📈Bitcoin ETFs show a record inflow over 5 weeks

Welcome to the Tuesday, May 20, 2025 Daily Tribune ☕️

Hello Cointribe! 🚀

Today is Tuesday, May 20, 2025 and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you should not miss!

But first…

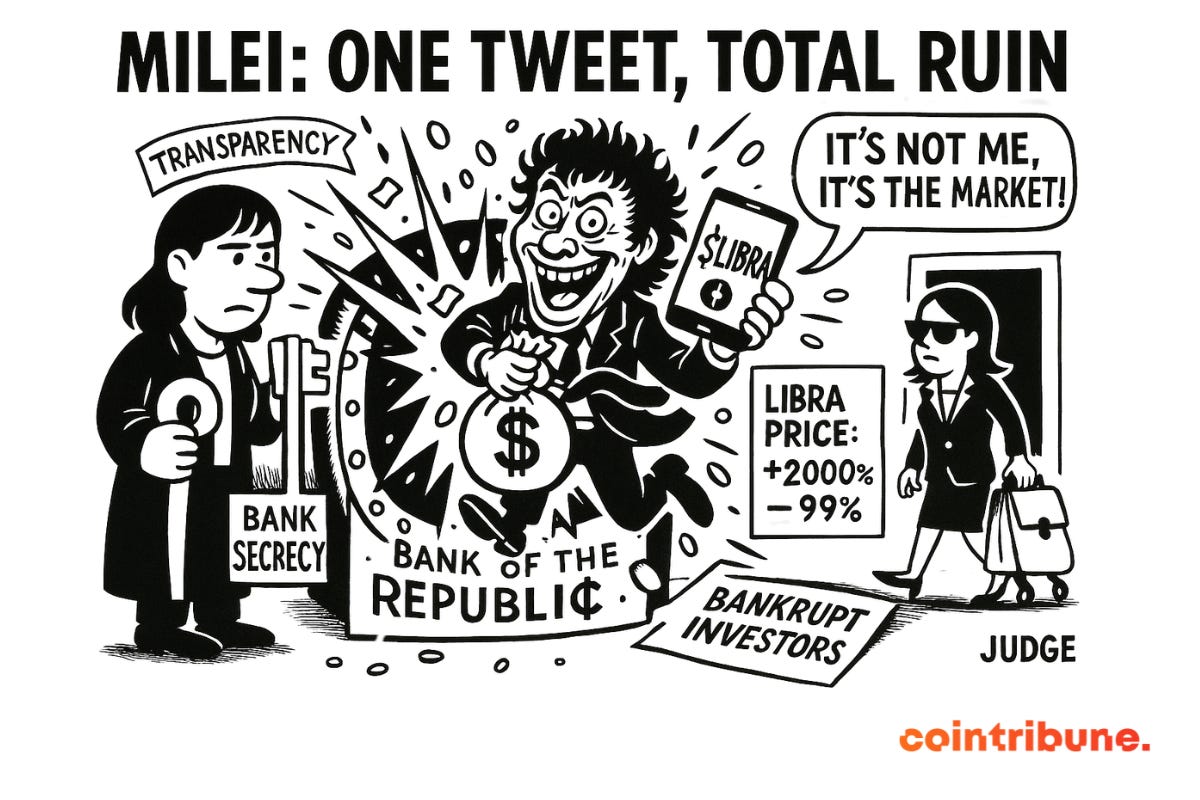

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

📈 Bitcoin ETFs record a five-week high inflow

From May 13 to 17, Bitcoin ETFs attracted $603 million, with no fund outflows on May 16. BlackRock, Fidelity, and Ark recorded the largest purchase volumes during this period. The Bitcoin price remained stable, moving within a technical consolidation zone.

🧠 Vitalik Buterin proposes "stateless" nodes for Ethereum

Vitalik Buterin suggests the use of "partially stateless nodes" allowing users to store only relevant data. This proposal aims to simplify node usage to ensure reliable and independent access.

🏢 Metaplanet intensifies its bitcoin accumulation with 1,004 additional BTC

On May 19, 2025, Metaplanet acquired 1,004 BTC for 15.2 billion yen, bringing its holdings to 7,800 BTC, around $807 million. This operation places the Japanese company tenth worldwide among publicly traded companies in terms of bitcoin holdings.

⚖️ Argentine justice lifts banking secrecy on Javier Milei’s accounts

Faced with the scale of the LIBRA scandal, Federal Judge María Servini ordered the lifting of banking secrecy on Javier and Karina Milei’s accounts. This decision comes as part of an investigation into suspicious financial transactions.

Crypto of the day: Aave (AAVE)

Aave is a decentralized finance (DeFi) protocol running on the Ethereum blockchain. It allows users to lend and borrow cryptocurrencies without intermediaries, using liquidity pools. Aave stands out for its "flash loans", instant loans without collateral, and the option for borrowers to choose between fixed or variable interest rates.

The AAVE token is used for protocol governance, enabling holders to vote on proposals affecting the system’s evolution. It also secures the protocol through staking, offering rewards to participants. The initial distribution of AAVE was done by migrating the LEND token to AAVE at a ratio of 100:1.

Recent performance:

Current price: $267.11 USD

24-hour change: +23.85 %

Market capitalization: around $4.04 billion

Rank on CoinMarketCap: #29

Bitcoin: A major reversal signal forming?

The crypto market enters a phase of careful observation. After several weeks of consolidation, Bitcoin (BTC) could record a first-order technical signal: the return of the Golden Cross. This bullish crossover of the 50-day and 200-day moving averages is generally interpreted as a medium-term trend reversal indicator. In a context of renewed macroeconomic uncertainty, this technical signal could act as an accelerator.

A technical signal in progress, carrying potential

To date, the crossover is not yet confirmed, but the 50-day moving average curve is rising sharply toward the 200-day moving average, after a period of flattening. This dynamic recalls that observed in early 2024, when an aborted death cross triggered a rapid bullish reversal. Experienced traders see here a similar scenario, with potential for institutional repositioning on a breakout.

If the Golden Cross is confirmed, short-term resistance levels around $105,000 could quickly give way, opening the path to intermediate targets between $115,000 and $120,000. Conversely, invalidation or a false signal would expose BTC to a return toward structural supports at $96,000 and $91,500.

A macro environment that reinforces the legitimacy of the signal

Beyond technical elements, the economic context strengthens Bitcoin’s appeal as a systemic diversification asset. The downgrade of the US debt outlook by Moody’s fuels growing distrust of the dollar, right as discussions on US budget sustainability intensify.

In this climate of prolonged budget imbalances, Bitcoin benefits from its status as a finite, incorruptible asset. If traders associate the Golden Cross signal with a medium-term macroeconomic interpretation, then the catalyst could be powerful, both technically and fundamentally.

The formation of a Golden Cross on Bitcoin could mark the beginning of a new valuation phase if confirmed by the market in upcoming sessions. At the crossroads of macroeconomic tensions and chart signals, BTC seems to be preparing for a large move.

But as always in technical analysis, it is the confirmation of the signal — not its anticipation — that should guide allocation decisions.