Bitcoin: Investors Bet Big, but the Market Stagnates

Welcome to the Saturday Daily Tribune of June 28, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, June 28, 2025, and like every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours that you shouldn’t miss!

Dear reader,

We wrote to you last night to warn you of an ongoing phishing attempt specifically targeting subscribers to our newsletter.

⚠️ A fraudulent email imitating our official communications is currently circulating, coming from a spoofed address resembling ours. This message falsely announces the launch of a pseudo-token "$CTB" by Cointribune, with the promise of a free token distribution.

👉 This is a scam. Cointribune has never launched a $CTB token, nor conducted a Web3 "claim" campaign.

The aim of the cybercriminals is to trick you into clicking a fake "Claim Now" button to connect your crypto wallet and thus take control of it. Be vigilant!

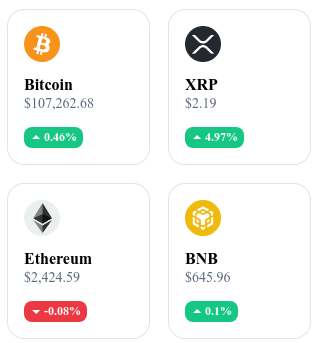

Now, let’s take a quick look at the market

🌡 Weather:

🌤️ Partly Sunny

24h crypto recap! ⏱

📈 Bitcoin and ETF Records

American Bitcoin ETFs have recorded record inflows for 13 consecutive days, totaling nearly 3 billion USD. This massive influx reflects sustained institutional interest over the long term.

🔄 WLFI Soon Tradable

World Liberty Financial, a project supported by Trump, is preparing to open trading of its WLFI token to meet growing demand, with an ongoing audit of the USD1 stablecoin and launch of a user-friendly app. The WLFI token has a total supply of 100 billion units, with 25 billion publicly sold for about 550 million USD.

🧬 Worldcoin Resists

Worldcoin continuously strengthens its biometric fingerprint database through its proof of humanity system, despite criticisms, according to Tools For Humanity.

🧊 Bitcoin: Flow vs Stagnation

Despite 3.5 billion USD injected via Bitcoin ETFs in June, the BTC price rose only 2%, due to persistent selling pressure from institutional holders and liquidations of seized assets. The market shows cautious sentiment, with low enthusiasm for short-term long positions.

Crypto of the day: Zcash (ZEC)

🧠 Technology & Innovation

Zcash is a layer 1 blockchain focused on the privacy of transactions. Launched in 2016, it relies on cryptographic technology called zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge), which allows masking the sender, receiver, and amount of a transaction while validating its legitimacy.

Unlike Bitcoin, whose original code it shares, Zcash allows users to choose between two types of addresses:

Transparent addresses (t-addresses): work like Bitcoin.

Shielded addresses (z-addresses): ensure a high level of privacy.

Zcash continues to evolve thanks to the involvement of the Electric Coin Company and the Zcash Foundation, with a roadmap focused on compatibility with EVM blockchains, integration of on-chain governance, and performance improvements via a gradual transition to proof of stake.

💰 Main Utility & Advantages of the ZEC Token

The ZEC token is used to pay transaction fees on the network.

It allows making private or public payments, depending on the chosen address type.

Users can mine ZEC via proof of work, although a transition to a PoS model is under discussion.

ZEC holders can participate in governance and community funding initiatives within the Zcash Foundation.

Zcash is particularly aimed at users concerned about privacy in their financial interactions.

📊Market Data (as of June 28, 2025)

Current Price: $37.98 USD

24h Change: –2.25%

Market Capitalization: ≈ 634.8 million $ USD

CoinMarketCap Rank: #92

Circulating Supply: 16,711,867 ZEC

24h Trading Volume: ≈ 74.8 million $ USD

Historic Dollar Drop: Towards a Shift in Favor of Bitcoin?

As markets celebrate a geopolitical reprieve in the Middle East, the US dollar records a spectacular drop, reaching its lowest level in three years. This persistent weakness of the American currency sparks renewed interest in alternative assets like Bitcoin and gold, seen as safe havens amid monetary tensions and doubts about Federal Reserve policy.

A Dollar Under Pressure: Between Monetary Uncertainty and Stock Market Rally

This week, financial markets showed record levels. The S&P 500 crossed the 5,500-point mark, the Nasdaq exceeded 20,000 points, and the Dow Jones reached new highs, driven by a wave of optimism linked to the announcement of a ceasefire between Israel and Iran. This news contributed to a massive inflow of capital into stocks, while the US dollar simultaneously collapsed in the currency markets.

The DXY index, which measures the dollar's value against a basket of major currencies, fell 0.43% in a single day, now showing a decline of more than 10% since the start of the year. This level, unprecedented in three years, reflects a series of deep imbalances. The prospect of a change at the head of the Federal Reserve fuels volatility. Persistent rumors suggest Jerome Powell will be replaced by a more accommodative figure likely to further ease monetary policy, weakening the greenback further.

In the background, investors question the US ability to maintain currency stability amid resilient inflation, growing public debt, and increasingly uncertain geopolitics. This combination fosters sustained downward pressure on the dollar.

Bitcoin and Gold: Winners from a Weakened Currency?

Faced with the dollar's decline, investors massively turn to assets considered more resilient. Gold, in particular, now trades around $3,348 an ounce, confirming its status as a classic safe haven. But the structural shift in portfolio allocations is most notable in cryptocurrencies.

Bitcoin fully benefits from this dynamic. In an environment where trust in monetary policies is eroding, BTC’s algorithmic scarcity and independence from central banks appeal. Cryptocurrency establishes itself as a digital refuge against fiat currency devaluation. This movement is all the more significant as it accompanies a renewed institutional interest, with capital inflows from investors seeking strategic diversification.

The flight from the dollar could thus accelerate the transition to decentralized monetary alternatives. For some analysts, this situation could be a turning point. If the dollar's persistent weakness is confirmed, it would strengthen the role of cryptos in the global economy, provided that regulatory and technical infrastructures keep pace.

The dollar's drop, far from being a mere cyclical episode, acts as a revealer of the systemic fragilities of the American economy. It catalyzes a redefinition of global investment strategies, where Bitcoin and gold take an increasing place. While markets digest new uncertainties, cryptocurrencies assert themselves as leading players in a world where trust in financial institutions is increasingly questioned.