💰Bitcoin: Institutions take back control with massive purchases

Welcome to the Daily of Tuesday, September 23, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, September 23, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the last 24 hours of news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

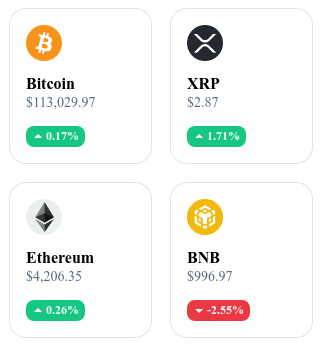

A quick look at the market…

🌡 Weather:

🌤️ Partly sunny

24h crypto recap! ⏱

🏦 Metaplanet strengthens its Bitcoin holdings with $632M

Metaplanet acquired an additional $632M in bitcoin, bringing its reserves to 107,725 BTC, worth around $12.5B. This move propels the Japanese company into the global top 5 of public Bitcoin treasuries, alongside MicroStrategy and Marathon.

👉 Read the full article

📉 Crypto: Over $1.5B liquidated, market takes a hit

In recent hours, 407,000 traders were liquidated for a total of $1.5B, including nearly $500M on ETH and $284M on BTC. This wave of liquidations triggered an instant market drop, with ether falling by up to 9%.

👉 Read the full article

🐳 MicroStrategy raises its holdings to 639,835 bitcoins

MicroStrategy bought an additional 9,300 BTC for $1.12B, reaching a total of 639,835 BTC. With this new acquisition, Michael Saylor’s company controls about $74B worth of bitcoin at current prices, consolidating its position as the world’s largest holder.

👉 Read the full article

💶 The digital euro still divides Europe despite a principle agreement

The European Parliament and the ECB validated a principle agreement on the digital euro in September 2025, but divergences remain among member states. Several countries, including Germany and the Netherlands, voiced concerns about privacy protection and the role of commercial banks in this future system.

👉 Read the full article

📌 Crypto of the Day: Arbitrum (ARB)

🧠 What innovation and added value?

Arbitrum is a Layer 2 solution for Ethereum, designed to improve speed and reduce transaction costs through optimistic rollups. Its Nitro architecture optimizes processing and allows developers to easily deploy Ethereum-compatible dApps, while benefiting from increased scalability.

The network includes two main chains: Arbitrum One, focused on DeFi and NFT dApps, and Arbitrum Nova, designed for social and gaming applications. Arbitrum has quickly established itself as one of the most adopted L2 solutions, with one of the highest TVLs (total value locked) in the ecosystem.

💰 The token: Utility and benefits for holders

The ARB token is primarily a governance token. Holders participate in votes via the Arbitrum DAO, which decides on protocol updates, the use of the community treasury, and security management.

Unlike ETH, which is used for gas fees on Arbitrum chains, ARB has no direct transactional role. It serves instead as a collective coordination and decentralized governance tool, essential for the protocol’s evolution and the alignment of community interests.

📊 Real-time performance (September 20, 2025)

💵 Current price: $0.4367 USD

📈 24h change: +0.85%

💰 Market cap: ≈ $2.36 billion USD

🏅 Rank on CoinMarketCap: #46

🪙 Circulating supply: ≈ 5.4 billion ARB

📊 Trading volume (24h): ≈ $389.25 million USD

Solana, soon ahead of Bitcoin and Ethereum? Signals to watch

The crypto ecosystem has been dominated for years by Bitcoin and Ethereum. But Solana could be the surprise. Attractive yields, growing adoption, increasing institutional use… Several indicators suggest the token could shake up the established order. Here are the key elements to watch closely.

Staking, real use, institutional allocation: Solana’s strengths

Solana offers a gross staking yield between 7% and 8%, much higher than Ethereum (3–4%) and of course Bitcoin, which offers no native yield. This differential positions Solana as a serious option for companies seeking to optimize treasury management with cryptoassets.

The network is also experiencing growing adoption in the real economy. Large companies such as Stripe and PayPal are building their applications on Solana, attracted by its low transaction fees, high throughput, and near-instant finality. These are major assets in the competition among blockchains to host mass-market applications.

On the market side, Solana still shows a significant deficit in institutional allocation: barely 1% of circulating supply is held by professional investors, compared to 16% for Bitcoin and 7% for Ethereum. This underexposure represents a potential growth lever if institutional demand accelerates.

Catalysts, ETFs, and volatility: the unknowns of the bullish scenario

Several catalysts could act as triggers for this rise. Among them, the Helius initiative, with the company deciding to include the SOL token in its reserve strategy, marks a notable precedent. This type of use could multiply as companies explore alternatives to traditional assets to diversify their treasury.

Another factor to monitor is the possibility of a Solana ETF. If the trend set by Bitcoin and Ethereum ETFs continues, such a product could mechanically drive significant investment flows into Solana, closing its current institutional allocation gap.

At the same time, some factors still hinder mass adoption. Solana’s historical volatility, estimated at around 80%, remains high compared to its direct competitors. This instability may attract speculative profiles but is a barrier for long-term strategies. Added to this is a still immature governance, raising questions for investors attentive to the decision-making clarity of protocols.

Between solid technical fundamentals, clear underexposure to institutions, and high-leverage catalysts, Solana today represents a bold yet strategic bet. If the network manages to maintain its development pace and reassure on governance, its potential to outperform Bitcoin and Ethereum could materialize. The coming months will be decisive.