💸 Bitcoin ETFs rebound after a loss of $1.5 billion

Welcome to the Daily tribune for Saturday, December 28, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, December 28, 2024, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Stormy ⛈️

24h crypto recap! ⏱

📉 A major correction: Bitcoin plunges below $93,000

Bitcoin recently underwent a significant correction after reaching a peak of $97,330 following the expiration of $14.2 billion in options in December 2024. Despite net inflows of $475 million into Bitcoin ETFs in the United States, which had temporarily stabilized prices, the flagship cryptocurrency fell to $93,900.

Investors, who were expecting a possible rise to $160,000 in 2025, are faced with persistent volatility, amplified by a "max pain" set at $85,000, which indicates the price level where most options expire worthless. This correction underscores the market's instability once again, calling for increased vigilance among ecosystem players.

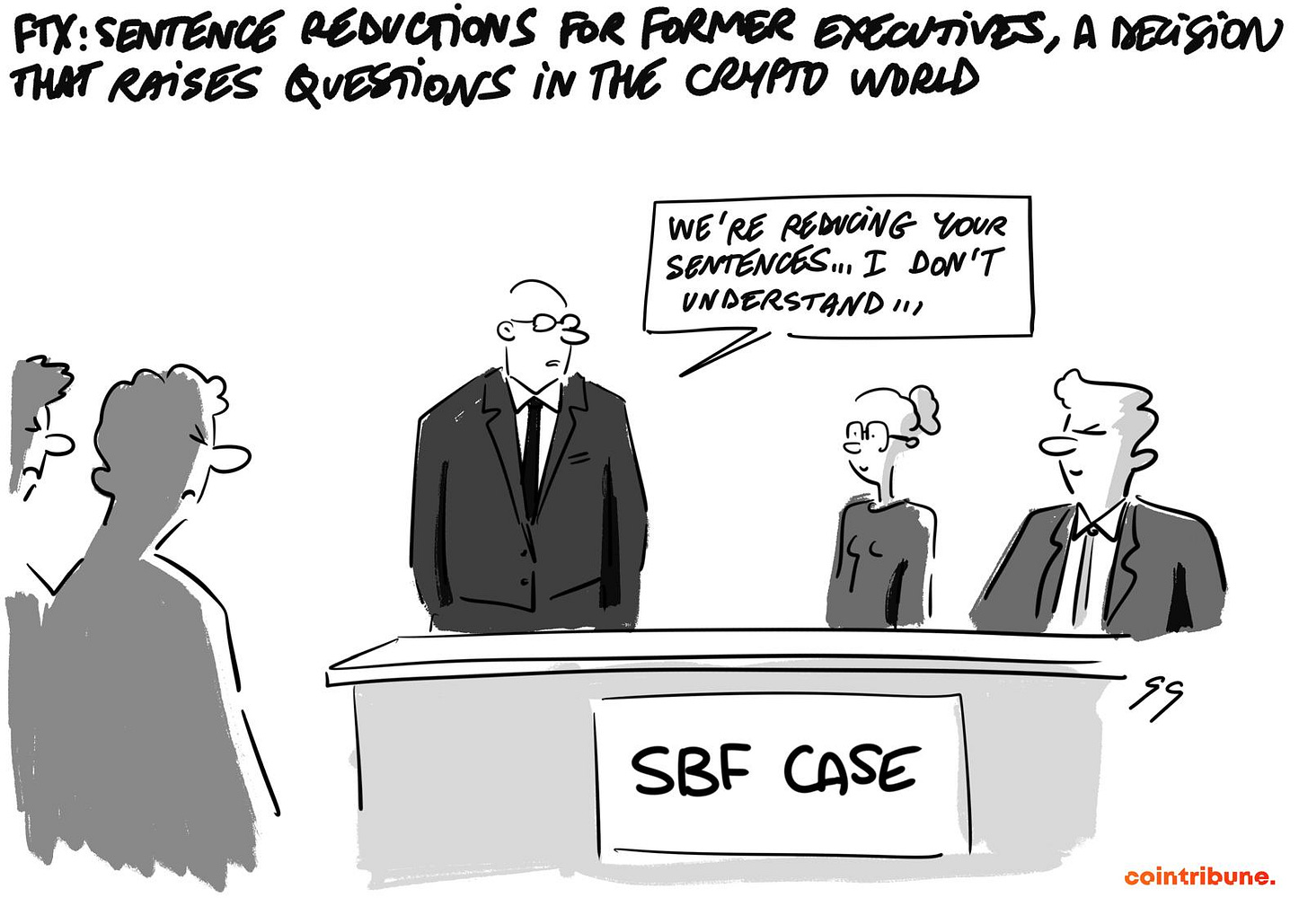

⚖️ Reduced sentences for former FTX executives: a controversial decision

Ryan Salame and Caroline Ellison, former FTX executives, have had their prison sentences reduced. Initially sentenced to 7.5 years, Salame will be released in March 2031, one year earlier than expected. As for Ellison, former CEO of Alameda Research, she benefits from a three-month reduction.

These adjustments come as Sam Bankman-Fried, the main accused in the FTX collapse, remains sentenced to 25 years, with no apparent hope of sentence reduction. The reasons behind these decisions remain unclear, heightening doubts about judicial transparency in this case that caused massive losses and disrupted the crypto ecosystem.

💸 Bitcoin ETFs revive after a loss of $1.5 billion

After a hemorrhage of $1.52 billion between December 19 and 24, American Bitcoin ETFs finally regained positive net inflows, marking a turning point on December 26. On that day, 11 funds collected $475.2 million, led by Fidelity ($254.4 million), followed by ARK 21Shares ($186.9 million) and BlackRock ($56.5 million). In contrast, players like Grayscale and VanEck attracted only modest amounts.

Despite this rebound, BlackRock's iShares Bitcoin Trust experienced its worst day on December 24, with a record outflow of $188.7 million. Meanwhile, Ethereum garnered $301.6 million over three days but remains in the shadow of Bitcoin, which is still at the center of attention. However, the famous "Christmas rally" did not occur, as BTC remains well below $100,000.

🏛️ MiCA and USDT: Regulators' uncertainty destabilizes crypto exchanges

