🚀Bitcoin Hits a Record Number of Active Addresses

Welcome to the Daily Tribune for Tuesday, May 6, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, May 6, 2025, and as every day from Tuesday to Saturday, we're summarizing the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

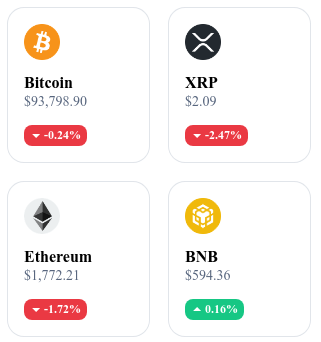

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

reach?

Bitcoin records a record number of active addresses, signaling growing activity on the network. This increase suggests renewed investor interest and could indicate a bullish momentum. Some analysts believe the $100,000 threshold is becoming feasible in the short term.

💸 $TRUMP soars, but Donald Trump claims he gains nothing… Really?

The $TRUMP token experiences a spectacular surge on the markets, attracting investors' attention. Despite this rise, Donald Trump asserts he derives no profit from this cryptocurrency. Doubts remain about the truthfulness of this statement, with some observers pointing to potential indirect links.

🏦 ETFs absorb far more Bitcoin than miners produce

Exchange-traded funds (ETFs) accumulate quantities of Bitcoin exceeding the miners’ daily production. This trend puts pressure on the available supply, potentially positively influencing Bitcoin’s price. Institutional interest in these financial products highlights growing adoption of digital assets.

🔑 The key level that propelled Ethereum from $450 resurfaces

A major technical level, which previously triggered a significant rise in Ethereum, appears again on the charts. Analysts are closely monitoring this zone, considered a potential tipping point for a new bullish impulse. Reactivating this level could attract more investors to ETH.

Crypto of the day: Optimism (OP)

Optimism is a layer 2 scaling solution for Ethereum, using optimistic rollup technology to improve speed and reduce transaction costs. It allows developers to deploy decentralized applications (dApps) more efficiently while benefiting from Ethereum network security.

The native token OP is used for governance of the Optimism protocol, enabling holders to vote on proposals affecting network development. It also serves to incentivize participants to secure the network and support the ecosystem via incentive programs. The initial distribution of OP was done through airdrops and allocations to the community, developers, and investors.

Recent performance:

Current price: $0.6132 USD

24-hour change: -6.93%

Market capitalization: approximately 1.016 billion dollars

CoinMarketCap rank: #67

XRP ready to bounce back? A rare technical setup draws attention

As the crypto market goes through a consolidation phase, an intriguing opportunity emerges on the XRP/BTC pair. A rare Bollinger Bands configuration appears and could signal an imminent bullish move of XRP against Bitcoin, with a potential increase of 30%.

A compression of Bollinger Bands signaling upcoming volatility

In recent hours, a marked compression of Bollinger Bands is observed on the XRP/BTC pair. This phenomenon, often interpreted as a precursor to a major directional move, suggests a volatility surge. Currently, XRP trades around 0.00002292 BTC, while the upper band stands at 0.00003079 BTC — representing about a 30% upside potential. This setup presents a leverage opportunity for strategic repositioning.

A favorable technical context, but risk to be measured

Beyond the Bollinger Bands, the market shows other encouraging technical signals: a healthy consolidation phase, support levels holding, and momentum that remains neutral but reactive. However, this bullish hypothesis is not without risk. A false breakout or prolonged inertia could instead trap overly aggressive long positions. Caution is therefore advised, especially facing Bitcoin’s structurally strong position in the market.

XRP could surprise the market with a relative rebound against Bitcoin if the current compression indeed results in a bullish breakout. This rare technical setup constitutes an interesting watch signal for investors attentive to medium-term opportunities. Nevertheless, as always in crypto, timing respect and risk management will be essential to capitalize on this potential rebound without exposure to volatility risks.