📈Bitcoin finally breathes: fewer deposits, less stress, more stability?

Welcome to the Daily for Wednesday, December 10, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, December 10, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

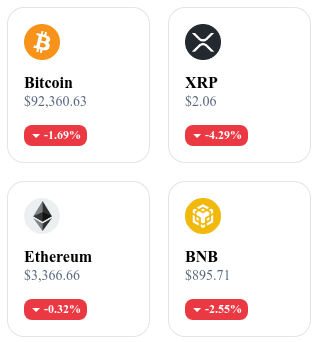

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

🔒 USDCx: Circle launches a confidential stablecoin for enterprises

Circle is launching USDCx, a version of USDC designed to offer increased transaction privacy. The protocol hides transaction amounts and certain transfer-related metadata. The product is presented as a solution aimed at companies and institutions.

👉 Read the full article

⛓️ XRPL 3.0.0 is released with several technical changes

Ripple has deployed XRPL version 3.0.0, a system update including fixes and adjustments to consensus mechanisms. This release also brings improvements intended to strengthen the network’s stability. Node operators can now adopt the new version.

👉 Read the full article

⚙️ Polygon activates the Madhugiri hard fork on its network

Polygon has activated the Madhugiri hard fork to modify several performance-related parameters. The upgrade aims to deliver faster execution on the main chain. The hard fork is now deployed and operational.

👉 Read the full article

📉 NFT sales fall to 320 million dollars in November

Total NFT sales for November reached 320 million dollars, marking a notable decline compared to previous months. The contraction affects all major platforms measured.

👉 Read the full article

Crypto of the Day: Chainlink (LINK)

🧠 Innovation and Added Value

Chainlink provides an oracle infrastructure that connects smart contracts to reliable external data. The protocol ensures the integrity of information used by Web3 applications: asset prices, weather data, sports results, cryptographic proofs, financial information or any type of off-chain feed.

The network strengthens smart-contract security through multiple validations, a system of independent operators and an architecture designed to prevent manipulation. Chainlink plays a key role in DeFi, insurance, stablecoins, tokenized assets and institutional applications.

💰 The Token

The LINK token powers the network’s economy. Oracle operators receive payments in LINK for delivering valid data, creating a direct incentive for service quality. Users pay for data requests using the token, which supports operational demand.

LINK is also used in collateral mechanisms required for premium services: operators lock up tokens to demonstrate reliability and prevent malicious behaviour. LINK usage follows the growth of Chainlink integrations across DeFi, institutions and tokenized real-world asset solutions.

📊 Real-Time Performance (CMC)

💵 Current price: €12.25

📉 24h change: –3.32%

💰 Market cap: €8.54B

🏅 CoinMarketCap rank: #12

🪙 Circulating supply: 696.84M LINK

📊 Trading volume (24h): €528.61M

Bitcoin capitulation over? The market calms down and price turns upward

Bitcoin is experiencing a welcome cooldown after several tense weeks. According to the latest on-chain data published by CryptoQuant, BTC deposits to exchanges are dropping sharply, reducing selling pressure. This dynamic coincides with a rebound toward 94,000 USD, suggesting a possible stabilization phase. Here’s what’s happening.

Exchange inflows drop and ease market pressure

Crypto exchanges are seeing their Bitcoin reserves decline rapidly. Since November 21, the volume of BTC deposited daily has fallen significantly: from 88,000 units to just 21,000 today, a 76% decrease. This trend indicates a slowdown in the supply hitting the market, a signal often interpreted as a sign of relief by on-chain analysts.

Whales are also contributing to this easing. Their share of incoming flows has dropped from 47% to 21%, according to CryptoQuant. At the same time, the average transaction size toward exchanges has declined from about 1.1 BTC to 0.7 BTC. These developments suggest a change in behaviour among the market’s most influential participants.

Is stability returning?

Another key factor supports this relaxation: the scale of realized losses on the blockchain. According to CryptoQuant, around 3.2 billion dollars in losses have been recorded in recent weeks. This level indicates that many investors were forced to sell at a loss, a scenario known as “capitulation.”

Such a phase is often followed by a return to equilibrium. With the most fragile actors pushed out, selling pressure naturally decreases. Bitcoin’s recent rebound to 94,000 USD may therefore be interpreted as the first step in repositioning, or even a potential trend reversal.

It is still too early to call for a sustained bullish cycle, but these converging signals offer a window for cautious optimism in the coming days.