📉 Bitcoin heading to $72,000? CryptoQuant warns of a potential correction ahead

Welcome to the Daily for Wednesday, November 5, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, November 5, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the top news from the past 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

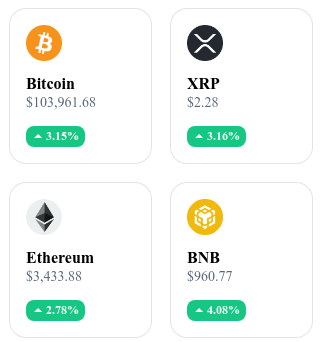

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🟩 Ripple’s RLUSD stablecoin enters the Top 10 and surpasses $1 billion in market cap

Ripple’s RLUSD stablecoin has exceeded $1 billion in capitalization less than a year after its December 2024 launch, securing a spot among the world’s top 10 stablecoins.

👉 Read the full article

🟩 Strategy launches a euro-denominated IPO to fund Bitcoin purchases

Michael Saylor’s company Strategy has filed for a euro-denominated stock IPO (ticker STRE) to raise funds for expanding its Bitcoin acquisitions.

👉 Read the full article

🟩 Vitalik Buterin hails a new milestone in Ethereum’s scaling progress

The Ethereum network hit a record 3,453 transactions per second yesterday — a milestone its co-founder Vitalik Buterin celebrated as a key step in scalability.

👉 Read the full article

🟩 Sam Bankman-Fried faces tense appeal hearing before U.S. justice

Former FTX CEO Sam Bankman-Fried appeared before the U.S. Court of Appeals on November 4, 2025, contesting his fraud conviction; the court expressed doubts over his request for a new trial.

👉 Read the full article

Crypto of the Day: Injective (INJ)

🧠 Innovation and Added Value

Injective is a Layer-1 blockchain designed for decentralized financial applications. Built with the Cosmos SDK and Tendermint consensus, it offers near-instant finality and high scalability. Its innovation lies in its integrated financial primitives: a fully on-chain order book, derivatives modules, cross-chain bridges (to Ethereum, Solana, etc.), and IBC compatibility.

Injective enables developers to easily create low-cost DeFi applications (exchanges, derivatives, asset tokenization) without relying on external infrastructure. It aims to democratize access to decentralized finance while ensuring speed and security.

💰 The Token

The INJ token is at the heart of the Injective ecosystem. It governs the protocol: holders vote on updates and key parameters. It also secures the network through staking — validators and delegators lock their INJ to validate blocks and earn rewards.

Part of the fees generated on the network is used to buy back and burn INJ, creating a deflationary effect.

Finally, the token can serve as collateral in derivatives markets and as a means of paying on-chain fees. INJ thus combines utility, economic incentive, and governance power within a sustainable model.

📊 Real-Time Performance

💵 Current price: ≈ 6.70 USD

📈 24-h change: +2.04 %

💰 Market cap: ≈ 669 million USD

🏅 CoinMarketCap rank: #84

🪙 Circulating supply: ≈ 99.97 million INJ

📊 24-h trading volume: ≈ 129.65 million USD

Bitcoin heading to $72,000? CryptoQuant warns of a possible correction ahead

Could Bitcoin fall back below $100,000? On-chain analytics firm CryptoQuant suggests a potential technical correction toward $72,000 by the end of 2025. This forecast is based on a convergence of indicators related to investor behavior, derivatives market dynamics, and the broader macroeconomic context.

A critical $100,000 level under pressure

For CryptoQuant, the $100,000 mark is more than a symbolic threshold — it’s a liquidity support level whose breakdown could trigger a cascade of sell-offs. The projected move toward $72,000 is supported by several recent signals:

On October 10, a massive liquidation of over $20 billion shook the markets — a sign of excessive leverage and a weakening bullish trend.

Bitcoin ETF flows have turned negative, reflecting reduced institutional appetite for derivative-based crypto exposure.

The Coinbase Premium Index — which measures BTC’s price difference on Coinbase versus other exchanges — turned negative, suggesting weaker U.S. demand.

Finally, CryptoQuant’s Bull Score Index dropped to 20, signaling a sharp loss of momentum.

Macro context, market psychology, and strategies

Beyond the data, the macroeconomic backdrop reinforces this correction thesis. Ongoing uncertainty surrounding the Federal Reserve’s monetary policy, tighter credit conditions, and increased profit-taking by long-term holders have all contributed to market fragility.

CryptoQuant doesn’t predict a crash but rather a healthy mid-cycle correction — a potential “breather” before the next growth phase. The $72,000 zone could thus serve as a consolidation level before a renewed rally.

For investors, this outlook raises key strategic questions:

Should one set stop-losses, hedge via derivatives, or wait patiently for a constructive pullback to reaccumulate? This scenario serves as a reminder that even in a bull market, risk management remains essential in crypto investing.