Chain innovates by introducing "restaking," a feature that allows users to reuse their already staked assets to maximize their gains in the DeFi ecosystem. By re-engaging their assets on other platforms or programs, users can increase reward potential, thereby strengthening their participation. This initiative aims to reverse the recent decline in the Total Value Locked (TVL) on BNB Chain, attracting more users and stimulating engagement. With a declining TVL, down from $5.8 billion in March to about $4.215 billion, restaking could revitalize the ecosystem. If successful, increased demand could drive up the price of BNB, reinforcing BNB Chain's position in decentralized finance.

🇮🇳 India Maintains Its Leadership Despite Ambiguous Regulation

India retains its position as a global leader in crypto adoption for the second consecutive year, despite an uncertain legislative framework and punitive tax policies. This success is based on a young, tech-savvy population, and a burgeoning blockchain ecosystem, supported by the commitment of local startups. Despite high taxes on transactions of up to 30% and regulatory uncertainties, Indian investors, both small and large, continue to actively participate in the market. The growing interest in cryptos is seen as a unique opportunity for financial inclusion. The resilience of these players could allow India to further strengthen its global leadership if regulation becomes more favorable, despite security challenges like the recent hack of WazirX.

🚨 The FBI Warns About Hacking of Crypto ETFs

The FBI warns against North Korean hackers, notably the infamous Lazarus Group, targeting Bitcoin ETFs and other crypto assets. With over $15 billion invested in these funds since July 2024, ETFs have become attractive targets for these cybercriminals, especially as most of these funds lack any theft insurance. A successful attack could trigger panic in the market, with ETFs plummeting to zero in an instant, causing massive liquidations and shaking investor confidence. The security of ETFs remains problematic, as key management is often centralized and security standards are lacking. While some, like Fidelity, choose to secure their assets themselves, most fund managers delegate this task to external partners, increasing risks.

🇬🇧 The United Kingdom Clarifies the Legal Status of Cryptos and NFTs

The United Kingdom has taken a major step by introducing the Property (Digital Assets etc.) Bill, which officially recognizes cryptos and NFTs as a new category of assets, distinct from physical goods and claims. This legislation aims to protect digital asset holders against fraud and provide them with legal security in case of disputes. It introduces measures to enhance protection against scams, while attracting more investments into the UK digital sector. This reform positions the UK as a global leader in crypto regulation, consolidating its role as a hub for legal services related to blockchain. This modernized framework should not only secure investors but also boost London's competitiveness on the international stage.

Crypto of the Day: Axie Infinity (AXS)

Axie Infinity is a blockchain-based gaming platform using non-fungible tokens (NFTs) to represent creatures called Axies. The main innovation lies in using NFTs for in-game items, offering verifiable ownership and the ability to trade them freely on the market. This creates added value by allowing players to truly own their digital assets and earn rewards while playing.

The native crypto, Axie Infinity Shards (AXS), primarily serves to govern the platform, participate in community decisions, and pay for transactions within the game. It was distributed via an ICO (Initial Coin Offering) and gaming rewards. AXS holders benefit from voting rights and can participate in managing the game's treasury. The crypto can be used to buy NFTs, participate in competitions, and as a means of exchange on the platform.

Recent Performances

Current Price: €4.22

Percentage Increase/Decrease: +1.88% (increase over 1 day)

Market Capitalization: €631,175,400

Rank on CoinMarketCap: #85

🚀 Trump or Harris: Bitcoin Will Cross $100,000 Regardless of What Happens!

Many crypto experts believe that Bitcoin will cross the $100,000 mark, regardless of who wins the 2024 U.S. presidential election, whether it’s Donald Trump or Kamala Harris. According to Steven Lubka of Swan Bitcoin and James Davies of Crypto Valley Exchange, Bitcoin price movements are influenced more by global economic conditions than by U.S. political dynamics. While crypto startups might face challenges under a Harris presidency due to potentially stricter regulation, the rise of Bitcoin ETFs and institutional adoption will continue to support the value of BTC. For Lubka, short-term fluctuations related to the election will not impact medium-term bullish outlooks, reinforcing the idea that Bitcoin remains a global commodity.

Bernstein analysts suggest that under Trump, Bitcoin could reach $90,000, while a Harris presidency could see it fluctuate temporarily around $40,000. However, observers agree that even under a stricter regulatory environment, similar to that advocated for by Senator Elizabeth Warren and SEC Chairman Gary Gensler, Bitcoin has historically performed well. The resilience of BTC against regulations and the growing influence of global economic factors bolster experts' confidence in the cryptocurrency's ability to thrive, regardless of U.S. electoral outcomes.

🔗 Read the full analysis here.