📉 Bitcoin in danger? The Bank of Japan could trigger a sharp 30% drop

Welcome to the Daily of Monday, December 15, 2025 ☕️

Hello Cointribe! 🚀

Today is Monday, December 15, 2025, and as every day from Tuesday to Saturday, we summarize the must-read news from the past 24 hours!

But first…

✍️ Cartoon of the day:

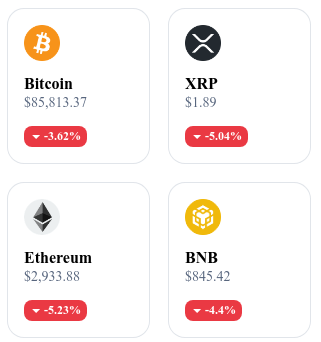

A quick look at the market…

🌡 Weather:

Stormy ⛈️

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

⚡ Ethereum reaches a peak of 34,468 transactions per second

Ethereum records a peak of 34,468 transactions per second on its network, according to the cited data. This level is achieved thanks to high traffic and active scaling solutions on-chain.

👉 Read the full article

📊 The stablecoin market hits a record at $31.011 trillion

The total market capitalization of stablecoins reaches a record level of $31.011 trillion, surpassing previous thresholds. This figure includes assets such as USDT, USDC, and other stablecoins backed by various reserves.

👉 Read the full article

📈 XRP benefits from strong optimism as ETFs see record inflows

XRP is experiencing increased investor interest linked to significant inflows into several ETFs exposed to the token. Some XRP ETF products are reporting unprecedented levels of inflows. This momentum is reflected in volumes and open interest around the token.

👉 Read the full article

⚖️ Bitcoin influencer Rodney sued for massive fraud in the United States

An influencer known as Rodney is facing legal action in the United States for alleged fraud related to cryptocurrency investments. Authorities accuse him of misappropriating funds from multiple victims. The case is currently before U.S. courts.

👉 Read the full article

Crypto of the Day: TRON (TRX)

🧠 Innovation and Value Proposition

TRON is a performance-oriented blockchain designed to deliver fast, low-cost transactions at scale. The network relies on a delegated proof-of-stake (DPoS) consensus mechanism, enabling high throughput and near-instant finality.

TRON has established itself as a key infrastructure for stablecoins and payments, with strong adoption of USDT on its chain. The ecosystem spans DeFi, gaming, NFTs, and payment applications, attracting significant volumes thanks to low fees and a smooth user experience.

💰 The Token

The TRX token underpins the network’s economy. It is used for transaction fees, staking, and governance through Super Representatives. Holders can delegate their tokens to help secure the network and earn rewards.

TRX also plays a role in managing network resources, including bandwidth and energy required to execute transactions and smart contracts. The token’s utility grows with increasing transaction volumes, particularly for stablecoin usage and cross-border payments.

📊 Real-Time Performance (CMC)

💵 Current price: €0.2371

📈 24h change: +0.53 %

💰 Market capitalization: €22.45 B

🏅 CoinMarketCap rank: #8

🪙 Circulating supply: 94.68 B TRX

📊 24h trading volume: €664.19 M

Interest Rate Hike in Japan: Why Bitcoin Could Plunge by 30%

The Bank of Japan is preparing to turn a historic page by raising its key interest rates for the first time in nearly two decades. A decision that could send shockwaves through global financial markets. At the center of concerns: Bitcoin. Based on past precedents, such a move could trigger a drop of up to 30% in its price. How can a monetary adjustment in Japan destabilize the world’s leading cryptocurrency?

The yen carry trade: an overlooked but decisive lever for Bitcoin

For years, the Bank of Japan’s ultra-loose monetary policy has made the yen extremely cheap to borrow. This environment fueled a financial strategy known as the yen carry trade: investors borrow yen at very low cost, convert it into dollars, and invest in higher-yielding assets such as high-yield bonds, tech stocks… or Bitcoin.

This mechanism indirectly boosts global liquidity by channeling capital into risk-on markets. In other words, the Japanese yen has become an unintentional source of international financing. But that setup may soon change.

By raising rates, the Bank of Japan would make this strategy less attractive. Financing costs would rise, forcing investors to reassess the balance between potential returns and currency risk. If the interest rate gap between the yen and the dollar narrows, capital outflows could be sharp—especially from highly volatile assets like cryptocurrencies.

What history tells us: past Bitcoin shocks linked to Japanese policy

What might sound like a theoretical risk is backed by historical data. In 2024, the Bank of Japan made two monetary policy adjustments. Each time, Bitcoin reacted sharply: a -23% drop after the first move, followed by a decline of more than -30% after the second.

If the BoJ confirms another rate hike, Bitcoin could once again face a wave of deleveraging from investors who relied on yen-based leverage. That said, not everyone agrees on this scenario. Some analysts argue that a potential easing by the U.S. Federal Reserve could offset the negative impact of Japanese policy. In that case, a shift in global liquidity toward a more accommodative dollar environment could help support the crypto market and limit the downside.

This delicate balance between national monetary policies highlights how sensitive Bitcoin has become to macroeconomic dynamics. Once seen as detached from traditional finance, Bitcoin now reacts closely to its shifts.