🌐 Bitcoin, more than a currency, a store of value!

Welcome to the Daily Tribune Wednesday, March 13, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, March 13, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

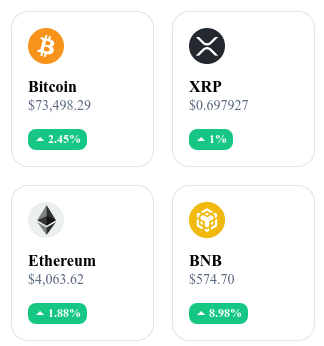

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24-hour crypto summary ! ⏱️

🚀 Bitcoin rises to the ranks of financial giants

Bitcoin surpasses silver and becomes the 8th largest asset in the world. Bitcoin has surpassed a new milestone by surpassing the value of silver, establishing itself as the eighth most significant financial asset in the world. With a price surpassing $72,000, its market capitalization has reached over $1.4 trillion for the first time, marking an impressive increase of over 60% since the beginning of the year.

Despite this enviable ranking, Bitcoin remains behind giants such as Alphabet, but nevertheless surpasses silver with a market capitalization of $1.3 trillion. Gold remains the asset with the largest market capitalization. Forecasts suggest that the value of Bitcoin could surpass that of Google and Amazon if it were to exceed $85,000 and $94,000 respectively. While some may consider these targets ambitious, Bitcoin's recent evolution, gaining over 40% of its value in the last two weeks, demonstrates its remarkable rise and potential for future growth.

The positioning of Bitcoin as the 8th most important financial asset marks a turning point in the perception of cryptocurrencies as a legitimate and sustainable asset class. This ascent not only illustrates Bitcoin's rise as a store of value but also its increasing adoption among institutional investors. Comparisons to gold and other traditional assets highlight Bitcoin's evolution from a mere digital currency to an essential financial asset, defying conventions and redefining the notion of value.

💡 EIP-4844, the Ethereum revolution that reduces transaction fees

Ethereum finally reduces gas fees with EIP-4844. Ethereum is about to radically transform the universe of transaction fees with the introduction of EIP-4844. This upgrade promises to significantly reduce second-layer (L2) transaction costs, paving the way for massive adoption in the spheres of decentralized exchanges (DEXes) and decentralized finance (DeFi). Previously, high fees represented a major obstacle, with average transaction costs of $2.02 on Arbitrum and $1.42 on Optimism, even the \"cost-effective\" solution Base had a transaction cost of $0.58, deterring many retail investors.

With EIP-4844, Ethereum foresees fee reductions of up to 80% on popular L2 networks, marking an era of rebirth for DEXes by making them truly affordable for the general public. This advancement is seen as an opportunity for Ethereum to achieve unprecedented levels of adoption. DeFi projects are preparing for this evolution, sharpening their strategies to attract new users and develop new value-added services. EIP-4844 is undoubtedly a crucial milestone for the Ethereum ecosystem, promising the democratization of L2 transactions and potentially an explosion in activity volumes.

The introduction of EIP-4844 by Ethereum represents a major step towards solving the gas fee problem, promoting wider adoption and increased accessibility. By drastically reducing costs, Ethereum can potentially transform the landscape of decentralized applications (DApps) and decentralized financial services (DeFi), stimulating innovation and attracting new users.

🛡️ EU imposes strict compliance measures on cryptocurrencies

The European Union takes drastic measures against cryptocurrency service providers, adopting new sanction rules to strengthen the enforcement of financial restrictions within its 27 member states. Inspired by the punitive actions of the United States against giants such as Binance, which recently received a fine of over 4 billion dollars, these new regulations will allow for the freezing of assets of non-compliant actors, including cryptocurrencies. Adopted by a large majority in the European Parliament, these rules aim to bridge the gaps in divergent national approaches and enable the confiscation of frozen assets, highlighting a unified effort to secure the European financial ecosystem against sanctions violations.

This decision comes in a context of heightened tensions, notably in response to Russia's invasion of Ukraine, and marks a significant step in the EU's efforts to harmonize the enforcement of financial sanctions. It is welcomed by supporters of European cooperation in security matters, affirming the need for a common approach to effectively combat violations of financial sanctions. With these measures, the EU aims to strengthen its regulatory framework for cryptocurrencies, reflecting its commitment to monitor and regulate this rapidly expanding space.