The imminent entry into force of the MiCA regulation, scheduled for December 30, 2024, casts a shadow over Tether's USDT stablecoin, a key player in global crypto transactions. While some exchanges like Coinbase have decided to withdraw USDT from Europe as a precaution, others, such as Binance and Crypto.com, maintain it. This divergence reflects the lack of clear guidance from European regulators, exacerbating uncertainty among industry players.

MiCA provides for a transition period that varies by country, further complicating platform adaptation. This situation, marked by regulatory disparities and a lack of coherence, could slow innovation and erode investor confidence in an already complex market. The fate of USDT will be a critical test to assess the European Union's ability to balance innovation and regulation.

The crypto of the day: AI16Z (AI16Z)

AI16Z is built on the Solana blockchain, known for its speed and low transaction costs. This project stands out with a major innovation: it is the first DAO (Decentralized Autonomous Organization) led by artificial intelligence, aiming to transform venture capital by using algorithms for collective investment decisions.

The native crypto, AI16Z, was initially distributed through a public and private sale mechanism. It offers unique advantages for its holders, including governance rights in DAO decisions and discounts on fees associated with ecosystem products. Users can also stake it to generate passive yields.

Recent performances

Current price: €1.22

24-hour change: +38.68%

Market capitalization: €1.34 billion

Ranking on CoinMarketCap: #204

🔍 ONDO Finance: On the razor's edge facing critical support

ONDO Finance, a once-promising RWA (Real-World Assets) crypto, is now facing alarming bearish signals. Having already lost over 30% of its value since its peak at $2.14, it dangerously approaches the key support of $1.46.

According to analyst Ali Martinez, a break of this level could lead to an additional 30% correction, bringing the price down to $1.05. Investors hope that resistance at $1.86 can reverse the trend, but a close below $1.48 would confirm the formation of a head-and-shoulders pattern, increasing the likelihood of a major drop. This scenario emphasizes the urgency for players to monitor movements to avoid significant losses.

The potential fall of ONDO would not be limited to its ecosystem. Some observers fear a domino effect on other cryptos, including Bitcoin. Recent market fluctuations and rising volatility highlight the risk of widespread panic among investors. If the critical threshold of $1.50 is not preserved, a cascade of sales could trigger a shockwave, impacting overall market sentiment in crypto.

However, the potential of RWAs in the coming years, estimated at $30 trillion by 2030, offers opportunities, provided market players can navigate this turbulent period.