By imposing a stricter regulatory framework, the EU seeks to enhance confidence in the crypto space, but it also risks hindering the development and adoption of blockchain technologies, especially for startups and innovative initiatives.

💭 Michael Saylor reaffirms the intrinsic value of Bitcoin

Mr. Saylor: "Bitcoin does not need to replace fiat currency". Michael Saylor, CEO of MicroStrategy, recently expressed on CNBC a provocative view of Bitcoin, presenting it not as a medium of exchange but rather as a store of value. According to Saylor, Bitcoin is not intended to compete with fiat currencies or serve as a means of payment in daily transactions. Its true strength lies in its ability to preserve the value of global savings in the face of inflation, a proposition far more valuable and ambitious than that of being a mere medium of exchange. This perspective, although controversial, highlights the importance of distinguishing Bitcoin's roles and potentials in the digital economy.

Saylor argues that Bitcoin should be seen as a digital asset, akin to real estate, rather than as a currency. He emphasizes that governments will continue to manage legal currencies, and that Bitcoin, as a store of value, does not need to replace fiat currency to succeed. This approach aligns with Saylor's philosophy, who sees Bitcoin as a wealth preservation tool rather than a means to revolutionize the existing monetary system.

Michael Saylor's emphasis on Bitcoin as a store of value rather than a medium of exchange reflects a strategic vision of Bitcoin's place in the global financial architecture. This perspective shifts the focus away from its volatility and regulatory challenges to its potential for inflation protection and asset diversification. Saylor suggests that Bitcoin could coexist with fiat currencies, complementing rather than replacing the existing monetary system. This vision could shape future investment strategies and encourage a more nuanced consideration of the role of cryptocurrencies in modern economies, particularly in the context of increasing financial instability.

Crypto of the day: Algorand (ALGO)

Algorand represents a major breakthrough in the world of cryptocurrencies with its pure proof-of-stake (PoS) consensus protocol. This technology provides an efficient solution to scalability and security issues without compromising decentralization. Algorand stands out for its ability to process a large number of transactions per second while maintaining low transaction fees, offering a robust platform for decentralized application developers and financial transactions.

Algorand's native cryptocurrency, ALGO, is primarily used to secure the network through the staking mechanism, where holders can participate in the consensus process and be rewarded for it. ALGO was initially distributed through public sales and staking rewards. For holders, ALGO offers the advantage of participating in network governance, receiving staking rewards, and paying transaction fees. It can also be used in a variety of decentralized financial applications built on the Algorand blockchain.

Recent performance

Current price: $0.3153 USD

Percentage increase/decrease: 13.63% (1-day increase)

Market capitalization: $2,542,112,144 USD

Rank on CoinMarketCap: #53

Crypto analysis of the day: Ethereum (ETH)

Today, we delve into a captivating analysis that is sure to excite any crypto investor: Ethereum has surpassed the $4,000 threshold! This news, beyond its immediate impact on the market, marks a crucial milestone for Ethereum and demonstrates not only the strength of its uptrend but also the proximity to its all-time high. After reaching the $3,300 range, ETH has taken off, surpassing $4,000 and dangerously approaching its historical high. This movement is not insignificant; it is part of a trend confirmed by the breach of the 78.6% Fibonacci retracement level, calculated from its peak.

Let's analyze this situation more deeply. Ethereum's persistence above its 50-day moving average and the maintenance of its uptrend, despite a slight exhaustion observed through oscillators, indicate a solid underlying strength. However, the most fascinating aspect may lie in the analysis of ETH/USDT derivatives. Open interest in these perpetual contracts exceeds the price of ETH and reveals growing speculative interest. This, coupled with mostly bullish liquidations during corrections and a positive funding rate, suggests a predominance of long positions. But beware, this phenomenon could increase volatility and the risk of liquidations, especially as critical zones such as $4,100 are approached, where potential large orders could be triggered.

In conclusion, if ETH maintains its position above $3,900, we could witness a rise towards $4,200 or even $4,400, marking a significant increase. However, a drop below $3,900 could reverse the trend and send us back to lower support levels. In this exciting context, it is essential to remain attentive to market reactions at different key levels and navigate with caution, keeping in mind that cryptocurrency prices are subject to rapid fluctuations, influenced by both technical and fundamental factors.